In the US domestic upstream oil and gas market, 2021 has been all about consolidation and exploration and production (E&P) companies focusing on disciplined growth and asset optimization. In an effort to win back the confidence of public and capital markets, many E&P companies have recalibrated their strategies and focus toward maximizing the value of existing assets by deploying maintenance capital to drill wells on existing leases and relying less on acquiring new prospects and chasing growth just for growth’s sake. All of this is aimed at establishing a consistent, stable-free cash flow that can be returned to investors and recouping some of the financial losses borne by those investors over the tumultuous past decade.

The wavering confidence in the E&P sector from public and capital markets has cascaded across the oil and gas value chain, affecting midstream as well. As a result, midstream businesses are also facing pressure from their own financial backers and investors to minimize additional capital expenditures and maximize cash flow. For the midstream companies that build the gathering, separating, transportation, storage and processing infrastructure to service the volumes of oil, gas and water that E&P companies produce, this check on E&P growth means that the midstream sector must adapt its own growth plans and strategies as well. If E&P companies are not spudding as many new wells and developing as many new drilling locations, then there is not as great of a need for the build out of midstream infrastructure to service production-related volumes. Additionally, existing pipelines, processing facilities, compressors and storage units may be facing capacity constraints as producers aim to maintain or increase production from existing wells or drill additional wells in their current production areas instead of focusing on production growth from newly acquired and developed properties.

One upshot of this more disciplined oil and gas environment is that it has created some strange bedfellows. Some midstream companies, who typically compete with one another for E&P customers, are working together. This cooperation manifests itself through creative commercial arrangements, contracts or joint ventures to utilize the midstream companies’ collective existing infrastructure to maximize overall throughput and related service fees and minimize any additional capital spend. We outlined some of the strategies we’ve seen below, along with relevant advantages and complications to consider.

CAPACITY LEASES AND TRADES (PIPE-WITHIN-A-PIPE)

One of the most common commercial arrangements between midstream competitors is a capacity lease. This is where one midstream company leases capacity on an existing pipeline to another midstream company, allowing the company without an existing pipeline—the pipeline lessee—to satisfy that pipeline lessee’s customer obligations by being able to transport or service production without having to build its own pipeline to do so.

In the local gathering context, this often comes in the form of a capacity trade. A simple example is where two midstream companies, Northern Half Midstream (NHM) and Southern Half Midstream (SHM), have existing infrastructure in a particular area, Production County. NHM has pipelines in the northern half of Production County, and SHM has pipelines in the southern half of Production County (See: Figure 1 below). NHM and SHM each have gathering agreements with separate producers where all of their respective producers’ Production County volumes are dedicated to NHM and SHM, as applicable. The majority of NHM’s customers’ wells are in the northern half of Production County, but some are in the southern half. The majority of SHM’s customers’ wells are in the southern half of Production County, but some are in the northern half. To avoid both having to build additional pipelines and create overlapping networks, NHM and SHM enter into a capacity trade.

Under a capacity trade, each party leases a specified amount of capacity on the other party’s existing pipelines to service the wells in the part of Production County where their customers have wells, but the pipeline lessees don’t have pipelines. Both NHM and SHM can “gather,” virtually through the capacity trade, a greater amount of production volumes without having to undertake the additional capital expenditure to install their own pipelines to service those volumes. This arrangement works well when a true trade is at play because each party benefits from, and is burdened by, the capacity lease arrangements. This results in ample incentive for NHM and SHM to work together and develop trust in one another.

In the long-haul pipeline context, this arrangement may occur when there is an existing long-haul pipeline in place, and a new midstream company has signed customers up to transport the same product to and from roughly the same locations. It is particularly beneficial when the existing pipeline is under financial distress and/or is struggling to reach capacity on the pipeline. In these types of agreements, sometimes called a pipe-within-a-pipe, the new midstream company will contract with the existing pipeline owner for a set volume of capacity on the existing line to service the new midstream company’s customers. This works well for the new midstream company, as they do not have to build a new long-haul pipeline, and is also good for the existing pipeline owner because it allows them to monetize the vacant space on their pipeline.

