Interest in Qualified Opportunity Zones ("QOZs") has increased since October 29, 2018, when the Department of the Treasury and the Internal Revenue Service published the proposed rules relating to QOZs in the Federal Register.

Anticipation for the final rules has been thick since the Valentine's Day hearing on the rules. Nothing says love like tax rules. Given the complex nature of the program, and the lack of final rules, there is still a lot of uncertainty about how QOZs can be used. Based on that, I would imagine that if I were to have a conversation with a "friend" about QOZs, it would go something like this. I anticipate having additional conversations – with a "friend" – on related QOZ topics, and if there is anything you would like to see discussed, please let me know.

Author: Since this is our first time getting together in quite a while, I thought it would be useful to discuss a topic that is applicable in all 50 states and the rules of which, at present, are still being written. I'm talking about Qualified Opp...

Friend: QOZs, right? Little late to the party there, aren't you sport? I'm pretty sure I've read about 60 of these little summaries since the IRS and the Department of the Treasury released the proposed rules. You have anything fresh?

Author: Perhaps. The key thing you just said was "proposed rules." That means the final rules haven't been issued yet, and a lot of your summaries were based on information that may change, even though the proposed rules do state in various sections that people or entities "may rely on the proposed rules … before the date of applicability of this section, but only if the rules [are applied] in their entirety and in a consistent manner."

Friend: Let me guess: you're going to offer to publish a blackline of this article that will show all of the changes to the proposed rules made by the final rules. Man, you lawyers love your blacklines.

Author: That's not a terrible idea. Could be a quick way for taxpayers and investors to get up to speed on the final rules and the changes. Either way, anyone interested in forming a Qualified Opportunity Fund...

Friend: What in the world is that?

Author: We'll get to it below. As I was saying, if you're interested in forming a Qualified Opportunity Fund ("QOF"), or investing through one of these funds, you really should consult a tax advisor, CPA, and an attorney.

Friend: Wait. Are you talking about having to talk to all three of these people? At the same time? For one deal? I think I'd rather just pay full taxes.

Author: Up to you, but right now, I'd like to refresh the recollection...

Friend: You're not a litigator.

Author: ...of some of our readers about QOZs as the proposed rules are currently structured.

Friend: If you must. So, what are these things – what's their purpose? Most importantly, what's...

Author: ...in it for you? I thought that was where you were going. For this initial scintillating legal education piece, I'll divide up the topic so that the main facets of QOZs are easier to understand.

Tax Benefits

First, let's talk about the tax benefits. QOZs are designed to encourage long-term private investment into distressed communities by providing taxpayers with certain benefits. The benefits potentially include allowing taxpayers to defer capital gains, partial forgiveness of capital gains and full forgiveness of additional gains for investing in QOFs, which invest in Qualified Opportunity Zone Property ("QOZP").

Friend: I'm starting to think I'll need to consult an attorney about all of this. You know any good ones? How does all of this work?

