In 1971, Creedence Clearwater Revival (CCR) released the song, “Have You Ever Seen the Rain”. One line in the song says “When it’s over, so they say, it’ll rain a sunny day, I know, shinin’ down like water”. We have to concede that when it comes to song lyrics, poetic license occasionally must trump the rules of grammar. Whatever John Fogerty (lead singer and song writer) and CCR were trying to convey, it probably had nothing to do with tax-exempt bonds.

Nonetheless, on October 28, 2014, the IRS issued a private letter ruling, “shinin’ down” about bonds for water projects. PLR 201507002, which was publicly released on February 13, 2015, was a favorable ruling for the issuer that requested it. Whether CCR had anything to do with the favorable treatment or it was a simple matter of the IRS correctly applying the law to the facts, we will never know. Perhaps it was a bit of both.

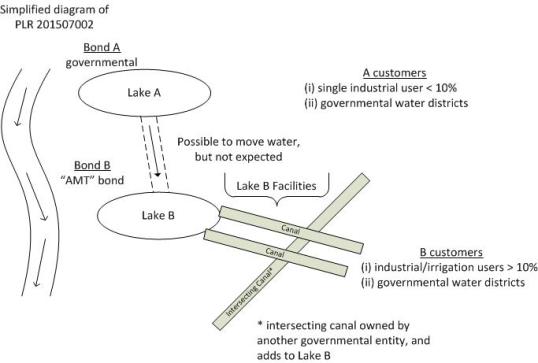

The ruling deals with two different types of water bonds. The first issue is a governmental bond (Bond A). A governmental bond is defined in Treas. Reg. §1.150-1(b) as an issue of tax-exempt bonds none of which are private activity bonds. The second issue is a type of permitted private activity bond, an exempt facility bond issued under Section 142(a)(4) of the Code to finance “facilities for the furnishing of water” (Bond B). Because it is a governmental bond, the interest on Bond A will not be subject to the alternative minimum tax imposed by Section 55 of the Code (AMT) for individual holders (a so-called “non-AMT” Bond) under the exception found in Section 57(a)(5) of the Code. Conversely, the interest on Bond B will be subject to the AMT (a so-called “AMT” bond). Because of the additional tax implications, AMT Bonds carry a higher interest rate than non-AMT bonds. Thus, as a proportion of the overall financing, the issuer would like Bond A to be as large as possible and Bond B to be as small as possible. One nice feature of the ruling is the recognition by the IRS that, while there is a physical connection between the fungible water supplies, they chose to treat each water supply separately.

FACTS.

As is the case with all private letter rulings, the IRS begins with a recitation of the facts and representations made by the issuer.

The issuer of the bonds is a political subdivision of a state whose task is to develop, conserve and protect water resources in a river watershed. To accomplish that, the issuer operates facilities to collect, store and distribute raw water for industrial, municipal, and irrigation purposes, primarily relying on gravity. The storage facilities consist of two respective lakes (Lake A and Lake B) and related facilities. The water is distributed to different, respective sets of customers (A Customers and B Customers). The Lake B facilities include two canals that deliver the water to the B Customers. The river that is the source of the water for Lake B and the two canals intersects a third canal which is owned by another governmental entity and that governmental entity’s water enters one of the Issuer’s canals. The Lake B water is extracted downstream from Lake A and the issuer has the ability to move water from Lake A to Lake B, but the issuer does not expect this to occur in any significant amount based on recent history. The issuer represents that at least 95% of the proceeds of Bond B will be spent on Lake B facilities.

The issuer has entered into or will enter into “take or pay” contracts with both the A Customers and the B Customers. Because a water supply is dependent on the uncontrollable forces of nature, the supply may not always be fully available. A simple “take” contract is a contract where the purchaser agrees to pay for the output only if the facility is capable of producing that output. If the facility fails to meet the customer’s needs, the customer does not have to pay. But a “take or pay” contract is defined in Treas. Reg. §1.141.-7(b)(4) as a contract under which the purchaser agrees to pay for the output from the financed facility regardless of whether the facility can actually deliver all of the expected output. This means the A Customers and the B Customers will pay for the output even if there is a drought and the output is less than expected. The A Customers and the B Customers cannot get out of the contract just because there is insufficient water to meet their needs. We note that the printed ruling has a glitch in its cite to Treas. Reg. §1.141-7(c)(4) (instead of (b)(4)) for the definition of a take or pay contract but the meaning is clear.

The A Customers consist of (i) a single industrial user and (ii) governmental water districts. The issuer has already entered into the take or pay contract with the industrial user and expects to enter into the take or pay contracts with the governmental water districts. The issuer expects that the industrial user will use less than 10% of the water supply and the remainder will be used by the governmental water districts.

The B Customers are (i) industrial and irrigation users and (ii) governmental water districts. The industrial and irrigation customers will take more than 10% of the supply funded with proceeds of Bond B. For this reason, Bond B cannot be a governmental, non-AMT bond and has to be issued as an exempt facility, AMT bond. The issuer represents that at least 25% of the Lake B supply will go to the municipal water districts.

LAW.

Again, as is the case in every private letter ruling, the IRS then recites its view of the relevant law and applies it to the facts. It breaks that analysis into two parts, the rules for governmental bonds and the rules for exempt facility bonds.

