On March 6, 2024, the Securities and Exchange Commission (the “SEC”) adopted regulations[1] that will require public companies to file mandatory climate-related disclosures with the SEC beginning in 2026. First proposed in March 2022, the climate-related disclosure rules were finalized after consideration of over 24,000 comment letters and active lobbying of the SEC by business and public interest groups alike. These new rules are aimed at eliciting more consistent, comparable, and reliable information for investors to make informed decisions related to climate-related risks on current and potential investments.

The new rules require a registrant to disclose material climate-related risks and activities to mitigate or adapt to those risks; information about the registrant’s oversight of climate-related risks and management of those risks; and information on any climate-related targets or goals that are material to the registrant’s business, results of operations, or financial condition. In addition, these new rules require disclosure of Scope 1 and/or Scope 2 greenhouse gas (“GHG”) emissions with attestation by certain registrants when emissions are material; and disclosure of the financial effects of extreme weather events.

Unlike the initial proposal, the EU Climate Sustainability Reporting Directive (“CSRD”) and the California Climate Data Accountability Act, the new rules do not require disclosure of Scope 3 GHG emissions. The new rules require reporting based upon financial materiality, not the double-materiality (impact and financial) standard utilized by the EU under the CSRD. Whether registrants will ultimately be required to comply with the new rules depend upon the outcome of anticipated challenges, such as the challenge to the SEC’s authority to promulgate the rule filed in the Eleventh Circuit on March 6th by a coalition of ten states.

Highlights of the New Rule

In the adopting release, the SEC notes that companies are increasingly disclosing climate-related risks, whether in their SEC filings or via company websites, sustainability reports, or elsewhere; however, the content and location of such disclosures have been varied and inconsistent.[2] The new rules not only specify the content of required climate-related disclosures but also the presentation of such disclosures.

The new rules amend the SEC rules under the Securities Act of 1933 (“Securities Act”) and Securities Exchange Act of 1934 (“Exchange Act”), creating a new subpart 1500 of Regulation S-K and Article 14 of Regulation S-X. As a result, registrants, companies that are registered under the Exchange Act, will need to:

- File climate-related disclosures with the SEC in their registration statements and Exchange Act annual reports;

- Provide the required climate-related disclosures in either a separately captioned section of the registration statement or annual report, within another appropriate section of the filing, or the disclosures may be included by reference from another SEC filing so long as the disclosure meets the electronic tagging requirements; and

- Electronically tag climate-related disclosures in Inline XBRL.

The rules require a registrant to disclose:

- Climate-related risks that have had or are reasonably likely to have a material impact on the registrant’s business strategy, results of operations, or financial condition;

- The actual and potential material impacts of any identified climate-related risks on the registrant’s strategy, business model, and outlook;

- Specified disclosures regarding a registrant’s activities, if any, to mitigate or adapt to a material climate-related risk including the use, if any, of transition plans, scenario analysis, or internal carbon prices;

- Any oversight by the board of directors of climate-related risks and any role by management in assessing and managing the registrant’s material climate-related risks;

- Any processes the registrant has for identifying, assessing, and managing material climate-related risks and, if the registrant is managing those risks, whether and how any such processes are integrated into the registrant’s overall risk management system or processes;

- Information about a registrant’s climate-related targets or goals, if any, that have materially affected or are reasonably likely to materially affect the registrant’s business, results of operations, or financial condition. Disclosures would include material expenditures and material impacts on financial estimates and assumptions as a direct result of the target or goal or actions taken to make progress toward meeting such target or goal;

- For large accelerated filers (“LAFs”) and accelerated filers (“AFs”) that are not otherwise exempted, information about material Scope 1 emissions and/or Scope 2 emissions;

- For those required to disclose Scope 1 and/or Scope 2 emissions, an assurance report at the limited assurance level, which, for an LAF, following an additional transition period, will be at the reasonable assurance level;