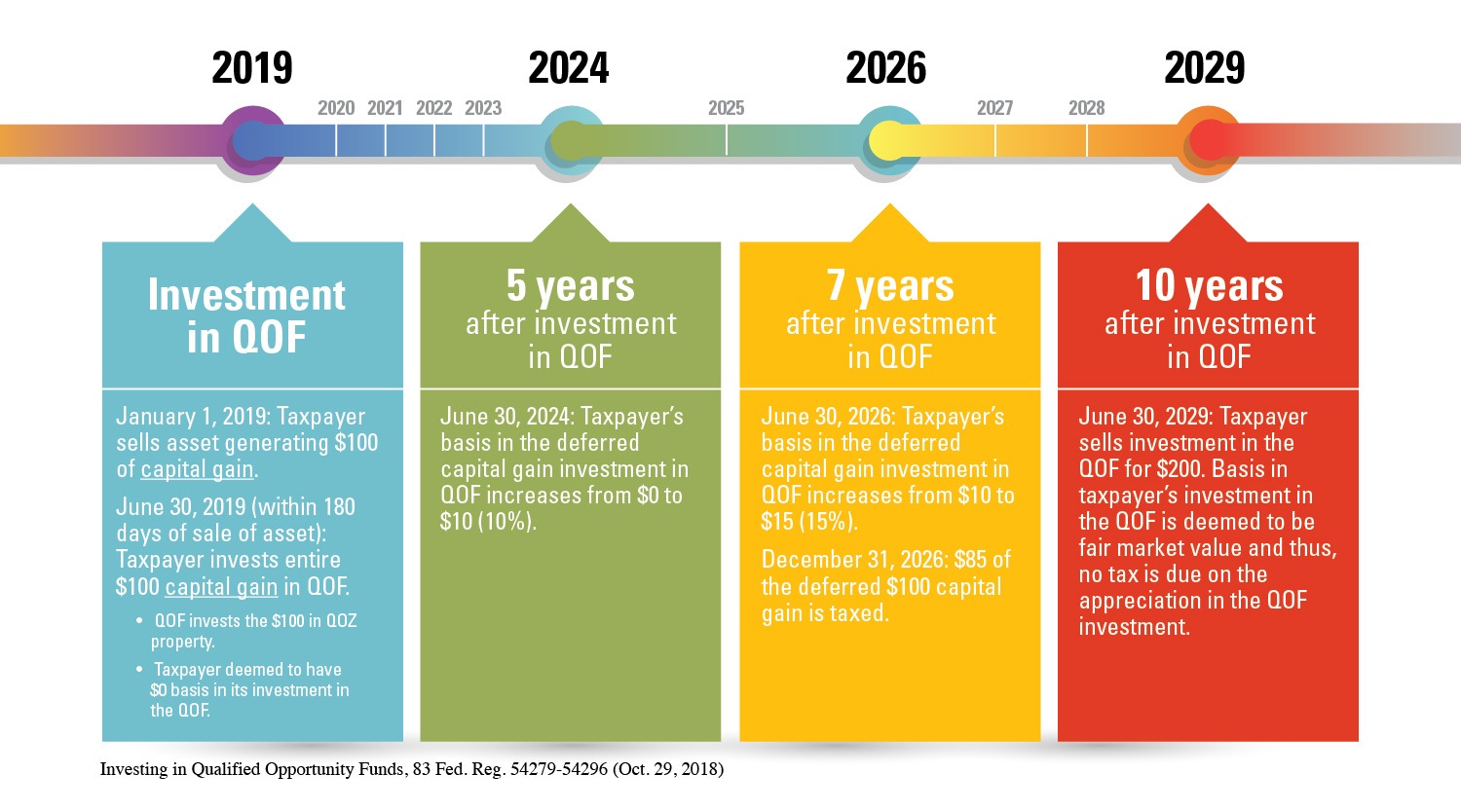

Author: First, a taxpayer sells an investment that has unrealized capital gain. Within 180 days, the taxpayer must invest the capital gain (the "original gain") into a QOF. If the taxpayer holds that investment for five years in the QOF, the basis of the original investment is increased by 10 percent, leaving 90 percent of the original gain to be taxed. If the taxpayer holds the investment for a total of seven years in the QOF, the basis of the original investment is increased by a total of 15 percent, leaving 85 percent of the original gain to be taxed. Taxpayers can defer the tax on the original gain until the earlier of December 31, 2026, or until they sell their interest in the QOF.

In addition, if the taxpayer holds the investment in the QOF for ten years, the basis of the investment in the QOF becomes equal to the fair market value of the investment, resulting in the forgiveness of gains on the investment. Note, though, that the taxpayer will still owe tax on 85 percent of the original gain that was deferred when the taxpayer recognizes that gain as income. I'm sensing that the diagram below might really help you sort this out.

Friend: That diagram is helpful and well done – clearly you didn't make it. You said the deferral of the original capital gain is only good until December 31, 2026? That means someone has to sell an investment with capital gain and invest it into a QOF within 180 days this year to get the extra 5 percent step up in basis. Is that right?

Author: That is correct.

Friend: You don't think we could have used that information, say, last year?