In both arrangements—the capacity trade and the pipe-within-a-pipe—there are drawbacks to consider. From an operational perspective, the pipeline lessee is now placing the customer’s product in the custody and care of another service provider. They will need to get comfortable (and seek contractual protection and indemnification) that the other service provider will maintain the appropriate levels of operational integrity, commitment to safety and dedication to excellence that customers expect and are paying for. From a financial perspective, the nature of these arrangements is to forego the potential upside from the prospect of new customer contracts with higher rates in exchange for a “sure thing” at a percentage of the pipeline lessee’s fees. The contracted for leased capacity may also limit the pipeline lessee’s long-term growth prospects if they have the opportunity to sign up more production than they have leased capacity for.

OVERLYING DEDICATION ARRANGEMENTS

In rare occasions, production from the same producer in a particular area is dedicated to two different midstream companies (a dual-dedication). Putting aside how a dual-dedication can come into play, let’s assume the resulting effect in this scenario, under the gathering agreements in place, is that the two midstream companies, UpperCon Gathering (UCG) and LowerCon Gathering (LCG), find themselves competing with one another to respond to connection requests from their producer, MultiCon Production (MC Production), and to offer the most competitive gathering rates in connection with MC Production’s requests. UCG and LCG quickly realize that the financial ramifications of this competition, and the lack of foresight and direction with respect to requirements to build out pipeline infrastructure, will be disastrous for each of them. Instead of competing, UCG and LCG create an arrangement where UCG agrees to respond to all connection requests on the First County side of the dedication, and LCG agrees to respond to all connection requests on the Second County side of the dedication (See: Figure 2 below). If a substantial majority of the connection requests are in one county and not the other, UCG or LCG, as applicable, will make a pre-agreed true up payment at the end of the year.

This type of arrangement is not without complexity and potential pitfalls. One key issue to consider for UCG and LCG is damaging relations with MC Production should it become aware of UCG and LCG’s arrangement (which it will). There could also be issues between UCG and LCG around application of the true up payment and the ability to audit the other party’s books related to the volumes and revenues from the new connections. While this example may not solve all dual-dedication issues, it is illustrative of the trend for midstream competitors to work together to find a mutually beneficial arrangement and the creativity with which those arrangements are implemented.

“SUBCONTRACTOR” STRUCTURE

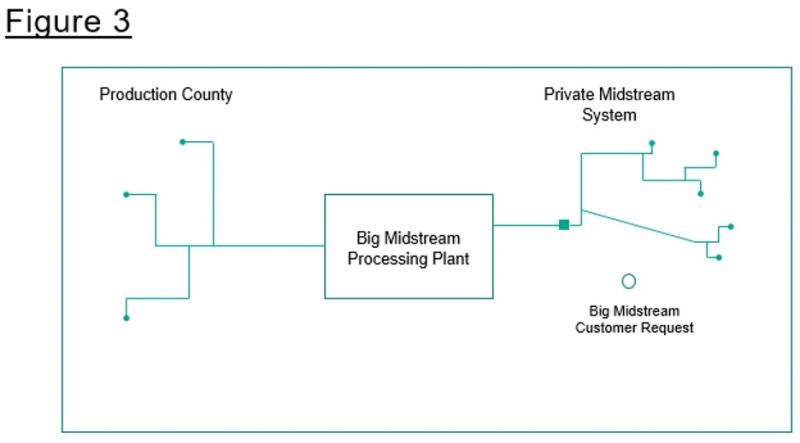

A more recent development is what is known as the subcontractor structure. This is where a larger, often publicly-traded, midstream company (Big Midstream) has a dedication from a large customer for all of that customer’s production in Production County. Big Midstream has a multi‑train processing facility in the middle of Production County and a series of gathering pipelines on the western half of Production County. A smaller, private midstream company (Private Midstream) has a set of smaller customers on the eastern half of Production County and its own gathering infrastructure to service those customers but has not constructed a processing facility (See: Figure 3 below). Additionally, Private Midstream delivers some of the volumes it transports to Big Midstream’s plant for processing (pursuant to Private Midstream’s customers’ separate processing and marketing agreements with Big Midstream).

