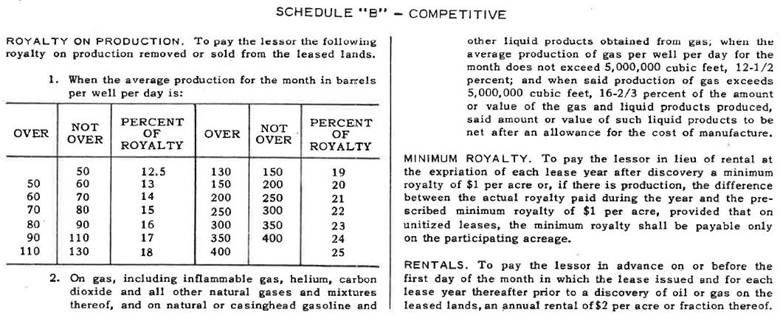

Most leases on federal lands administered by the Bureau of Land Management (“BLM”) have flat royalties of 12.5% (evidenced by the use of the standard Schedule A to the BLM oil and gas lease form).[1] However, certain leases issued by the BLM have “sliding-scale” or “step-scale” royalties for average daily production of oil or gas per well on the leased lands. The most common sliding-scale royalty is evidenced by the use of Schedule B. It is applicable to all leases issued between May 3, 1945 and August 8, 1946, as well as, all competitive leases issued after August 8, 1946 and prior to December 22, 1987.[2] There are two other sliding-scale royalty schedules, Schedule C and Schedule D, that are used for certain renewal and exchange leases, but those schedules are even less common. The form of Schedule B is set forth below:

HOW TO CALCULATE SLIDING-SCALE ROYALTIES:

The regulations for calculating sliding-scale royalties for the “the average production per month in barrels per well per day” are found in 43 CFR § 3162.7-4 (“SSR Rules”). The Office of Natural Resources Revenue (“ONRR”) provides guidelines and explanations for calculating sliding-scale Schedule B royalties on its website . Per the SSR Rules, the “average daily production per well for a lease is computed on the basis of a 28-, 29-, 30-, or 31-day month (as the case may be), the number of wells on the leasehold counted as producing, and the gross production from the leasehold.” “Gross production,” is defined in the ONRR Guidelines to be “all production from the lease excluding any production used on the lease or unavoidably lost.” For specific circumstances, the foregoing resources should always be consulted. But as a general rule for operated wells, the following wells shall be “counted as producing” under the rules above: (1) existing wells on a lease (i.e., wells that were producing in the previous month) must produce at least 15 days in the month, (2) new oil wells drilled during the month must produce at least 10 days, and (3) for gas wells, any wells that produce during the month are counted. For injection wells, we refer you to the rules but note that injection wells must operate at least 15 days to be counted. Subparagraph (e) of the SSR Rules provide that “head wells” will be counted which “make their best production by intermittent pumping or flowing as producing every day of the month, provided they are regularly operated in this manner with approval of the authorized officer.” Wells that predominately produce oil but have some gas production would be “counted as producing” under the royalty rates for oil in Schedule B, and not for gas (and vice versa for primarily gas wells that produce some oil). For leases that had production for the previous month, but no wells produced for 15 days in the current month, the royalty is calculated on actual days produced, and for previously productive leases where no well produces for a month but oil was shipped, the previous calendar month’s royalty rate is used.

The SSR Rules and ONRR Guidelines provide the following example for calculated sliding-scale royalties for a hypothetical federal lease with Schedule B that has eight wells located on the leased lands in the month of June:

|

Well No. and record |

Count (marked X) |

|

1. Produced full time for 30 days |

X |

|

2. Produced for 26 days; down 4 days for repairs |

X |

|

3. Produced for 28 days; down June 5, 12 hours, rods; June 14, 6 hours, engine down; June 26, 24 hours, pulling rods and tubing |

X |

|

4. Produced for 12 days; down June 13 to 30 |

|

|

5. Produced for 8 hours every day (head well) |

X |

|

6. Idle producer (not operated) |

|

|

7. New well, completed June 17; produced for 14 days |

X |

|

8. New well, completed June 22; produced for 9 days |

|

In this example, there are eight wells on the leasehold, but wells 4, 6, and 8 are not counted in computing royalties. Wells 1, 2, 3, 5, and 7 are counted as producing for 30 days. The average production per well per day is determined by dividing the total production of the leasehold for the month (including the oil produced by wells 4 and 8) by five (the number of wells counted as producing), and dividing the answer by the number of days in the month.

