In this article we will explore the recent movement by larger community banks and their regional counterparts ("Interested Banks") to engage in derivatives markets. This is banking space almost exclusively inhabited by the larger commercial banks and money center banks historically. Low interest rates and lackluster loan demand have squeezed the net interest margin of community banks, leaving little opportunity for earnings growth at a time when banks are expected, and will soon be required, to have increasing amounts of capital. While the Federal Reserve has stated that it intends to keep interest rates depressed until the unemployment rate is reduced and until inflation increases, it is expected that interest rates will again rise in the relative near term. This inevitable rise in interest rates is especially problematic for community banks which, in order to effectively contend in today's competitive commercial lending market, must offer borrowers longer terms and fixed rates, increasing the banks' sensitivity to interest rate risk and potentially subjecting the banks to regulatory scrutiny. Though the situation is far from optimal, community banks have access to interest rate derivatives designed to mitigate or hedge interest rate risk while, in certain circumstances, being accretive to earnings. As a consequence, commercial hedging programs are becoming more popular in community banking because they allow banks to provide customers a long-term fixed rate while managing the banks' interest rate risk.

In a very visible trend, larger community banks and regional banks have added executives from the even larger national and international banks. These executives had interest rate management and foreign exchange management products at their old banks. They are familiar with and understand the benefits of having these products, and their customers may have used them in the past. Another trend, the so-called "down market" movement by larger banks into the competitive space of smaller banks, is a well-understood and widespread phenomenon in the banking industry. To be competitive, the smaller banks need to have the same offerings as their larger competitors. To offset the "down market" syndrome and to expand into new markets, the Interested Banks need to expand their offerings. It's simple logic.

Given the upwardly trending interest rate environment and the regulatory emphasis on interest rate risk management processes, Interested Banks should familiarize themselves with how derivatives function and with the regulatory landscape in which they operate. The legal issues embedded in the development of these products are comprehensive and, in some respects, quite complicated, but the issues can be dealt with effectively and efficiently by the management of the banks that are involved or want to become involved with these activities. We believe that the activities can best be added to community banks with at least $500 million in assets; accounting implications and now increasing regulatory burdens will likely keep many smaller banks from implementing a commercial hedging program or foreign exchange management platform.

Interest Rate Management – Interest Rate Swaps

In their most basic form, interest rate swaps are contractual arrangements between two parties (often referred to as "counterparties") whereby the parties agree to exchange payments (each payment stream is a "leg" of the swap) based on a defined principal amount (the "notional amount" or "notional principal") for a certain duration ("tenor"). (See Figure 1.) Certain interest rate swaps convert fixed interest rates to floating interest rates (or vice versa) based on an index (e.g., LIBOR). Indices that expire before the maturity of the swap will automatically reset. Fixed for floating (or vice versa) swaps allow counterparties to hedge against increases (and decreases) in interest rates. Because swaps have a present value of zero when executed, the counterparty paying the fixed leg is generally predicting, and thus hedging against, a rise in interest rates, while the counterparty paying the floating leg is generally predicting, and thus hedging against, a decrease in interest rates.

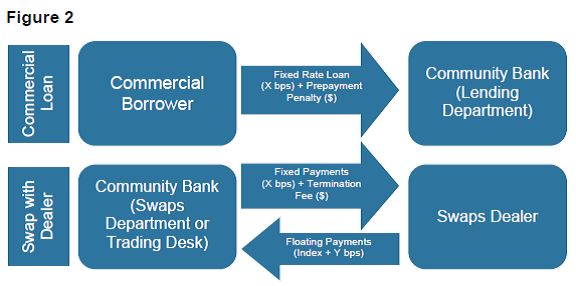

In the lending context, Interested Banks have two particularly appealing means of using interest rate swaps to hedge interest rate risk while attracting commercial borrowers. The first option is for the bank to make a commercial loan to a borrower at a fixed rate while swapping the fixed rate for a floating rate with a swaps dealer. (See Figure 2.) To mitigate against any losses resulting from early termination of the loan, the bank should include prepayment language in the loan documents making the borrower responsible for the economic impact of a possible early termination of the swap. The main advantages of this option are that the bank may offer customers longer-term fixed-rate loans by passing on the risk of the fixed-rate loan to the swaps dealer without ever involving the borrower, while decreases in the value of the swap will be offset by increases in the value of the loan and vice versa.

As a second option, the Interested Bank may make a commercial loan to a borrower at a floating rate while swapping the floating rate for a fixed rate with the borrower, and by entering into an offsetting or mirrored swap with a swap dealer. (See Figure 3.) The interest rate swap and commercial loan with the borrower are separate contracts; however, the two contracts will be cross-defaulted and cross-collateralized, and the interest rate swap will have a notional amortization schedule identical to that of the commercial loan. The net effect on the borrower will be the payment of principal and a fixed rate of interest. The main advantages of this option are that the bank may avoid problematic accounting issues as the swaps identically offset one another and will be marked to market on a daily basis, and that borrowers may benefit from rising interest rates, increasing the market value of their swap with the bank.