Author: That's why we're going over it now, and I'm pretty sure it was in at least one of the 60 QOZ summaries you said you'd received.

Friend: Touché.

Author: If I may continue, I should also note that an investor only has to roll his or her deferred capital gain into a QOF, not the original principal of the investment.

Key Terms: The ABCs of QOZs

Now that we're through the tax fun, let's discuss what some of these different key terms mean.

Friend: I'll take complicated tax structure acronyms that start with the letter "Q" please, Alex.

Author: I'll press on. Here are some of the key terms:

-

QOZs are low-income census tracts in each U.S. state and territory, nominated by governors, that have been certified by the Department of the Treasury. There are about 8,700 around the United States and its territories.

-

QOFs are investment vehicles, organized as corporations or partnerships, that are required to invest or hold at least 90 percent of their assets in QOZP. While slightly more complicated than this, the 90 percent is tested every six months. QOFs also can be LLCs as long as they are not pass-through entities. QOFs can be set up by entities, a group of people... heck, even you could set one up.

Friend: Even me? That's great. I'll start...

Author: Maybe I got ahead of myself.

Let me get back to the terms.

-

QOZP is property that includes interests in stock of a corporation, partnership interest, or business property, each of which must be involved in a Qualified Opportunity Zone Business ("QOZB"). For the stock or partnership interests,

-

they must have been acquired after December 31, 2017, solely in exchange for cash,

-

the underlying entity must have been a QOZB when the stock or interest was issued or, if a new entity, the entity was being organized for the purposes of being a QOZB and

-

during substantially all of the QOF's holding period of the stock or interest, the entity qualified as a QOZB.

-

-

Qualified Opportunity Zone Business Property ("QOZBP") is tangible property used by a QOZB

-

that was acquired after December 31, 2017,

-

the original use of which in the QOZ commenced with the QOF or the QOF substantially improves the property (during any 30-month period after acquisition) and

-

during substantially all of the QOF's holding period of the QOZBP, substantially all of the property was in a QOZ. The clear and concise proposed rules did clarify that "substantially improve" means, in essence, that the QOF must increase the tax basis of the property by at least 100% during the 30-month period. The basis in the land is not included for these purposes, just the basis in the building.

-

-

A QOZB is...

Friend: Please, make it stop. I'm starting to feel like Dark Helmet in "Spaceballs:" "My brains are going into my feet..."

Author: Well, we can't stop; we've got to slow down first. Back to QOZBs.

A QOZB is a trade or business in which

-

substantially all (which has been defined in the proposed rules as at least 70 percent) of the tangible property owned or leased by the entity is QOZBP,

-

at least 50 percent of the total gross income of such entity is derived from the active conduct of a trade or business in a QOZ,

-

a substantial portion of the intangible property of such entity is used in the active conduct of a trade or business in a QOZ,

-

less than 5 percent of the average of the aggregate unadjusted basis of the property of such entity is attributable to nonqualified financial property, which does not include reasonable amounts of “working capital assets” held in cash, cash equivalents, or debt instruments with a term of 18 months or less (referred to as a working capital safe harbor) and

-

the business is not a private or commercial golf course, country club, massage parlor, hot tub facility, suntan facility, racetrack or other facility used for gambling, or any store the principal business of which is the sale of alcoholic beverages for consumption off premises.

And since I know you're dying for clarification, the working capital safe harbor is dependent on three requirements:

-

the amounts must be designated in writing for the acquisition, construction and/or substantial improvement of tangible property in a QOZ,

-

there must be a written schedule consistent with the ordinary start-up of a trade or business for the expenditure of the working capital and

-

the working capital assets must be spent within 31 months from receipt by the business in compliance with the first two requirements.

Friend: You lost me after the golf course thing. That's a deal killer right there. I already have plans drawn up for a tanning and massage facility for racehorses.