For the foregoing example, the 1,000 bbls produced in June would be divided by the five counted wells and then divided by 30 calendar days in June, which equals 6.67 (and falls under 12.5% royalty rate on Schedule B for oil). As noted above, this includes production from all wells, even those that are not counted under the rules.

Finally, the ONRR Guidelines provide that the applicable royalty rate is based on monthly production (and not on monthly sales), and the “first in first out” method applies. For the lease above, if 1,000 bbls are produced in June but only 700 bbls are sold in June, the 12.5% royalty applies to the 700 bbls sold in June. If July has higher production, resulting in a royalty rate of 13% under Schedule B for the month of July, the first 300 bbls sold out of inventory in July will be attributed a 12.5% royalty from the remaining 300 bbls of unsold production from the month of June.

PRACTICE TIPS FOR DRAFTING DOCUMENTS INVOLVING FEDERAL LEASES WITH SLIDING-SCALE ROYALTIES:

In certain transactions, the failure to account for a federal lease with a sliding-scale royalty can result in ambiguities, which can then lead to unintended consequences or disputes. For example, it is common for assignments of oil and gas leases to have a reserved overriding royalty interest that is calculated as the positive difference between existing burdens and a set percentage. For example, consider an assignment where the assignor conveys all oil and gas leases described on Exhibit A and reserves an overriding royalty interest equal to the positive difference between existing burdens and 20% and there was a previous overriding royalty interest of record of a flat 5%. For a lease with a sliding-scale royalty, it may not be clear how the reserved overriding royalty interest should be calculated if the sliding-scale royalty moves up from 12.5%. The parties could indicate that the assignment is intended to convey a flat net revenue interest to the assignee (i.e., 80%), but that could create an ambiguity if there is not enough net revenue interest to satisfy the purportedly assigned net revenue interest (i.e., if the sliding-scale royalty moves above 20%). As a result, it is necessary to include a statement that the existing burdens include a sliding-scale royalty and indicate how the reserved overriding royalty interest is to be calculated. The complexity of the chain of title can be compounded when there are multiple assignments with this structure (i.e., an assignment first reserving an overriding royalty interest of the difference between existing burdens and 20%, followed by an overriding royalty interest of a flat 1%, followed by a later assignment reserving an overriding royalty interest of the difference between existing burdens and 22%). Generally, if there are ambiguities in recorded assignments and no other extrinsic evidence of intent, courts can turn to rules of construction such as the rule that a document will be construed against the party who prepared the document. As a result, any party preparing an assignment of a sliding-scale royalty lease with a reserved overriding royalty interest equal to the positive difference between existing burdens and a set percentage should take care to remove any ambiguities in the interests created by the assignment.

Other common industry documents could be impacted by federal leases with sliding-scale royalties, such as the joint operating agreement (“JOA”). Most forms of JOA have a provision which sets a baseline royalty burden for all parties contributing leases to the contract area. For example, the 1989 form A.A.P.L. JOA, in Article III(A) provides that: “Regardless of which party has contributed any Oil and Gas Lease or Oil and Gas Interest on which royalty or other burdens may be payable and except as otherwise expressly provided in this agreement, each party shall pay or deliver, or cause to be paid or delivered, all burdens on its share of the production from the Contract Area up to, but not in excess of, _______% and shall indemnify, defend and hold the other parties free from any liability therefor.” To the extent leases are contributed which exceed the baseline burden amount the such party contributing that lease “shall assume and alone bear all such excess obligations and shall indemnify, defend and hold the other parties hereto harmless from any and all claims attributable to such excess burden.” A party to a JOA that owns a federal lease with a sliding-scale royalty should carefully consider the potential economic impacts of this provision (in particular where the contractual interests of the parties under the JOA do not match their respective interests of record), and provide additional terms to address potential adverse impacts or ambiguities.

It is common for title examiners, whether landman providing lease reports, title attorneys providing drilling or division order title opinions, or division order analysts preparing revenue decks to provide ownership tables for federal sliding-scale royalty leases with an assumed royalty of 12.5%. However, if not properly noted, subsequent parties relying on such tables could over-look that a sliding-scale royalty lease is involved. It is important for landmen, title attorneys, and division order analysts to provide conspicuous statements in all ownership tables, noting the applicable sliding-scale royalty schedule.

[1] Applies to noncompetitive leases issued subsequent to the Act of August 8, 1946, and competitive and noncompetitive leases issued pursuant to the Federal Onshore Oil and Gas Leasing Reform Act of 1987.

[2] Leases issued between August 1, 1935 and May 3, 1945, also have royalty Schedule B, except the maximum rate for oil is 32% when daily production exceeds 2,000 barrels per well.

i

i