As shown above, Interested Banks may provide alternative solutions to their commercial borrowers by utilizing interest rate swaps. Not only will this allow Interested Banks to grow their balance sheets without incurring additional interest rate risk, but these banks may also generate additional-fee income. These benefits may be offset to some extent by the additional regulatory and accounting oversight to which interest rate swaps are subject. Currently under U.S. GAAP, interest rate swaps may be carried on bank balance sheets on a net basis only when the bank and its accounting advisors determine, pursuant to Accounting Standards Codification Section 815-10-45, that either (A) a master netting agreement is established with each of the community bank's counterparties or (B) the ISDA Master Agreement or other trading documentation with appropriate setoff language included satisfies the standards of Section 815-10-45 and is in place between the bank and each applicable counterparty.

Foreign Exchange Management—FX

Currencies, particularly the dollar and the euro, have been quite volatile during the last year or so, with the dollar strengthening and the euro declining for the most part. Foreign exchange management products can be used to deal with this situation, and the regulatory scene is reasonably simple and straightforward.

The foreign exchange (FX) market is the largest and most liquid sector of the global economy. According to the 2010 Triennial Survey conducted by the Bank for International Settlements, FX turnover averages $4.0 trillion per day in the cash exchange market, a 20% increase over the 2007 survey results, while activity in OTC interest rate derivatives grew by 24% during the same period, with average daily turnover of $2.1 trillion in April 2010. The FX market serves as the primary mechanism for making payments across borders, transferring funds and determining exchange rates between different national currencies. An FX transaction is an agreement between you and a counterparty to exchange one currency for another at an agreed-upon exchange rate on an agreed date. It provides you with protection against unfavorable exchange rate movements. An FX transaction may be useful in managing the currency risk associated with exporting or importing goods denominated in foreign currency, investing or borrowing overseas, repatriating profits, converting foreign currency denominated dividends, or settling other foreign currency contractual arrangements.

The FX market has become less dealer-centric, to the point where there is no longer a distinct interdealer-only market. A key driver has been the proliferation of prime brokerage, allowing smaller banks and other players to participate more actively. The evolving market structure accommodates a larger diversity, from high-frequency traders, using computers to implement trading strategies at the millisecond frequency, to the private individual (retail) FX investor. Trading costs have continued to drop, thus attracting new participants and making more strategies profitable. This trend started with the major currencies, and more recently it reached previously less liquid currencies, especially emerging-market currencies. Today's market structure involves a more active participation of non-dealer financial institutions in the trading process. Trading activity remains fragmented, but aggregator platforms allow end users and dealers to connect to a variety of trading venues and counterparties of their choice. With more counterparties connected to each other, search costs have decreased and the velocity of trading has increased.

Dodd-Frank Implications for Interested Banks in Derivatives

No discussion on the use of derivatives is complete without mentioning the Dodd-Frank Act. The Wall Street Reform and Consumer Protection Act of 2010 (the Dodd-Frank Act) was passed largely in response to the recent financial crisis. The purpose of the law, as policymakers argued, was to rein in practices that contributed to the crisis in order to prevent a future crisis from occurring. While the Dodd-Frank Act proved burdensome to small banks in many respects, there are relatively few regulations that affect community banks and their customers. We will explore the few worth mentioning below.

Swap Dealer Registration

The Dodd-Frank Act imposed a series of regulatory, compliance, reporting and "know your customer" requirements and obligations on certain types of entities—most notably, swap dealers and major swap participants. Registration as a swap dealer with the Commodity Futures Trading Commission (CFTC) invites a comprehensive regulatory regime that includes requirements related to business conduct, record keeping and reporting, documentation, capital and margin. The Dodd-Frank Act defines a "swap dealer" as any person who (1) holds itself out as a dealer in swaps, (2) makes a market in swaps, (3) regularly enters into swaps with counterparties in the ordinary course of business for its own account, or (4) engages in any activity causing the person to be commonly known in the trade as a dealer or market maker in swaps. CFTC rules exempts a person from the requirement to register as a swap dealer if they are within the de minimis threshold, which is a notional aggregate amount of $8 billion or less of swap dealing activities over a 12-month period. While the vast majority of community banks are unlikely to come close to the de minimis threshold, there are some considerations to keep in mind. First, the threshold is expected to be decreased to $3 billion in December 2017. Second, that threshold is limited to $25 million for swaps with a counterparty that is a "special entity," a category that generally includes a federal agency, employee benefit plan or state, city, county or municipality.