Author: I'm going to ignore that. There's another way to explain how all of these terms work together, and that is in terms of ownership structure: direct and indirect. We'll assume a partnership for the purpose of this explanation

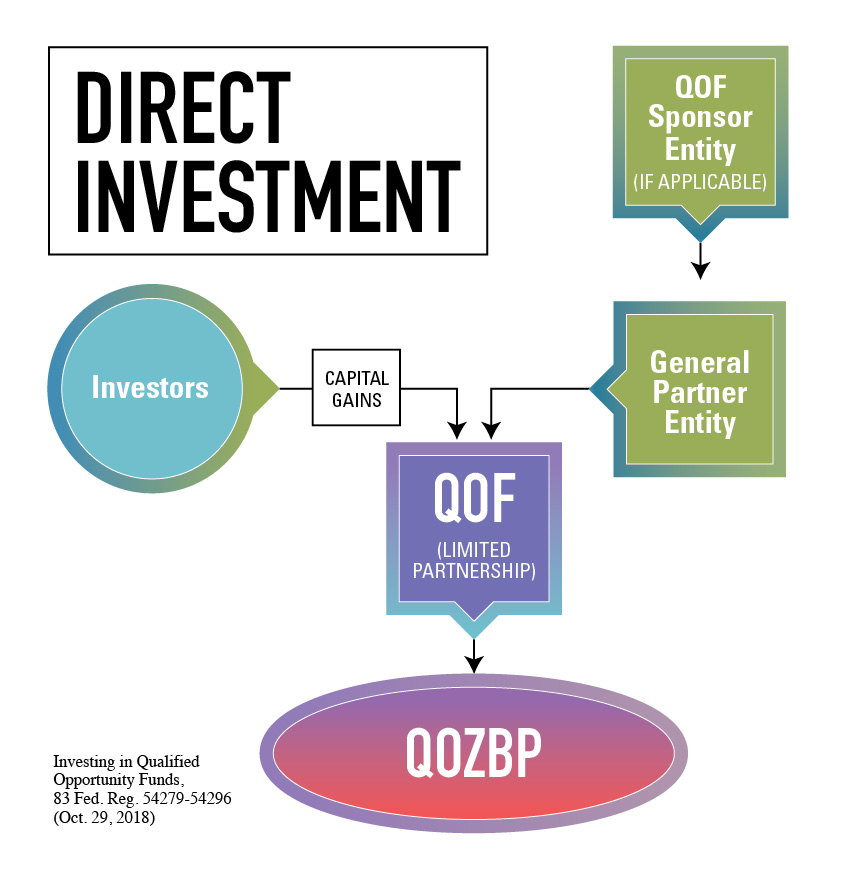

- A direct structure would have investors (as limited partners) and a general partner entity (as the general partner) owning and controlling the QOF. The QOF would then directly own QOZBP used in a trade or business, which would have to comply with all of the requirements we discussed earlier before you showed your age with your movie reference.

