Investment advisers registered with the U.S. Securities and Exchange Commission (“SEC”) or with a state (“Advisers”) as well as commodity pool operators (“CPOs”) and commodity trading advisors (“CTAs”) registered with the U.S. Commodity Futures Trading Commission are subject to important annual compliance obligations. This summary sets forth the primary obligations of which your firm should be aware. This summary should not be considered an exhaustive list of your firm’s obligations under the broader federal securities laws, tax laws or applicable state, local or foreign laws. Obligations for state-registered Advisers may vary from SEC obligations and clients should feel free to contact us for more information.

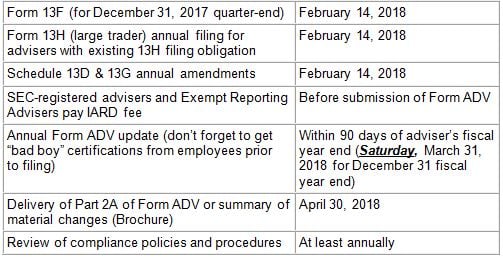

List of annual compliance deadlines for Advisers

Important Notice for 2018 Form ADV Filers

Beginning on October 1, 2017, all advisers filing Form ADV are required to use an updated version of Form ADV Part 1 that contains several new items. Among other items, the updated form (i) requires increased disclosures for advisers to separately managed accounts, (ii) streamlines the registration process for multiple private fund advisers operating as a single advisory business and (iii) requires enhanced disclosures regarding certain business practices, including information regarding an adviser’s online presence and financial industry affiliations. For advisers with a December 31 fiscal year end that have not made an other-than-annual amendment to Form ADV since October 1, 2017, the annual update due in March 2018 will be the first filing under the updated form. Advisers should allot additional time to complete the updated form this year to allow sufficient time to assess the impact of new items and undertake potentially significant data collection efforts to satisfy the new form requirements. The new requirements impact investment advisers with separately managed accounts in particular.

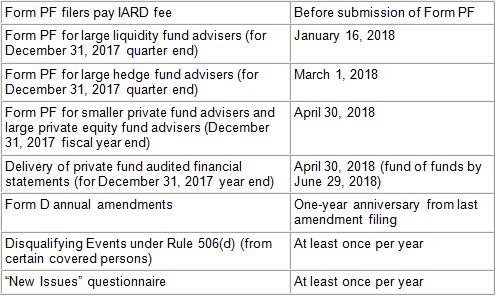

Obligations for Private Fund Advisers

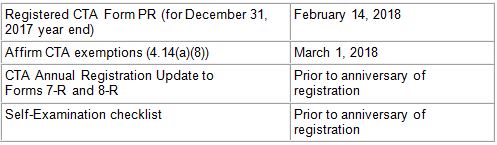

Obligations for CTAs

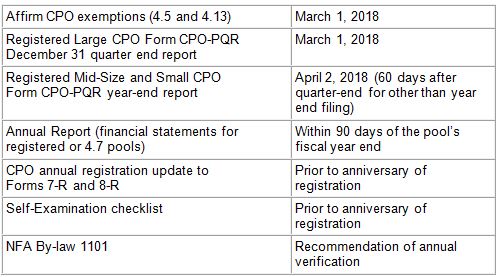

Obligations for CPOs

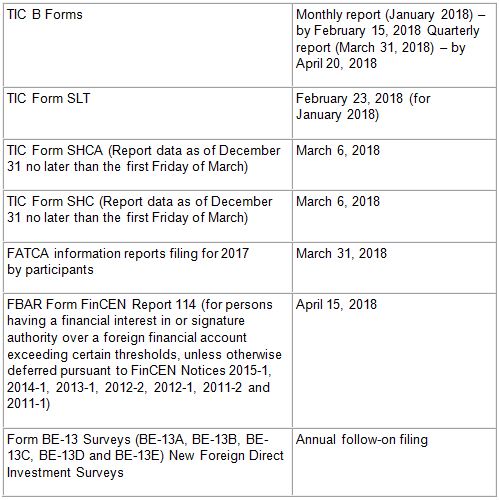

Tax, Treasury and Other Filings

Jeff VonDruska contributed to this article.

/>i

/>i