Governmental Bonds. The IRS starts with the fundamental premise that a private activity bond cannot be a tax-exempt bond under Section 141(a)(1) of the Code. A private activity bond is a bond that meets both the private business use test and the private security or payment tests described in Section 141(b) of the Code. The IRS then turns to an analysis of the private business use test found in Section 141(b)(1) of the Code and the definition of private business use found in Section 141(b)(6) of the Code, which states that private business use is use in a trade or business by any person other than a governmental unit. Use as a member of the general public is not use in a trade or business.

The IRS then notes that the Treasury Regulations provide special rules for the application of the private business use test to the purchase of output from “output facilities”. While most people are likely to think of electric generation facilities as output facilities, most people are not likely to have ever thought about whether water production facilities are output facilities. But Treas. Reg. 1.141-1(b) clearly defines an output facility to include water collection, storage, and distribution facilities. The IRS notes that Treas. Reg. §1.141-7(c)(1) provides that purchase of output by a nongovernmental person is taken into account under the private business use test if the contract providing for that purchase transfers the benefits and burdens of paying the debt service on the bonds to a non-governmental person. Treas. Reg. §1.141-7(c)(2) states that a take or pay contract does transfer the benefits and burdens to the purchaser of the output. Treas. Reg. §1.141-7(d) tells the reader that the amount of private business use will be based on the amount of output purchased. Treas. Reg. 1.141-7(h) instructs the reader to determine whether the output contract should be allocated to an issuer’s entire system, a particular facility, or a portion of a financed facility based on all the facts and circumstances. This allocation can greatly affect the amount of private business use because the numerator, the amount of the purchase, remains unchanged but the denominator, the capacity against which that use is to be measured, can vary widely as between one unit of a facility versus the capacity of the issuer’s entire system. On the other hand, the allocation to a more limited portion of a facility can restrict a contract that gives rise to private business use to a particular bond issue where its use is a more favorable percentage.

The IRS analyzes the facts in this matter and concludes that the A Customers will only receive Lake A supply funded by Bond A and the B Customers will only receive Lake B supply funded by Bond B and that there is no expected interaction between the two supply sources and so no expected interaction between the two bond issues. The IRS therefore concludes that Bond A is a good governmental bond because the one industrial customer of Lake A supply will take less than 10% of supply from Lake A.

Of course, if the facts change over the period of time Bond A is outstanding, the issuer may have to make adjustments. Three conceivable changes would be (i) an increase in the amount of Lake A supply going to the existing industrial user, (ii) the addition of more industrial or irrigation users, or (iii) a mixing of the Lake A and Lake B supply.

Exempt Facility Bonds. The IRS then turns its attention to an analysis of exempt facility bonds for the furnishing of water. A qualified exempt facility bond must (i) use at least 95% of the proceeds (ii) for the permitted purpose, in this case furnishing water.

Because the issuer represented that it will satisfy the 95% test, the IRS focuses on what constitutes furnishing water and determines that several factors are critical in making that determination. First, the IRS reaches the obvious conclusion that the issuer is supplying water and cites the conference report regarding the statute that enacted the furnishing of water category of exempt facility bonds, H.R. Conf. Rep. No. 95-1800, at page 237 (1978), (Vol. 1) C.B. 521, at 571, which states that a facility for the furnishing of water is a facility that must be a component of a system or project which furnishes water. That is not an earth shattering conclusion! The statute, the legislative history and the applicable regulations never require that the water be potable. Raw water is acceptable. Second, the IRS concludes that the facilities financed are for furnishing water. Treas. Reg. 1.103-8(h) defines water facilities to include “artesian wells, reservoirs, dams, related equipment and pipelines, and other facilities used to furnish water for domestic, industrial, irrigation and other purposes. Interestingly, the IRS never cites these regulations in the ruling. Third, Section 142(e) of the Code also requires that a facility for furnishing of water must be a facility that makes water available to the general public. The general public is defined for this purpose to include electric utilities, industrial, agricultural or commercial users. The Lake B supply will only go to governmental water districts, industrial and irrigation customers (agricultural users) and the issuer had represented that at least 25% was going to municipal water districts, so this test is clearly met. Fourth, Section 142(e) of the Code requires that the facility either be operated by a governmental unit or that the rates to be paid by customers are either established by state or political subdivision thereof, an agency or instrumentality of the United States, or a public service or public utility commission or similar body. In this case, the Lake B facilities will be operated by the issuer, a governmental unit, and so the IRS acknowledges that this requirement is also satisfied.

The IRS also recognizes that there is an interaction between the Lake B supply and another governmental authority where the canal operated by the other governmental authority intersects and adds supply to the Lake B supply. The IRS again reaches an obvious conclusion that the Lake B supply is operated by a governmental unit because the other source of water is operated by another governmental unit.

CONCLUSION.

While the facts of this ruling make the legal analysis relatively straightforward, the IRS does a nice job of reciting the relevant law and reaching the foregone conclusion. We often are inclined to criticize the IRS when we disagree and perhaps more reluctant to congratulate them for a job well done. This is a job well done. So, to quote CCR, “Someone told me long ago, there’s a calm before the storm”. We should enjoy the calm this ruling provides as a storm will undoubtedly come along before we know it.

i

i