While we are all concerned about COVID-19 pandemic and the impact it is having on society, the market turmoil is creating estate planning opportunities.

1. Amending Intrafamily Loans

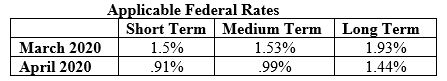

The Applicable Federal Rate (AFR) that is required to be charged on intrafamily loans dropped significantly in light of actions by the Federal Reserve. April’s short-term AFR rate dropped to 0.91%. You may wish to consider amending any intrafamily loans to take advantage of the lower rates.

2. Grantor Retained Annuity Trusts (GRATs)

Rolling (zeroed-out) grantor retained annuity trusts (GRATs) can take advantage of the current market dip and volatility. The April 7520 rate (which acts as a hurdle for the GRAT) was lowered to 1.2% compared to 1.8% in March. The GRAT allows you to pass along appreciation in excess of the hurdle gift tax-free. This is a great strategy to the extent you want to keep your current asset base, but pass along appreciation to the next generation.

3. Sales to Defective Grantor Trusts

The market dip plus the low interest rates make sales transactions currently very appealing. In addition, we are anticipating seeing significant increases in discounts for minority interests in limited liability corporations (LLCs). The alignment of these three factors creates a unique opportunity to shift tremendous value to future generations by selling minority interests in family investment LLCs.

/>i

/>i