After years of preparation and controversy, California’s cap-and-trade program has entered a new stage. The first compliance period officially began on January 1, 2013, requiring businesses to comply with GHG emissions limits or purchase allowances for emissions that exceed their allocations. Regulators and businesses have been preparing for the start of California’s cap-and-trade program for the past seven years, since then-California Governor Arnold Schwarzenegger enacted the Global Warming Solutions Act of 2006, commonly known as AB32.

The state’s experiment will have profound consequences—both within California’s borders and as a test case, domestically and internationally. California is the 15th largest emitter of greenhouse gases (GHGs) worldwide, representing about 2% of global GHG emissions.1 AB32 sets an ambitious goal of reducing GHG emissions to 1990 levels by 2020. While only certain industry sectors are required to comply with the law, AB32’s impact will be felt by all companies doing business and using energy in the state. Given the cap-and-trade program’s expansive scope and aggressive goals, it is critical to understand the program’s components and the status of its implementation. This Advisory provides an overview of the AB32 legislation, the design of the cap-and-trade program and its implementation, including recent allowance auctions, and recent legal challenges.

I. AB32 Legislation

Signed into law on September 27, 2006, AB32 established a goal of reducing the state’s GHG emissions to 1990 levels by 2020—roughly 17% less than current levels, or 30% less than business-as-usual projections for 2020—and ultimately achieving an 80% reduction from 1990 levels by 2050. A principal means of meeting this goal is through a cap-and-trade system, a market mechanism that sets an overall limit on the GHG emissions from specified sources, then allows facilities subject to that cap to trade allowances to emit GHGs. AB32 places regulatory authority for the cap-and-trade program in the hands of the California Air Resources Board (CARB), a division of the California Environmental Protection Agency that reports directly to the governor.

Since AB32 was enacted, CARB has taken a number of steps to implement the law, most notably release of the Final Scoping Plan (the “Scoping Plan”) in August 2011, which recommends strategies for California to achieve the mandated GHG emissions reductions and provides details on the design of the cap-and-trade program.2 CARB has also required regulated entities to report their GHG emissions since 2008 to project future emissions and establish a baseline.

II. California’s Cap-and-Trade Regulation

a. How Does a Cap-And-Trade Program Work?

Generally, cap-and-trade programs begin by setting a limit—the cap—on the total annual pollution from designated sources. Then, a limited number of allowances, corresponding to a fixed amount of pollutant emissions, are established and distributed to regulated entities. Each regulated entity must hold allowances equal to its emissions. To meet this compliance obligation, entities can reduce their emissions or trade allowances with one another to make cost-effective emission reduction decisions. The cap—the total number of available allowances—declines over time toward the targeted emissions level, forcing regulated entities to reduce their emissions along the way, or pay increasingly higher prices for their allowances.

Under AB32, CARB set a target emissions cap for the state for 2020 of 427 million metric tons of carbon dioxide-equivalent (MtCO2e) of GHGs, representing the state’s emissions level in 1990. To reach that goal, CARB has placed a cap on the emissions of regulated entities for each year leading up to 2020.3

b. Which Pollutants Are Regulated?

AB32 defines GHGs to include carbon dioxide (CO2), methane (CH4), nitrous oxide (NO), sulfur hexafluoride (SF6), hydrofluorocarbons (HFCs), and perfluorocarbons (PFCs). Notably, this list reflects all six of the pollutants identified in the Kyoto Protocol to the United Nations Framework Convention on Climate Change (UNFCCC) adopted in 1997, which the United States has not ratified.

c. What Entities Are Regulated and When?

The cap-and-trade program will be implemented in two stages. Electric generating utilities, electricity importers and large industrial facilities are subject to the program beginning in 2013, and fuel distributors are added to the program in 2015. By 2020, the program will cover an estimated 85% of the state’s emissions. In all, approximately 360 large businesses, representing approximately 600 facilities, are expected to be covered by the cap-and-trade program. Regulated entities include businesses in the following fields:

- Production facilities (e.g., cement, cogeneration, glass, hydrogen, iron and steel, petroleum and natural gas systems; petroleum refining; foods and beverages)

- Mining and quarrying

- Sewage treatment facilities

- Colleges and universities

- Electricity generating facilities

- Electricity importers

- Natural gas suppliers

- Liquefied petroleum gas suppliers

- Carbon dioxide suppliers4

In preparation for the program, since 2008 regulated entities have been required to report their annual GHG emissions to establish a baseline emissions level.5 The program also allows non-regulated entities, including providers of offsets, to purchase, sell or voluntarily retire allowances. All entities that intended to participate in the initial phase of the program, whether mandatorily or voluntarily, were required to register with CARB in January 2012.

