Executive Summary

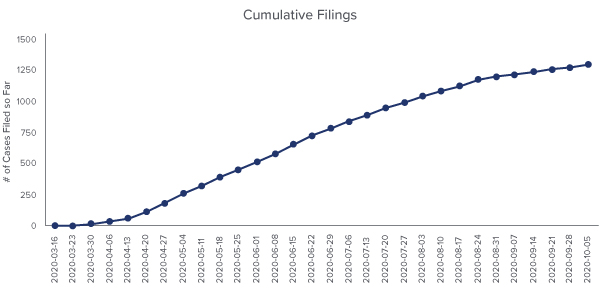

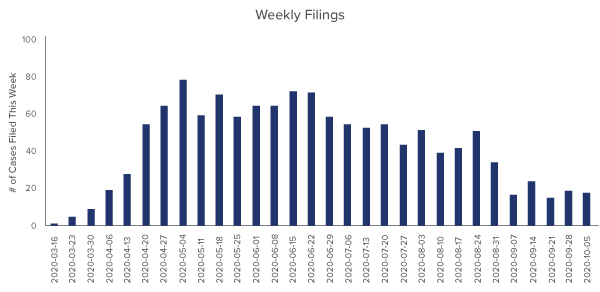

Companies in the United States continue to file business interruption lawsuits against their insurers for claims arising from state and local government shutdown orders in response to the COVID-19 pandemic. At least 1,250 cases have been filed nationally, and these cases have been filed in both state and federal court and in every state. While the weekly rate of new cases has declined, there are still historic numbers of cases being filed every month.

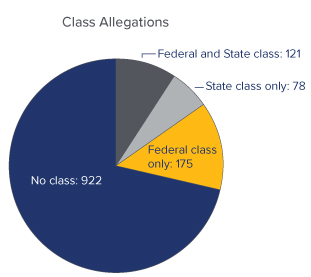

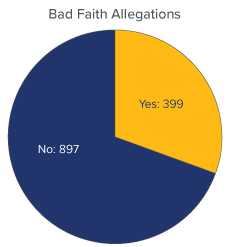

Over a third of these cases have been filed by restaurants and bars. Similarly, slightly less than a third of the cases have been filed as class actions, with a similar amount of cases containing bad faith claims.

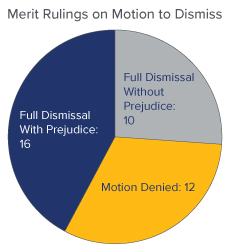

Of cases where courts have ruled, the nationwide trend is in favor of insurers. Nearly 75% of cases have resulted in dismissals of the policyholder’s claims. However, two opinions within the last several weeks, one in New Jersey and one in North Carolina, have found in favor of the policyholder. In Optical Services USA/JCI v. Franklin Mutual Insurance Co., No. BER-L-3681-20, Superior Court of New Jersey, Law Division, Bergen County, the court ruled that physical loss or physical damage was not required under New Jersey law. Similarly, in North State Deli LLC et al. v. The Cincinnati Insurance Co. et al.; 20-CVS-02569, Superior Court for the County of Durham, the court granted summary judgment in favor of the policyholder restaurants, concluding that physical damage to the building was not required under the policy at issue.

These two decisions have the potential to shape plaintiffs’ strategies in jurisdictions across the country, and insurers and their counsel should pay close attention to both rulings. More analysis is offered below.

COVID-19 Insurance Litigation Analytics

By early October, over 1,250 lawsuits against insurers have been filed in the United States since the pandemic began. The rate of filings has dropped; while in late August an average of 45-50 were being filed each week, that rate has dropped to 15-20 cases per week. This information and graphics was obtained from, and compiled by, the excellent COVID-19 Business Interruption litigation tracker which the University of Pennsylvania Carey Law School has created.

To put these case numbers and filing rates into perspective, the typical “large” hurricane will result in 100 or less business interruption cases being filed within the first year. Superstorm Sandy in 2012 resulted in approximately 150 business interruption cases being filed within the first year. Based on the amount of litigation COVID-19 is creating, it is the equivalent of a major hurricane making landfall every month.