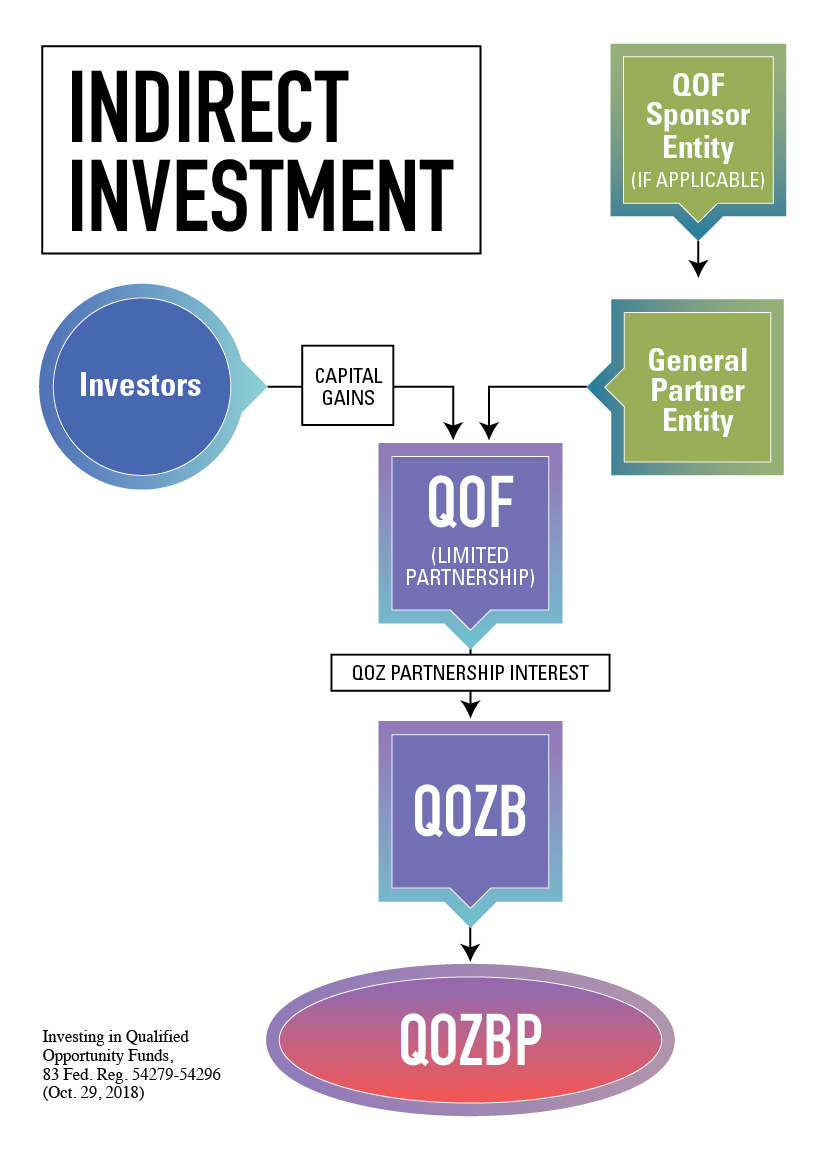

- An indirect structure is a bit more complex. Here, investors (as limited partners) and a general partner entity (as the general partner) would still own and control the QOF. However, the QOF and the general partner entity would then together own another limited partnership, a QOZB, which would then directly own the QOZBP. Thus, the QOF indirectly owns the QOZBP.

You look like you need caffeine.

Friend: Perhaps something a bit stronger.

Author: We're almost done.

What's Coming for QOZs?

Friend: All of this sounds like there is a lot of complexity and a host of additional issues behind what you've already, perhaps futilely, tried to explain. What's the next phase of QOZs? Who can really benefit from these things? And do I have to have another of these conversations with you?

Author: I'll answer your last question first: almost certainly. We still need to see the final rules on QOZs, and once we do, we can (a) take a look at how QOZs are impacting or could impact North Carolina, (b) analyze what kinds of structures have begun to appear (and by "structure," I mean fee structure, of course), (c) see about comparing or combining QOZ tax benefits with other tax structures and programs, including 1031 exchanges, and (d) dig into the aspirational or theoretical economic and other impacts QOZs are supposed to have.

Friend: I asked if I had to have another conversation. That's four you just listed. Your math isn't so great. History major, right?

Author: And proud of it.

Anyway, to finish up here, there are a lot of different kinds of people or entities that could use or benefit from QOZs. Managers of existing funds looking for additional sources of capital or looking to diversify their fund offerings, family offices or high net worth individuals with substantial unrealized capital gains, entrepreneurs looking for different ways to start or expand businesses in QOZs, existing businesses looking to expand their operations or geographic footprint either within or into QOZs, individuals in the real estate industry that could use the new, tax-efficient sources of capital for ground-up development or renovation projects. I would think that once the final rules are promulgated...

Friend: You could have just said "released" or "published." You didn't have to use a fancy lawyer word.

Author: I'm beginning to like your idea of one more conversation a lot better than four.

Once the final rules are promulgated, I think we will begin to see an increase in the amount of QOFs being created or engaging in transactions and also what their targeted investments are and who or what entities are taking advantage of them. It seems that there is some hesitation to throw significant resources into QOFs without the final rules, despite the Department of the Treasury's and the IRS's assurance that taxpayers and entities can rely on the proposed rules.

Friend: I await your call with bated breath.

/>i

/>i