- The capitalized costs, expenditures expensed, charges, and losses incurred as a result of severe weather events and other natural conditions, such as hurricanes, tornadoes, flooding, drought, wildfires, extreme temperatures, and sea level rise, subject to applicable one percent and de minimis disclosure thresholds, disclosed in a note to the financial statements;

- The capitalized costs, expenditures expensed, and losses related to carbon offsets and renewable energy credits or certificates (“RECs”) if used as a material component of a registrant’s plans to achieve its disclosed climate-related targets or goals, disclosed in a note to the financial statements; and

- If the estimates and assumptions a registrant uses to produce the financial statements were materially impacted by risks and uncertainties associated with severe weather events and other natural conditions or any disclosed climate-related targets or transition plans, a qualitative description of how the development of such estimates and assumptions was impacted, disclosed in a note to the financial statements.

Highlights of what did not get adopted

In its adopting release, the SEC described various modifications it made to its March 2022 proposed rules. The SEC explained that it made many of these changes in response to various comment letters it received. Some of the proposed rules that did not get adopted are:[3]

- The SEC eliminated the proposed requirement to provide Scope 3 emissions disclosure.

- The adopted rules in many instances now qualify the requirements to provide certain climate-related disclosures based on materiality.

- The SEC eliminated the proposed requirement for all registrants to disclose Scope 1 and Scope 2 emissions in favor of requiring such disclosure only by large accelerated filers and accelerated filers on a phased in basis and only when those emissions are material and with the option to provide the disclosure on a delayed basis.

- The SEC also exempted emerging growth companies and smaller reporting companies from the Scope 1 and Scope 2 disclosure requirement.

- The SEC modified the proposed assurance requirement covering Scope 1 and Scope 2 emissions for accelerated filers and large accelerated filers by extending the reasonable assurance phase in period for LAFs and requiring only limited assurance for AFs.

- The SEC eliminated the proposed requirements for registrants to disclose their GHG emissions in terms of intensity.[4]

- The SEC removed the requirement to disclose the impact of severe weather events and other natural conditions and transition activities on each line item of a registrant’s financial statements. The SEC now requires disclosure of financial statement effects on capitalized costs, expenditures, charges, and losses incurred as a result of severe weather events and other natural conditions in the notes to the financial statements.

- The adopted rules are less prescriptive than certain of those that were proposed. For example, the former now exclude in Item 1502(a) of Regulation S-K negative climate-related impacts on a registrant’s value chain from the definition of climate-related risks required to be disclosed. Similarly, this definition no longer includes acute or chronic risks to the operations of companies with which a registrant does business. Also, Item 1501(a) as adopted omits the originally proposed requirement for registrants to disclose (a) the identity of board members responsible for climate-risk oversight, (b) any board expertise in climate-related risks, (c) the frequency of board briefings on such risks, and (d) the details on the board’s establishment of climate-related targets or goals. Along the same lines, Item 1503 as adopted requires disclosure of only those processes for the identification, assessment, and management of material climate-related risks as opposed to a broader universe of climate-related risks. The rule as adopted does not require disclosure of how the registrant (a) determines the significance of climate-related risks compared to other risks, (b) considers regulatory policies, such as GHG limits, when identifying climate-related risks, (c) considers changes to customers’ or counterparties’ preferences, technology, or market prices in assessing transition risk, and (d) determines the materiality of climate-related risks. In the same vein, the adopted rules, unlike the proposed rules, do not require disclosure of how the registrant determines how to mitigate any high priority risks. Nor do the new rules retain the proposed requirement for a registrant to disclose how any board or management committee responsible for assessing and managing climate-related risks interacts with the registrant’s board or management committee governing risks more generally.

- The SEC eliminated the proposal to require a private company that is a party to a business combination transaction, as defined by Securities Act Rule 165(f), registered on Form S-4 or Form F-4, to provide the subpart 1500 and Article 14 disclosures.

Timing of Implementation

The new rules will become effective 60 days after publication in the Federal Register. Compliance with the rules will not be required until much later, however.

Consistent with its earlier proposal, and in response to comments that the SEC received concerning the timing of implementing the proposed rule, the new rules contain delayed and staggered compliance dates that vary according to the registrant’s filing status and the type of disclosure.