There are some important exclusions for certain types of swaps entered into by the swap dealer, not all of which are relevant, but we'll highlight one here a swap does not count against the de minimis threshold if it is entered into by an insured depository institution in connection with the origination of loans to customers, subject to certain conditions (the "IDI Exclusion"). This exclusion is by its terms limited to insured depository institutions (i.e., FDIC insured U.S. banks) and would not apply to other types of institutions, including most U.S. branches of non-U.S. banks, that commonly make loans and enter into swaps in connection with them. In order to qualify for the IDI Exclusion, the swap must be entered into in connection with originating a loan. To satisfy this requirement, the following criteria must be met (a) the swap must be entered into no more than 90 days before or 180 days after the date of the execution of the loan agreement or any draw of principal under the loan, (b) the swap needs to mitigate the risks to the borrower that arise from the loan itself, such as interest rate risk and F/X risk, (c) the swap and loan must have identical maturities, (d) the insured depository institution must be either (1) the sole source of the loan, (2) committed to fund 10% of the loan under a loan agreement or (3) committed to fund a loan where its portion of the loan is at least equal to the notional amount of all swaps entered into with the borrower "in connection with the financial terms of the loan"; and (e) the notional amount of the swap must match the principal amount outstanding under the loan.

As with the other transactional exclusions, the IDI Exclusion is not a general exemption from registration applicable to insured depository institutions; it merely removes from view all swaps of the insured depository institution that fall within its conditions in determining whether the insured depository institution is a swap dealer subject to the registration and other requirements of the Dodd-Frank Act. Generally speaking, most Interested Banks will find this exclusion to be useful if they engage in any lending activity.

Eligibility

Section 2(e) of the Commodity Exchange Act (CEA) requires each party to a swap to be an "eligible contract participant" or "ECP," as defined in Section 1(a)(18) of the CEA, at the time it enters into the swap. In addition, any guarantor to a swap must qualify as an ECP at the time of trading. Generally speaking, for an unregulated corporation, partnership or other entity to qualify as an ECP, its total assets must exceed $10 million; or, if it is entering into the swap in connection with its business or to manage risk, its net worth must exceed $1 million. There are some additional important but confusing nuances relating to eligibility, most of which were covered in CFTC No-Action letter 12-17, which deals with conferring ECP status to non-ECPs.

The term "ECP" also includes several defined classes of institutions (e.g., banks, insurance companies, registered investment companies, pension plans, governmental entities, broker-dealers and FCMs) and natural persons that meet certain asset and other requirements.

Clearing

Arguably one of the most important topics coming out of the Dodd-Frank Act is the requirement to clear swaps through central counterparties. Clearing is thought to bring a more secure and stable environment for trade settlement, increased transparency and better counterparty risk management. In November 2012, the CFTC issued a final clearing determination for certain classes of index credit default swaps and interest rate swaps.

Section 2(h)(7) of the CEA and CFTC Regulation 50.50 provide exceptions available to certain qualifying parties to the mandatory clearing requirement set forth in Section 2(h)(1) of the CEA, referred to as the "End-User Exception." The End-User Exception permits the CFTC to exempt small banks, savings associations, farm credit system institutions and credit unions from the definition of "financial entity"1 so that those entities can elect to not clear swaps that are otherwise required to be cleared. The End-User Exemption is available for small banks if they have less than $10 billion in total assets (measured on the last day of the entity's most recent fiscal year). According to the CFTC, 99% of small banks, savings associations, farm credit system institutions and credit unions will fall below the $10 billion threshold and will therefore be able to elect against clearing swaps that hedge or mitigate their commercial risk. That's certainly good news for Interested Banks, as clearing swaps is a costly endeavor. In addition to legal fees for the negotiation of cleared swap documentation, there is a requirement to post initial and variation margin determined by the clearinghouse, together with any additional margin required by the clearing broker above clearinghouse minimums.

Margin for uncleared swaps

Final rules on margin for uncleared swaps were issued by banking regulators on October 22 of this year and, largely as a result of the Business Risk Mitigation and Price Stabilization Act of 2015 signed into law earlier this year, margin rules that would otherwise apply to "financial entities" are not applicable to small financial institutions with $10 billion or less in total assets that enter into swaps for hedging purposes. This exception tracks similar exceptions from the mandatory clearing requirement that are available to small financial institutions. While collecting margin for uncleared swaps will not be required by CFTC rules, swap dealer counterparties may still require some level of margin, depending on their internal counterparty credit risk management procedures.