Big Midstream gets a request from its customer to connect to a well on the eastern half of Production County, but it does not want to undertake the capital spend to construct new pipelines to connect to that connection. Big Midstream also doesn’t want to release all of the related acreage under their gathering agreement by failing to connect, as it wants to maintain the ability to process that production and receive the resulting revenue. Big Midstream approaches Private Midstream and asks Private Midstream to serve as Big Midstream’s subcontractor of sorts and connect to Big Midstream’s customer’s new request and deliver Big Midstream’s customer’s production to Big Midstream’s processing facility.

As with other instances, in this arrangement, Big Midstream must ensure quality service and dedication to safety from Private Midstream and receive the related contractual protection in their commercial agreement with Private Midstream. Big Midstream must also consider the appropriate way to inform its customers of this arrangement, assess how this arrangement affects Big Midstream’s gathering and processing agreement with its customers and take care not to allow those relationships to deteriorate.

CARVE OUT JVS

This final scenario is one we have only seen on white boards and investment banking presentations so far but may come to fruition soon. A large, publicly traded integrated oil company, Big Oil and Gas Co. (BOGC), has an operating position spanning multiple counties (Production County, Development County and Exploration County), in a particular basin. BOGC also has its own gathering infrastructure for the eastern half of Production County but not the western half. BOGC has a mandate to focus on maintenance capital expenditures and has approved drilling plans to spud wells in the western half of Production County in the next 12 months (and must do so in order to maintain its leases there).

A smaller, private midstream company, Private Midstream II (PM-II), has gathering infrastructure all over Production County but heavily weighted toward Production County’s western half (See: Figure 4 below). BOGC approaches PM-II about forming a joint venture (Western Basin Gathering LLC) whereby BOGC would contribute its existing Production County gathering infrastructure and PM-II would contribute substantially all of its Production County assets. BOGC would then enter into a new gathering agreement pursuant to which all of its Production County production is dedicated to, gathered and processed by Western Basin Gathering LLC.

This allows BOGC to indirectly share the burden of building out new gathering infrastructure for its production from the western half of Production County and set itself up to monetize that gathering infrastructure down the road through a sale or initial public offering of Western Basin Gathering LLC. However, separating out those gathering assets and the related financials may be difficult, as well as giving up a significant amount of operating control over those midstream assets.

PM-II increases its footprint in Production County and becomes partnered with a premier anchor customer in BOGC. However, by merging into Western Basin Gathering LLC, PM-II would lose some of its independence and potentially tarnish relationships with other upstream customers. PM-II would also need to diligence (or otherwise receive or be provided up to date information regarding BOGC’s operations in Production County, Development County and Exploration County) to make sure Production County is not being overlooked or effectively discarded by BOGC in favor of Development County and Exploration County.

UPSTREAM CUSTOMER CONSIDERATIONS AND CONCLUSION

In all of the midstream-to-midstream agreement examples described in this article, it is imperative that midstream companies review and understand the terms and conditions of their commercial agreements with their upstream customers and to be sure not to run afoul of those agreements. In some instances, that may require a measured determination as to whether the midstream‑to‑midstream arrangement constitutes an assignment for which an upstream customer’s consent is required or is effectively nothing more than a permitted subcontractor agreement. Maintaining good relations with upstream customers and not breaching commercial agreements with those customers should be a key part of the calculus involved in considering whether or not to enter into any such midstream-to-midstream agreement.

While the examples above are by no means exhaustive, we’ve highlighted some of the benefits and issues around commercial arrangements that we have documented, worked on and conferred with E&P and midstream clients seeking to optimize existing infrastructure to generate increased levels of throughput and revenue. We look forward to continuing to counsel clients on innovative legal structures and agreements in the E&P and midstream industries to help them achieve the highest levels of commercial success.

/>i

/>i