Despite court closure orders and other restrictions entered across the country, commercial litigation continues to be filed, with many courts docketing new cases in 2020 on pace with 2019. For businesses considering litigation in uncertain times, there are special considerations, as well as enduring best practices. Preserving vital relationships will be key to mitigating the impact down the road and avoiding irreversible consequences. But filing a lawsuit is sometimes the right move, and businesses should consider consulting with counsel to understand the steps that can be taken to prepare and the dynamics business litigants are likely to face.

Court Restrictions and Innovations

In the United States, various courts in every state have issued some form of orders declaring judicial emergencies and/or restricting court functions or rules. The types of restrictions imposed vary widely and include suspension of all non-essential proceedings, tolling of deadlines, and postponing of trials.

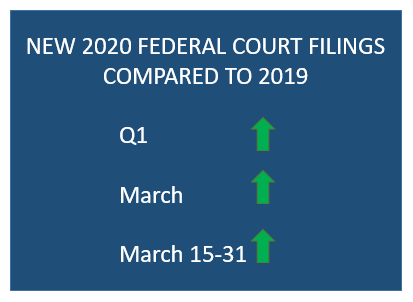

But in many instances, online filings in civil cases are proceeding in a normal fashion. Comparing the pace of filings in Federal Courts in 2020 to those in 2019, new filings, led by products liability cases, are up despite the onslaught of court restriction orders issued throughout March 2020.

In Seattle, Washington, even as the community endured being an early “hot spot,” hundreds of civil cases were filed in the Superior Court of King County. Likewise, in the similarly hard hit area of San Francisco, California, new cases continued to be initiated in the Superior Court for San Francisco, County.

Like many things unfolding on the local level, courts within a couple of miles of each other or in bordering counties may have different approaches to what proceedings they will hold and which functions they continue to serve. King County has issued special guidance regarding civil cases that contemplates continued motions practice but modifies procedures and postpones civil trials.

Foreclosure and eviction proceedings were previously among the most routine court proceedings and are now, depending on the jurisdiction, at a standstill. Even if not barred by a court order, on the commercial litigation side, what is considered appropriate, essential, or time-sensitive may viewed be differently by the judges, the litigants, and, eventually, the juries.

But innovations are also at play. Courts are holding more telephonic hearings, court reporters are refining virtual depositions, and mediators and arbitrators are hosting multi-party proceedings remotely. The legal industry and litigants will continue to adapt, and access and efficiency are on track to advance.

These dynamics require litigants to navigate carefully and include consideration of whether restrictions or, perhaps more likely, delays within the judicial system impact the litigation strategy. This analysis pertains to not only new cases, but also to already pending litigation.

Seeking a Better Outcome

The reality that all businesses are increasingly facing is that contracts, business relationships, and consumer/customer interactions are strained by the rippling effects of disease and containment measures. Crisis and change may cause more businesses and individuals to look to litigation to address the fallout.

If deciding whether to file a lawsuit or responding to an adverse party, consider the reputational risks of pursuing the litigation, the resources available to allocate to the dispute, and whether mitigation efforts are still available. For businesses facing a dispute and considering next steps, a call to counsel to discuss the following key questions may improve the end result:

-

Is there specific information about an adversary that would alter a decision about whether to file suit? If so, can you ask for it?

-

Are there interim agreements that would preserve a rocky relationship while sharing the pains of the present and the risks of unknown? What terms would you have made more clear, knowing what you know now?

-

Is this a business dispute that matters and will continue to matter to the vitality of the business, in light of changing priorities amid a pandemic?

-

Whether filing an action or being threatened with a lawsuit, what communications to, for example, customers, insurers, investors, or lenders need to be issued?

-

If the company anticipates litigation, are relevant records being maintained to document the impact as well as to comply with preservation and “litigation hold” obligations?

/>i

/>i