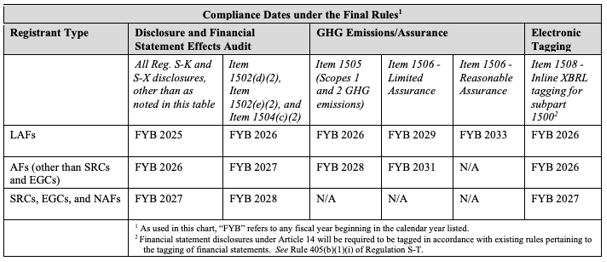

The below table from the SEC’s new release summarizes the phased-in implementation dates.[5]

Filing Status

Large Accelerated Filers (“LAFs”)—a group whom the SEC believed most likely to be already collecting and disclosing climate-related information—will be the first registrants required to comply with the rule. The earliest that an LAF would be required to comply with the climate-disclosure rules would be upon filing its Form 10-K for the fiscal year ended December 31, 2025, which would be due no later than March 2026.[6]

Accelerated Filers (“AFs”) are not required to comply with the new rules for yet another year after LAFs. Climate-related disclosures for AFs must be included upon filing a Form 10-K for the fiscal year ended December 31, 2026, due no later than March 2027. Smaller Reporting Companies (“SRCs”), Emerging Growth Companies (“EGCs”), and Non-Accelerated Filers (“NAFs”) have yet another year to meet the first compliance deadline for climate-related disclosures. These types of filers need not include their climate-related disclosures until filing their Form 10-Ks for the fiscal year ended December 31, 2027, which, again, would be due no later than March 2028.

Types of Disclosures

The new rules also phase in the requirements to include certain disclosures over time. The requirements to provide quantitative and qualitative disclosures concerning material expenditures and material impacts to financial estimates or assumptions under Items 1502(d)(2), 1502(e)(2), and 1504(c)(2) are not applicable until the fiscal year immediately following the fiscal year in which the registrant’s initial compliance is required. LAFs, for example, are not required to report these qualitative and quantitative disclosures until filing a Form 10-K for the fiscal year ended December 31, 2026, due in March 2027. That should be one year after an LAF files its first Form 10-K with climate-related disclosures. The SEC adopted this phased-in approach to respond to commentators’ concerns regarding the availability (or current lack thereof) of policies, processes, controls, and system solutions necessary to support these types of disclosures.

Likewise, the new rules provide for a further phased-in compliance date for those registrants required to report their Scope 1 and Scope 2 GHG emissions and an even later date for those filers to obtain limited or reasonable assurance for those emissions disclosures. An LAF, for example, is not required to disclose its Scope 1 and Scope 2 emissions until filing its Form 10-K for the fiscal year ended December 31, 2026, due in March 2027. And those disclosures would not be required to be subject to the limited-assurance or reasonable-assurance requirements until filing the Form 10-K for the year ended December 31, 2029 or December 31, 2033, respectively.

In accordance with the table above, AFs, SRCs, EGCs, and NAFs have even more time to meet these additional disclosure requirements, if they are required to meet them at all.

It should be noted that the SEC recognized that registrants may have difficulty in obtaining GHG emission metrics by the date their 10-K report would be due. As a result, the rule contains an accommodation for registrants required to disclose Scope 1 and Scope 2 emissions, allowing domestic registrants, for example, to file those disclosures in the Form 10-Q for the second fiscal quarter in the fiscal year immediately following the year to which the GHG emissions disclosure relates. This disclosure deadline is permanent and not for a transition period.