Phase I: Electric Generating Utilities, Electricity Importers and Industrial Facilities

Initially, the program applies only to electric generating utilities, electricity importers and large industrial sources with GHG emissions greater than or equal to 25,000 MtCO2e for any of the three years preceding the current compliance period. For instance, for the first compliance period, an electric generating utility that emitted more than 25,000 MtCO2e in any year between 2008 and 2011 would be a regulated entity under the program.6

Subject utilities are those that generate electricity in California or that import it into the state. For purposes of AB32, the entity that first introduces the power into the state is the regulated entity, not downstream suppliers.

Phase II: Fuel Distributors

In the second compliance period beginning in 2015, the program expands to apply to distributors of transportation fuels, including natural gas. For the transportation fuel distributors, the regulated entity is the fuel provider that distributes the fuel upstream.

The following table summarizes the compliance periods and regulated entities.

| Phase | Complaince Period | Regulated Entities | Annual Decrease in Allowances |

| Phase I | January 1, 2013– December 31, 2014 |

Electricity generating facilities and importers; large industrial facilities | 2% |

| Phase II | January 1, 2015– December 31, 2017 |

Above, plus upstream fuel distributors | 3% |

| Phase III | January 1, 2018– December 31, 2020 |

Same as Phase II | 3% |

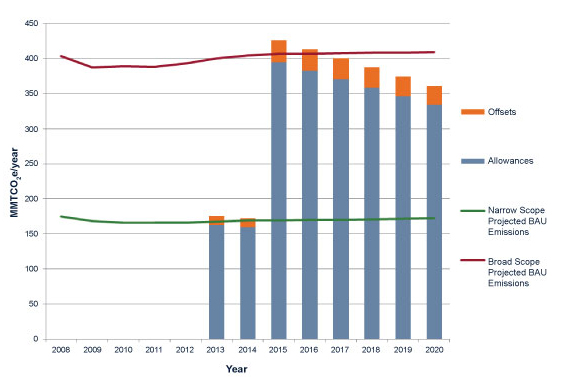

The following figure, taken from CARB’s 2010 Initial Statement of Reasons (ISOR), depicts the declining emissions cap and the “business-as-usual” (BAU) projections for electricity generating facilities, importers and large industrial facilities (“narrow scope projected BAU emissions”), and for all regulated entities (“broad scope projected BAU emissions”). As shown below, the allowance cap is initially set higher than the BAU projection of emissions before declining lower each year, giving companies time to adjust their processes.

Figure 1. AB32 Emissions Cap7

d. How Do Regulated Entities Satisfy Their Compliance Obligations?

Under AB32, each regulated entity must hold allowances equal to the amount of its GHG emissions during each compliance period. Production facilities are liable for the GHG emissions from their own stationary combustion and processes. Facilities that generate and supply electricity and fuel have compliance obligations for the GHG emissions that would result from combustion of their products in California.8

AB32’s compliance obligations provide some flexibility to account for variations in operations and businesses’ ability to shift resources, change production methods, and purchase or trade allowances. Each year, regulated entities must provide CARB with allowances or offsets equal to 30% of their previous year’s emissions. At the end of each compliance period, regulated entities must provide the remainder of their required allowances or offsets for the entire compliance period.

III. Distribution of Allowances

a. Direct Allocation of Allowances

For each compliance period, CARB distributes a certain number of allowances for free. Regulated entities receive allowances equal to 90% of emissions, based on their operational history and a benchmark that considers energy-efficient facilities in their sector. If individual companies exceed that level of GHG emissions, they must trade with other regulated entities or purchase additional allowances from CARB to make up the difference.9

b. Auctions

CARB will also sell allowances to regulated entities directly through regular auctions and reserve sales. The first quarterly auction was held November 14, 2012, and sold more than 23 million allowances to meet 2013 compliance obligations, generating $233.3 million in revenue.10 The auction also sold a limited amount of allowances to meet 2015 compliance obligations under a separate advance auction. The mean price for allowances of the 2013 vintage was $15.60 per MtCO2e, with a minimum price of $10 per MtCO2e.11 The minimum price will rise 5% each year, on top of adjustments for inflation. The next auction is scheduled for February 19, 2013.

c. Strategic Reserve

AB32’s allowance scheme also includes a strategic reserve to protect against market fluctuations. Each year, a portion of allowances is held in reserve by CARB at set prices. As allowance prices rise at auctions, this reserve will help limit the cost of compliance. Reserve sales are held following each quarterly auction, with the first scheduled for March 8, 2013.12

IV. Trading and Offsets

Regulated entities may also obtain the allowances they need for compliance through trading and the purchasing of offsets. Trading is intended to minimize overall compliance costs for the program by enabling regulated entities to purchase allowances if the cost of reducing their own emissions is higher than the price of purchasing the allowance from another regulated entity. Thus, trading incentivizes facilities to use cost-effective emissions reductions and avoids CARB having to guess the appropriate market price for an allowance. Under AB32, regulated entities are free to engage in trades with one another, subject to approval from CARB.