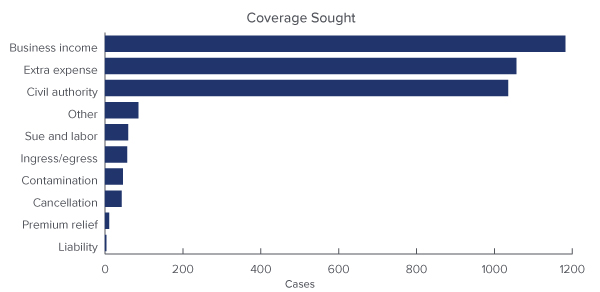

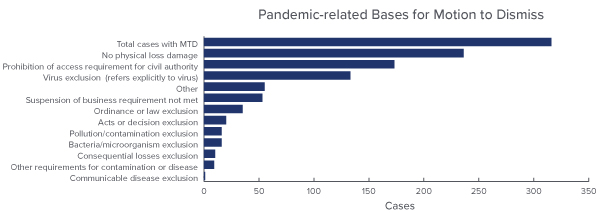

These lawsuits typically seek payments under either business interruption or civil authority coverage in connection with COVID-19. Some only seek a declaratory judgment, most articulate a breach of contract claim, and some include claims for bad faith insurance practices. Generally, the allegations articulate claims that government ordered closure (from either the state or local government) or changing consumer preferences (stemming from the pandemic) and disrupted supply chains obligate the insurers to provide coverage, either as a result of the civil authority provisions in the policy or the lack of a specific virus exclusion.

These lawsuits have been filed against every major insurer operating in the United States.

These cases have been filed in state court and federal court, as individual claims and class actions, and one-quarter of the cases involve claims for insurance bad faith, which can result in the imposition of treble damages or punitive damages against the insurer. More than one-quarter of the cases have been filed as class actions. Further, a greater percentage of cases filed now contain bad faith claims, as compared to our last update in early September.

Early Motions Practice Has Led to Many Dismissals

As early as July 2, 2020, a state court in Michigan ruled in favor of the insurers in Gavrilides Management Company, et al. v. Michigan Ins. Co. This appears to be the first substantive ruling on COVID-19 issues in the country. The insured argued that the virus exclusion did not apply because the loss of access was caused by the government orders, not by the virus. In addition, the insured argued that the loss of use of the property caused by the governmental orders constituted “direct physical loss” within the meaning of the policy. Applying Michigan law, the court rejected two arguments from the policyholder: (1) that the loss of use of their property as a result of government closure orders was a “direct physical loss” and (2) that the virus exclusion in the policy did not apply. In a bench ruling, it is reported that the Ingham County judge concluded that “direct physical loss or damage” requires more than mere loss of use or access, and that the virus exclusion was unambiguous and excluded coverage.

The majority of cases where the defendant insurer has responded with a Rule 12 motion to dismiss based on the pleadings have resulted in an early win for insurers. As a result, insurer exposure to these cases has been minimal.

Arguments From Some Policyholders Have Started Gaining Traction

Some policyholders have started to develop novel arguments. Many CGL policies issued in the United States since the original SARS and Ebola pandemics now contain a virus exclusion. At least one lawsuit has been filed to directly test the strength of the ISO "CP 01 40 07 06" virus exclusion. 1S.A.M.T. Inc. d/b/a Town and Country v. Berkshire Hathaway, Inc., No. 20-2025 (W.D. Pa. June 11, 2020) alleges that because of regulatory estoppel – an equitable doctrine that prevents insurers from asserting an interpretation in court which is contrary to the insurer’s original explanation of the policy when it obtained state regulatory approval of the policy – the virus exclusion does not apply.

Litigation has also revealed that some businesses in the United States have policies which contain an express endorsement which was added to the policies and, arguably, provide COVID-19 pandemic coverage. In SCGM v. Lloyds of London, a theater/restaurant company has sued Lloyds of London, based on a Lloyds policy which contains a “Pandemic Event Endorsement.” Lloyd’s has taken the position that COVID-19 is not “…covered under the Pandemic Event Endorsement as it is not a named disease on that endorsement.” Other documents from the case indicate that the endorsement at issue provides coverage for at least twenty-five (25) diseases, including avian flu, zika, and “Severe Acute Respiratory Syndrome-associated Coronavirus (SARS-CoV) disease.” It is unknown how widely the Lloyds policy was sold, or what other companies may have purchased the pandemic event endorsement.

In August, a federal judge in the Western District of Missouri ruled in favor of a group of hair salons and restaurants, by concluding that allegations of the presence of physical particles of the COVID-19 virus within their businesses satisfied the requirement for physical loss or damage under their insurance policies. Studio 417, Inc. v. Cincinnati Insurance Co., No. 20-03127, (W.D. Mo.).

