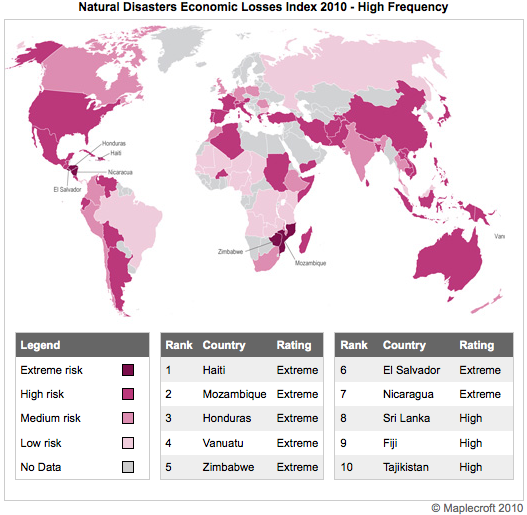

Natural disasters in any form wreak havoc not only on the property and residents of the area affected, but also on its economic stability. Risk intelligence company Maplecroft set out to answer the question of which countries are most vulnerable to economic losses from natural disasters.

To answer this, they used their Natural Disasters Economic Loss Index (NDELI), which evaluates the economic impact of “earthquakes, volcanic eruptions, tsunamis, storms, flooding, drought, landslides, extreme temperatures and epidemics between 1980 and 2010.”

The results highlighted the top 10 most vulnerable countries as:

- Haiti

- Mozambique

- Honduras

- Vanuatu

- Zimbabwe

- El Salvador

- Nicaragua

- Sri Lanka

- Fiji

- Tajikistan

As for industrialized economies, Italy, Japan, China, USA, Spain and France all ranked in the “high risk” category.

“When economic losses are taken as absolute figures, it is predominantly the industrialised countries, such as USA and China, that shoulder the greatest costs,” explained Maplecroft Environmental Analyst, Dr Anna Moss. “However, when losses are calculated as a percentage of GDP, it is developing countries that are most exposed. For example, the USA’s losses from the 1997-1998 El Niño were US$ 1.96 billion, or 0.03 percent of GDP, whereas in Ecuador, economic losses were US$ 2.9 billion, or 14.6 percent of GDP.”

Maplecroft says that the magnitude 7.0 earthquake that struck Haiti in January cost the country close to $8 billion, or 73% of annual GDP. As for number two Mozambique, it’s the increasing amount of flooding over the last decade. The World Bank has reported that Mozambique is at “increasing risk from storm surges . . . due to climate change and estimates that 41% of the country’s coastal area and 52% of coastal GDP is vulnerable.”

Says Profesor Alyson Warhurst, CEO of Maplecroft:

“Climate change has the potential to raise global temperatures and affect weather patterns – the fear for insurers is that this will lead to more frequent and extreme hydro-meteorological related losses.”

If you add up the costs associated with the earthquakes in Haiti and Chile, plus this year’s Atlantic hurricane season, the cost of natural disasters to the insurance industry in 2010 could reach $110 billion worldwide, according to Swiss Re. A frightening figure to say the least.

The above article is reprinted from the Risk Management Monitor - the official blog of Risk Management magazine.

/>i

/>i