Additionally, AB32 allows regulated entities to meet compliance obligations through offsets, subject to certain restrictions. Offsets are emissions reductions from outside the cap, used by regulated entities to compensate for their own emissions. Because offsets come from reductions outside the field of regulated entities, regulators often have concerns about their validity and seek to ensure that they represent reductions that are “real, additional, quantifiable, verifiable, permanent and enforceable.”13

To protect against these risks, AB32 restricts the use of offsets.14 Regulated entities may only satisfy up to 8% of their total compliance obligation through offsets. Offsets must be independently verified, must originate from emissions reduction projects in the United States, and are initially restricted to projects in the areas of forestry, urban forestry, dairy digesters and destruction of ozone-depleting substances.15 Nonetheless, AB32 also includes a framework to eventually recognize offsets from established, reliable international programs.

V. Legal Challenges to Date

a. Association of Irritated Residents, et al. v. California Air Resources Board

In December 2010, professional environmental advocacy groups challenged CARB’s selection of a cap-and-trade program as a preferred strategy to reach the emissions target set by AB32. They alleged that CARB failed to comply with (1) procedural requirements of the California Environmental Quality Act (CEQA), and (2) AB32’s requirement to provide the maximum feasible and cost-effective GHG emissions reductions.16

In March 2011, a California Superior Court judge ruled that CARB had not sufficiently considered alternatives to a cap-and-trade program and failed to complete an environmental impact review (EIR), violating CEQA. The court held that CARB’s action did not violate AB32. CARB was forced to complete a revised CEQA analysis, which it submitted in December 2011, though a California Court of Appeal decision allowed it to continue the implementation process while it revised its analysis. The environmental groups have vowed to appeal the Superior Court’s decision that CARB’s action did not violate AB32. The case is ongoing.

b. California Chamber of Commerce v. California Air Resources Board

On November 13, 2012, one day before the first scheduled auction under the cap-and-trade program, the California Chamber of Commerce filed suit in Sacramento Superior Court alleging that AB32 did not authorize auctions, and that auctions constitute an unauthorized and unconstitutional tax, as opposed to a permissible “fee.” The Chamber of Commerce asserts that the auction will generate up to $70 billion in new tax revenues to shore up the general state budget unrelated to AB32. A two-thirds vote in each house of the state legislature is required by the California Constitution to impose a new tax; AB32 was not passed by a two-thirds vote. While the lawsuit did not seek a court order to halt the first auction, which proceeded as scheduled, the Chamber of Commerce is attempting to prevent future auctions and deter participation by questioning the legality of the auction process.

Those supporting implementation of AB32 contend that AB32 gives CARB significant discretion to select strategies to reduce emissions, including to hold auctions. They also argue that the auctions represent a fee on regulated entities, not a tax, because proceeds will be used to fund items that further the goals of AB32, such as clean technology and public transportation investments. Moreover, they contend that regulated entities are not forced to buy allowances at auction; they can simply choose to reduce their emissions to the required level.

To address the question of whether the auction represents a fee or a tax, the court will likely consider the relationship between the revenues and the costs of the regulation and the allocation of the burden on regulated parties. Until the issue is resolved, however, uncertainty over the auction’s legality could diminish participation and depress prices.

VI. Conclusion

The first auction of GHG emissions allowances marks an important step for the implementation of the California cap-and-trade program as companies actually begin paying for the right to emit GHGs. Over the next year, many of the program’s design components will be put in action for the first time. This is likely to lead to other legal challenges as regulated entities and other parties test the limits of the regulations. It is critical for all companies that do business in the state to have a clear understanding of AB32’s design and implementation as it enters this crucial next phase.