Last month, a New Jersey court ruled that the presence of physical particles of COVID-19 was not required under New Jersey law to state a claim for business interruption coverage. This has been the most significant ruling in favor of policyholders anywhere in the U.S., and this case will be cited by the policyholder bar in all jurisdictions going forward. In Optical Services USA/JCI v. Franklin Mutual Insurance Co., No. BER-L-3681-20, Superior Court of New Jersey, Law Division, Bergen County, the policyholders presented straightforward business interruption and civil authority claims. The insurer responded that there had been no direct physical loss or damage, resulting in no coverage.

The plaintiffs argued two main bases for coverage being triggered under their policies. First, that the mere presence of a dangerous condition can constitute physical loss, citing Gregory Packaging Inc. v. Travelers Property Casualty Co. of America, 2014 U.S. Dist. LEXIS 165232 (D.N.J. Nov. 25, 2014). In Gregory Packaging, a federal court in New Jersey concluded that an ammonia gas discharge into a building rendered the air (and the entire building) “temporarily unfit for occupancy” and thus constituted direct physical loss or damage. Plaintiffs second argument was that the Governor’s closure orders “not only affected plaintiffs’ businesses, but they affected . . . all properties around plaintiffs” which triggered civil authority coverage.

The court also relied on Wakefern Food Corp. v. Liberty Mutual Fire Insurance Co., 406 N.J. Super. 524 (App. Div. 2009), which found a grocery store had business interruption coverage for an electrical outage because the electrical grid and transmission lines were not capable of performing their essential function of providing electricity. In reliance on Wakefern, the Optical Services court concluded that the word “physical” in an insurance policy should be construed more broadly than just “material alteration or damage.”

Optical Services is consistent with numerous decisions in New Jersey, many of which are in conflict with the insurance law of many other states. Optical Services finds the potential for coverage for a loss of use to a property, even without any tangible damage to property.

A group of North Carolina restaurants obtained judgment in their favor on their business interruption claims.

Every lawyer, judge, and legal commentator following COVID-19 business interruption litigation is aware that the restaurant and hospitality sector has been particularly hard hit by government closures and other shut-down orders. That negative impact on their business has been reflected in filings rates.

This month, a group of North Carolina restaurants became the first policyholders in the country to obtain a judgment in their favor on their business interruption claims. North State Deli LLC et al. v. The Cincinnati Insurance Co. et al.; 20-CVS-02569, Superior Court for the County of Durham. The Order, unlike many trial court decisions, is over 7 pages long. In granting partial summary judgment in favor of the policyholders (on their declaratory judgment claim), Judge Orlando Hudson focused on dictionary definitions of “physical” and “loss” and applied North Carolina common law (which is similar to many states) that various terms in a policy are to be construed harmoniously and that ambiguous terms are to be construed against the insurer. Specifically, Judge Hudson focused on the phrase “accidental physical loss or accidental physical damage.”

Here, the Policies provide coverage for "accidental physical loss or accidental physical damage." Cincinnati's argument that the Policies require physical alteration conflates "physical loss" and "physical damage." The use of the conjunction "or" means-at the very least-that a reasonable insured could understand the terms "physical loss" and "physical damage" to have distinct and separate meanings. The term "physical damage" reasonably requires alteration to property. See Damage, Merriam-Webster (Online ed. 2020) ("loss or harm resulting from injury to person, property, or reputation"). Under Cincinnati's argument, however, if "physical loss" also requires structural alteration to property, then the term "physical damage" would be rendered meaningless. But the Court must give meaning to both terms.

North State Deli, pg. 7.

After arriving at this conclusion, Judge Hudson concluded that the policyholder’s inability to access and use their facilities constituted a “physical loss” under the policies. He also concluded that the “Ordinance or Law,” “Acts or Decisions,” and “Delay or Loss of Use” exclusions did not apply. He then entered judgement in favor of the restaurants; the first judgment in favor of any policyholders on a business interruption claim in the United States that we are aware of. This ruling has been certified for immediate appeal, but will undoubtedly be cited to by policyholders across the country and presented to courts in other jurisdictions in support of arguments in favor of coverage.

If your clients have a commercial property insurance policy with business interruption coverage, they should submit a claim to their carrier and review the policy for the existence of coverage, or reach out to an experienced insurance lawyer to assist in your review.

/>i

/>i