Since the release of our recent article “Poison Pills, NOL Poison Pills and the COVID-19 Pandemic” in mid-April, we continue to see a surge in the number of companies implementing poison pills (also referred to as shareholder rights plans), a type of defensive tactic used by a corporation’s board of directors against a hostile takeover bid.

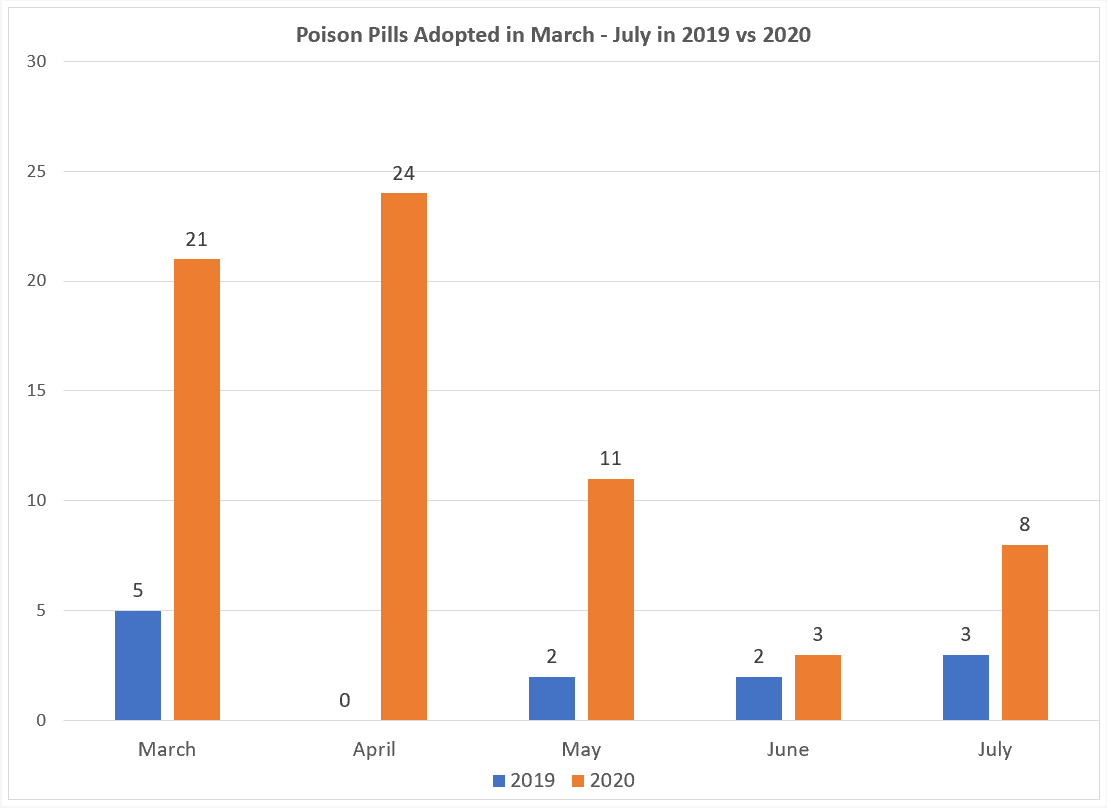

In addition to 21 poison pill actions adopted by U.S. corporations in March (including 16 traditional poison pills with terms of one year or less and five tax benefits preservation plans, commonly known as “NOL poison pills,” with terms of approximately three years), there were 46 poison pills adopted from April to July (including 35 traditional poison pills and 11 NOL poison pills).[1] Within the first seven months of 2020, there have been a total of 70 poison pills adopted, compared to only a total of 35 adopted in 2019 (12 of which were adopted during the period of March to July in 2019).[2]

The chart below compares the number of poison pills adopted in 2019 vs. 2020 during the period of March to July:

Among the 70 corporations which have adopted poison pills this year, 38 of them cited in their press releases that their boards of directors have taken note of the substantial increase in market volatility and uncertainty as a result of the global COVID-19 pandemic, as well as the pandemic’s negative impact on their stock price, which they believed did not reflect their companies’ inherent value or business performance.

The corporations that adopted poison pills in 2020 come from a variety of industries, including oil and gas (12 corporation), entertainment and media (8 corporations), pharmaceutical and medical (6 corporations), real estate (6 corporations), apparel retail (4 corporations), and aerospace and aircraft (4 corporations).

We will continue to follow developments and trends in this area.

ENDNOTES

[1] According to information available at S&P Capital IQ, a research and analytics platform for market and financial data.

[2] According to Deal Point Data, a merger & acquisition, securities and governance research firm.

/>i

/>i