On May 4, 2020, the Department of Labor and Department of Treasury (the Departments) issued joint guidance requiring certain COBRA, HIPAA and ERISA deadlines be determined without regard to th e “Outbreak Period,” which began March 1, 2020, and will continue until 60 days after the COVID-19 national health emergency is formally declared to be over ( Joint Notice ).

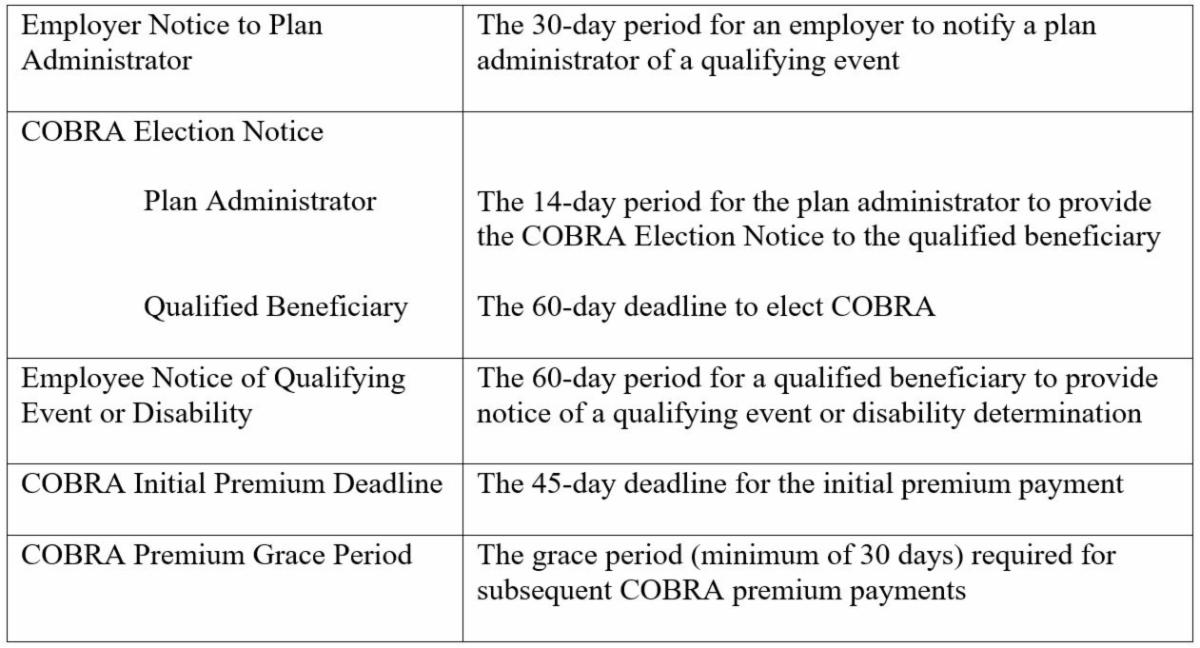

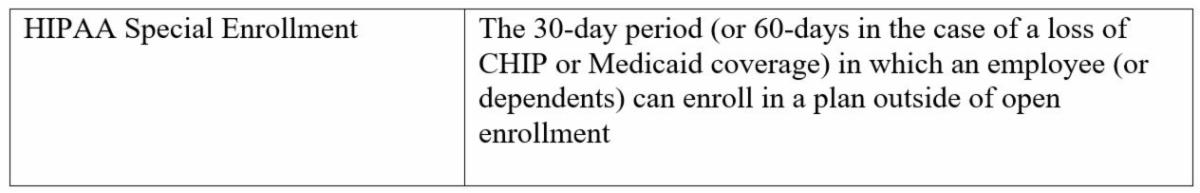

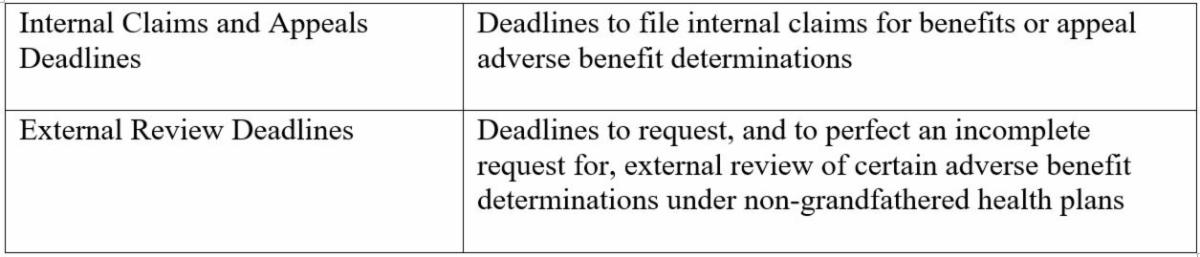

The Joint Notice requires that plans disregard the Outbreak Period for purposes of the deadlines enumerated below:

COBRA-Related Deadlines

HIPAA-Related Deadlines

ERISA-Related Deadlines

In addition to the Joint Notice, the Department of Labor also issued Disaster Relief Notice 2020-01, which:

-

delays the notice and disclosure requirements under Title I of ERISA (except those covered by the Joint Notice) and blackout notice requirements;

-

provides relief for plan failures to follow proper loan verification procedures;

-

provides relief from the ERISA adequate security requirements for plans that adopt the CARES Act plan loan provisions (e.g., delayed loan repayment, increased plan loan limits);

-

provides relief for temporary delays in sending participant contributions and loan repayments to the plan; and

-

delays Form 5500 and Form M-1 deadlines with respect to filings due prior to July 15, 2020 (as previously extended by IRS Notice 2020-23).

Both the Joint Notice and the Disaster Relief Notice 2020-01 will present unique challenges for employers administering ERISA plans, particularly because the Outbreak Period applies retroactively and it is unclear when the end of the Outbreak Period will occur and thus cannot yet be determined. The Departments continue to issue guidance which may change or evolve, therefore employers are encouraged to seek competent counsel with respect to these issues.

/>i

/>i