Several state and local minimum wage rates will soon increase, beginning on July 1, 2023 (with some increases taking place during other months in the summer and fall). This article presents the state and major locality minimum wage increases for mid-2023, along with related changes in the minimum cash wage for tipped employees where applicable. The new rates are in bold text.

Quick Hits

- State and locality midyear minimum wage rates are increasing in California, Connecticut, the District of Columbia, Florida, Illinois, Maryland, Minnesota, Nevada, and Oregon.

- The wage increases in all but Connecticut and Florida will take effect on July 1, 2023.

NOTE: Jurisdictions that will not have—or have not announced—upcoming midyear increases in their minimum wage rates are not included in the list below. This list includes the major localities with minimum wage rates that will increase in mid-2023. It is not exhaustive of every locality nationwide that may have a minimum wage rate different from the federal or state rate. Additionally, if a jurisdiction’s minimum cash wage for tipped workers is changing in mid-2023, it is included in the list below.

California

Berkeley

$16.99 to $18.07

Emeryville

$17.68 to $18.67

Los Angeles (City)

$16.04 to $16.78

Los Angeles (County – Unincorporated Areas)

$15.96 to $16.90

Malibu

$15.96 to $16.90

Pasadena

$16.11 to $16.93

San Francisco

$16.99 to $18.07

Santa Monica

$15.96 to $16.90

West Hollywood

- Employers with 50 or more total employees: $17.50 to $19.08

- Employers with 49 or fewer total employees: $17.00 to $19.08

- Hotel Employers (as defined): $18.35 to $19.08

Connecticut

- Statewide: $14.00 to $15.00 (effective June 1, 2023)

District of Columbia

- Districtwide: $16.10 to $17.00

- Districtwide (tipped workers): $6.00 to $8.00

Florida

- Statewide: $11.00 to $12.00 (effective September 30, 2023)

- Statewide (tipped workers): $7.98 to $8.98 (effective September 30, 2023)

Illinois

Chicago

- Employers with 21 or more total employees: $15.40 to $15.80

- Tipped workers: $9.24 to $9.48

- Employers with 4–20 total employees: $14.50 to $15.00

- Tipped workers: $8.70 to $9.00

Cook County

- Countywide: $13.35 to $13.70

- Countywide (tipped workers): $7.80 to $8.00

Maryland

Montgomery County

- Employers with 51 or more employees: $15.65 to $16.70

- Employers with 11–50 employees: $14.50 to $15.00

- Employers with 10 or fewer employees: $14.00 to $14.50

Minnesota

Minneapolis

- Large employers (101 or more total employees): $15.19 (no change)

- Small employers (100 or fewer total employees): $13.50 to $14.50

Saint Paul

- Macro businesses (10,001 or more total employees): $15.19 (no change)

- Large businesses (101–10,000 total employees): $13.50 to $15.00

- Small businesses (6–100 total employees): $12.00 to $13.00

- Micro businesses (5 or fewer employees): $10.75 to $11.50

Nevada

- Employers offering qualified health insurance benefits: $9.50 to $10.25

- Employers that do not offer qualified health insurance benefits: $10.50 to $11.25

Oregon

- Standard statewide rate: $13.50 to $14.20

- Portland metro-area employers (e., employers located within the “urban growth boundary of a metropolitan service district”): $14.75 to $15.45

- Employers in nonurban counties (as defined by the law): $12.50 to $13.20

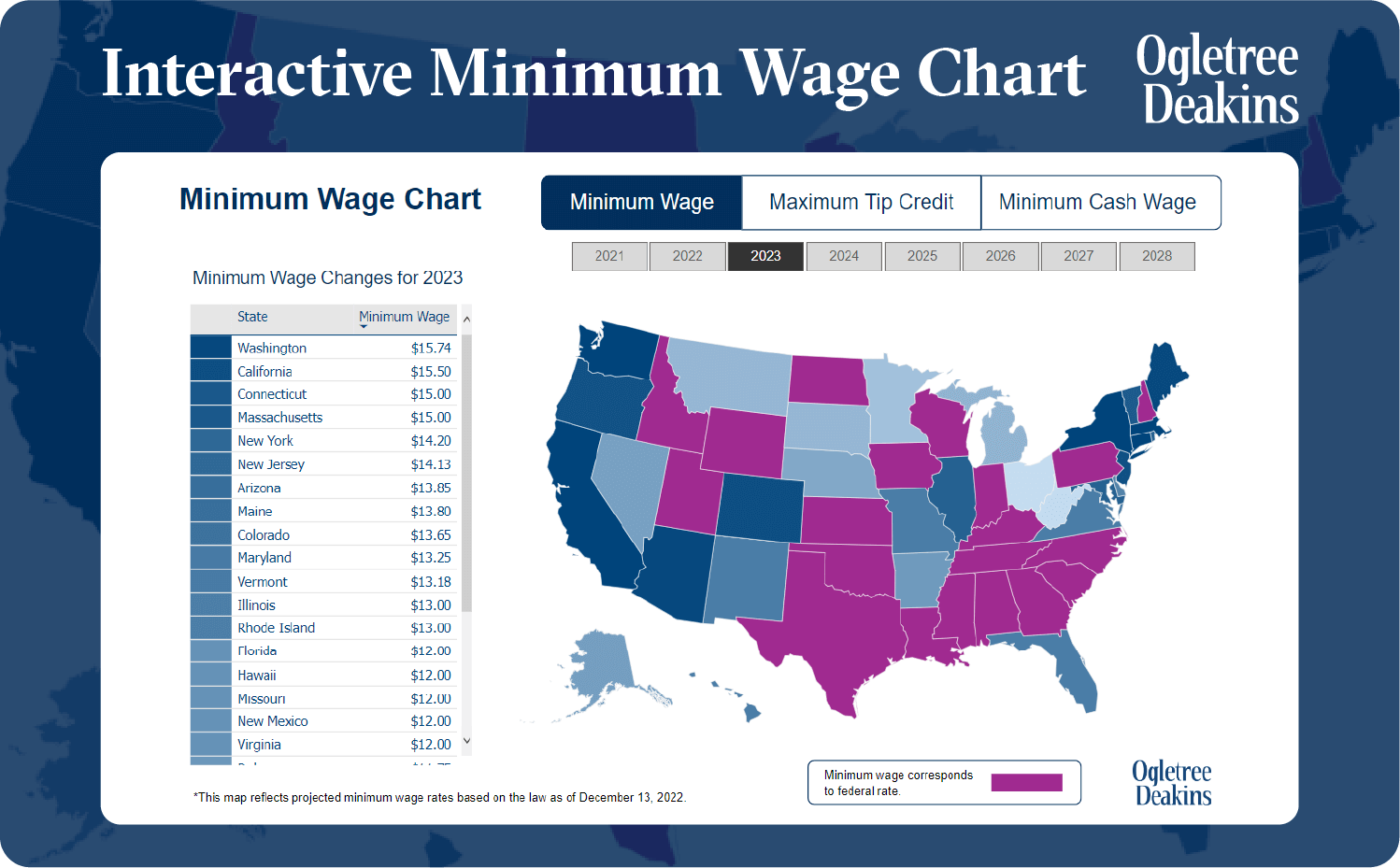

In addition to the above, employers may find the interactive minimum wage chart below helpful in preparing for these wage and hour changes in the summer and fall of 2023 and in coming years. The interactive minimum wage chart provides the minimum wage rate and applicable tip credit—in addition to employers’ minimum cash wage obligations—for each state and the District of Columbia.

/>i

/>i