Appendix: Suggested Resources Regarding AB32’s Cap-and-Trade Program

CARB

Program Overview: http://www.arb.ca.gov/newsrel/2011/cap_trade_overview.pdf

Auction Summary Report: Click Here

Implementation FAQ: http://www.arb.ca.gov/cc/capandtrade/implementation/faq.pdf

Center for Climate and Energy Solutions

California Cap-and-Trade Program Summary Table: http://www.c2es.org/docUploads/California-Cap-Trade-Summary.pdf

AB32 Fact Sheet: http://www.c2es.org/docUploads/CA-AB32factsheet.pdf

Summary of California’s Cap-and-Trade Program: http://www.c2es.org/us-states-regions/action/california/cap-trade-regulation

Environmental Defense Fund

AB32 Cap-and-Trade Fact Sheet: http://www.edf.org/sites/default/files/EDF-CA-CT-Fact-Sheet-August-2011.pdf

Los Angeles County Economic Development Corporation

The AB32 Challenge: Reducing California’s Greenhouse http://www.laedc.org/reports/TheAB32Challenge.pdf

1 CARB, Climate Change Scoping Plan (December 2008), http://www.arb.ca.gov/cc/scopingplan/document/adopted_scoping_plan.pdf.

2 CARB, Climate Change Scoping Plan (December 2008),http://www.edf.org/sites/default/files/EDF-CA-CT-Fact-Sheet-August-2011.pdf. Note that the cap-and-trade program is just one of roughly 70 separate measures recommended in the Scoping Plan to reduce GHG emissions. Other examples include mandatory emissions reporting, landfill methane capture, building and appliance energy efficiency standards, renewable energy portfolio standards, and transportation fuel efficiency standards. Cap-and-trade is projected to account for roughly 22% of the total GHG emissions reductions required by AB32. Environmental Defense Fund, AB32 Cap-and-Trade Fact Sheet, .

3 CARB, ARB Emissions Trading Program Overview, (October 20, 2011), http://www.arb.ca.gov/newsrel/2011/cap_trade_overview.pdf.

4 CARB, Preliminary Draft List of Entities Covered by the Cap-and-Trade Program, (October 27, 2011), http://www.arb.ca.gov/cc/capandtrade/covered_entities_list.pdf; Center for Climate and Energy Solutions, Summary of California’s Cap and Trade Program, http://www.c2es.org/us-states-regions/action/california/cap-trade-regulation.

5 CARB, ARB Emissions Trading Program Overview, (October 20, 2011), http://www.arb.ca.gov/newsrel/2011/cap_trade_overview.pdf.

6 A question that might come up is what happens to a facility that crosses over the applicability threshold after the compliance period begins. In such a case, a facility becomes immediately subject to compliance obligations for the year in which it first exceeds the emissions threshold, and for each subsequent year. The facility’s compliance obligations stay in place for the remainder of that compliance period. If its average annual emissions for an entire three-year compliance period are below 25,000 MtCO2e, it will not be required to comply during the subsequent compliance period. Practically, this means that a facility that exceeds the emissions threshold in one year must obtain allowances for the rest of the three-year compliance period, regardless of its emissions in the other years. Moreover, if its average annual emissions over the previous three-year compliance period are high enough, a facility could be required to obtain allowances during the next compliance period, regardless of its whether its current emissions are below the threshold.

7 Source: CARB, California Cap-and-Trade Regulation Initial Statement of Reasons, Appendix E: Setting the Program Emissions Cap, http://www.arb.ca.gov/regact/2010/capandtrade10/capv3appe.pdf.

8 Center for Climate and Energy Solutions, Summary of California’s Cap and Trade Program, http://www.c2es.org/us-states-regions/action/california/cap-trade-regulation.

9 Ricardo Lopez, “California’s first carbon-cried auction raises $290 million,” Los Angeles Times (November 20, 2012).

10 Id.

11 CARB, Additional Auction 1 Summary Statistics, Click here (November 19, 2012).

12 CARB, AB32 Implementation FAQ, http://www.arb.ca.gov/cc/capandtrade/implementation/faq.pdf.

13 Center for Climate and Energy Solutions, Summary of California’s Cap and Trade Program, http://www.c2es.org/us-states-regions/action/california/cap-trade-regulation.

14 CARB, ARB Emissions Trading Program Overview, (October 20, 2011), http://www.arb.ca.gov/newsrel/2011/cap_trade_overview.pdf.

15 Center for Climate and Energy Solutions, Summary of California’s Cap and Trade Program, http://www.c2es.org/us-states-regions/action/california/cap-trade-regulatio.

16 Ass’n of Irritated Residents, et al. v. California Air Resources Board, Superior Court of California (San Francisco County), Case No. CPF-09-509562.

i

i