Liability for Non-Compliance

In the introduction to the adopting release, the SEC explains that requiring registrants to provide certain climate-related disclosures in their filings will, among other things, “subject them to enhanced liability that provides important investor protections by promoting the reliability of the disclosures.”[7] This enhanced liability stems from the treatment of the disclosures as “filed” rather than “furnished” for purposes of Exchange Action Section 18 and, if included or otherwise incorporated by reference into a Securities Act registration statement, Securities Act Section 11.[8] According to the SEC, “climate-related disclosures should be subject to the same liability as other important business or financial information” that registrants include in registration statements and periodic reports and, therefore, should be treated as filed disclosures.[9]

In an attempt to balance concerns about the complexities and evolving nature of climate data methodologies and increased litigation risk, the SEC, in the adopting release, emphasizes certain modifications made in the new rules including:

- limiting the scope of the GHG emissions disclosure requirement;

- revising several provisions regarding the impacts of climate-related risks on strategy, targets and goals, and financial statement effects so that registrants will be required to provide the disclosures only in certain circumstances, such as when material to the registrant; and

- adopting a provision stating that disclosures (other than historic facts) provided pursuant to certain of the new subpart 1500 provisions of Regulation S-K constitute “forward-looking statements” for the purposes of the PSLRA safe harbors.[10]

Registrants are subject to liability under Securities Act Section 17(a), Exchange Act Section 10(b), and/or Rule 10b-5 for false or misleading material statements in the information disclosed pursuant to the new rules.[11]

Observations

Consistent with its recent trajectory, the SEC continues to be a kinder, gentler regulator on climate disclosure requirements. Although the new rules will apply broadly to publicly traded companies, their scope is less demanding than the requirements under recent similar laws enacted in California or the EU. Under the California Climate Corporate Data Accountability Act (the “CCDA”), companies with annual revenues in excess of $1 billion and “doing business in California”[12] will be required to publicly disclose Scope 1 and Scope 2 emissions beginning in 2026, and Scope 3 emissions beginning in 2027. And because the California law applies to all companies, not just those that are publicly traded, it is also more broadly applicable and will trigger assessments and compliance for companies that are not subject to the SEC’s rule. The CCDA is currently the subject of legal challenge that includes questions of whether the required disclosures violate the First Amendment right to free speech, as well as possible federal preemption. As a result, there is a chance that the CCDA may yet be diluted or found unconstitutional. But in light of the imminent timeline for compliance, many companies subject to the CCDA are already developing programs to facilitate and ensure timely compliance with the requirements.

Similarly, the EU has broader reporting obligations under the CSRD than the SEC’s new rules. Compliance with the CSRD is required for both public and private EU companies as well as for non-EU companies with certain net annual turnovers, certain values of assets, and a certain number of employees. Under the CSRD, companies must publish information across a wide spectrum of subjects, including emissions, energy use, diversity, labor rights, and governance. Initial reporting under the CSRD begins to phase-in in 2025.

A key takeaway here is that although the SEC rules may have taken a lighter approach to climate disclosures, many large companies are likely to be subject to more stringent requirements under either the CCDA or the EU CSRD. And as some companies begin to comply to provide this information and data, the market may drive demand and an expectation that other companies, not otherwise subject to these various reporting regimes, follow suit. While the SEC rules may be a slimmed down version of what could have been, it is likely that the trend toward transparency and disclosure will continue to be driven by other regulatory bodies and market forces alike.

[1] Securities and Exchange Commission, Final Rule The Enhancement and Standardization of Climate-Related Disclosures for Investors, 17 CFR 210, 229, 230, 232, 239, and 249, adopting release available at https://www.sec.gov/files/rules/final/2024/33-11275.pdf.

[2] Id. at 48.

[3] Id. at 31-33.

[4] Id. at 225.

[5] Id. at 589.

[6] The new rules’ compliance dates apply to annual reports and registration statements. But, in the case of registration statements, compliance is required beginning with any registration statement that is required to include financial information for the full fiscal year indicated in the table above.

[7] Id. at 13.

[8] Id. at 584. At a high level, Section 18 imposes liability for false and misleading statements with respect to any material fact in documents filed with the SEC under the Exchange Act and Section 11 imposes liability for material misstatements or omissions made in connection with registered offerings conducted under the Securities Act.

[9] Id.

[10] Id. at 803.

[11] Id.

[12] A term which is not defined in the law, but is likely intentionally very broad, and is expected to be interpreted in that way.

i

i