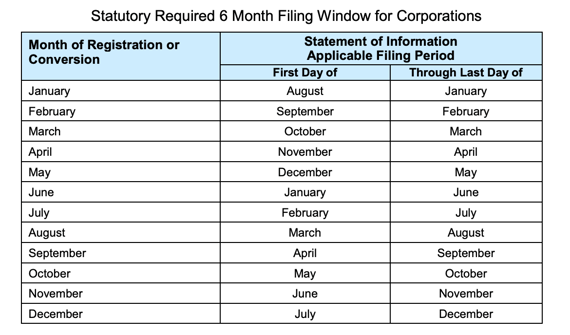

California law requires that every California stock, agricultural cooperative and registered foreign corporation file a Statement of Information with the California Secretary of State. Initial statements must be filed within 90 days of registering with the California Secretary of State. Thereafter, the a specific 6-month filing period based on the original registration date. Cal. Corp. Code §§ 1502 & 2117 and Food and Ag. Code § 54040. The annual statement is filed on Form SI-550. The easiest way to file is to do so electronically on the Secretary of State's website. To determine the applicable filing period, the Secretary of State provides the following convenient table:

A failure to file can result in the assessment of a penalty and suspension of corporate powers, rights and privileges. Cal. Corp. Code §§ 2204, 2205 & 2206. Nonetheless, filers should be aware that the annual statement is a public record. This means that the names, phone numbers, email addresses, and mailing and street addresses will be publicly available. See these Frequently Asked Questions regarding personal information in public filings.

A failure to file can result in the assessment of a penalty and suspension of corporate powers, rights and privileges. Cal. Corp. Code §§ 2204, 2205 & 2206. Nonetheless, filers should be aware that the annual statement is a public record. This means that the names, phone numbers, email addresses, and mailing and street addresses will be publicly available. See these Frequently Asked Questions regarding personal information in public filings.

/>i

/>i