Swap reporting and record keeping

As required under Parts 43, 45 and 46 of the CFTC's regulations, swaps must be reported to a registered swap data repository (SDR) or to the CFTC by one of the parties to such transaction. Part 43 deals with real-time reporting, which is to the public, facts that are available to everyone. You can access the Depository Trust & Clearing Corporation's website and actually see live trade reporting across asset classes. Real-time reporting is intended to show trade prices and trade sizes and is not intended to be a complete disclosure of the identities of the parties or the actual trade details in every respect. Part 45 reporting is what's called "swap data repository reporting," which is regulatory reporting and much more detailed. SDR reporting enables regulators to know exactly what swaps are being executed by which parties. To that extent, all parties are required to have what's called a "legal entity identifier," or an LEI, which is similar to a tax identification number. The third category of reporting is Part 46 reporting, which is the reporting of historical swaps, which are swaps that predate the Dodd-Frank Act. Under most circumstances, swap dealers will act as the reporting party, unless you are trading with a non-registered entity, in which case it then depends on whether one of the parties is a “financial entity” or a nonfinancial entity.

Also within the reporting rules are record keeping rules. These rules require that you keep "full, complete and systematic records, together with all pertinent data and memoranda" for each swap, which include data regarding the creation of the swap on an ongoing basis. Swap records must be kept for the entire life of the swap, plus at least five years thereafter, and the records are subject to inspection by the CFTC.

Municipal derivatives

Section 975 of the Dodd-Frank Act imposed a registration requirement and regulatory scheme for "municipal advisors"2 (the Municipal Advisor Rule). Under Section 975, registration as a municipal advisor is required if a person gives "advice" to a municipal entity3 or obligated person4 with respect to municipal financial products (defined as municipal derivatives, guaranteed investment contracts (GICs) and investment strategies). Thus, if a bank provides advice to a municipal entity or an obligated person with respect to an interest rate swap, the bank will be required to register with the SEC unless it qualifies for an exclusion or an exemption. One of the exemptions is to retain an independent registered municipal adviser to represent the customer in its derivatives transactions with the bank. If a municipal entity or an obligated person is represented by an independent municipal advisor, an Interested Bank that is a participant in the transaction could provide advice with respect to the same aspects of the transaction for which the advisor is engaged without registering as a municipal advisor if the following requirements are met: (1) the municipal advisor is registered with the Securities and Exchange Commission; (2) the Interested Bank must receive from the municipal entity/obligated person a written representation that it is represented by, and will rely on the advice of, an independent registered municipal advisor; (3) the Interested Bank must have a reasonable basis for relying on the representation; (4) the Interested Bank must disclose in writing to the municipal entity/obligated person that it is not a municipal advisor and not subject to the municipal advisor fiduciary duty, a copy of such disclosure to also be provided to the municipal advisor; and (5) the recipient is given sufficient time to assess any conflicts the Interested Bank may have with regard to the transaction. The key consideration for use of this exemption is whether the Interested Bank would be advising on the same aspects of the transaction for which the municipal advisor was hired.

Foreign Exchange

Congress provided the Secretary of the Treasury with the authority to determine whether requirements for swaps under the Dodd-Frank Act should apply to FX swaps and forwards, based on the recognition within Congress that the unique characteristics and pre-existing oversight of the FX swaps and forwards market already reflect many of the Dodd-Frank Act's objectives for reform—including high levels of transparency, effective risk management and financial stability.

The FX swaps and forwards market is markedly different from other derivatives markets. This market plays an important role in helping businesses manage their everyday funding and investment needs throughout the world, and disruptions to its operations could have serious negative economic consequences. Furthermore, settlement of the full principal amounts of the contracts would require substantial capital backing in a very large number of currencies, representing a much greater commitment for a potential clearinghouse in the FX swaps and forwards market than for any other type of derivatives market. Given these considerations, the Secretary of the Treasury has issued a final determination providing that certain mandatory derivatives requirements will not apply to FX swaps and forwards. This determination is narrowly tailored; FX swaps and forwards will be subject to the Dodd-Frank Act's new requirement to report trades to repositories as well as its rigorous business conduct standards. Importantly, the final determination does not extend to other FX derivatives, such as FX options, currency swaps and nondeliverable forwards. These other FX derivatives will be treated as swaps that are subject to the full scope of derivatives regulation under the Dodd-Frank Act.

Retail Foreign Exchange

The CEA provides that a U.S. financial institution for which there is a federal regulatory agency shall not enter into, or offer to enter into, certain types of foreign exchange transactions described in section 2(c)(2)(B)(i)(I) of the CEA with a retail customer except pursuant to a rule or regulation of a federal regulatory agency allowing the transaction under such terms and conditions as the federal regulatory agency shall prescribe (the "retail forex rule"). The CEA gives the CFTC jurisdiction over off-exchange (over-the-counter) foreign currency futures and options transactions as well as over certain leveraged foreign currency transactions offered to or entered into with retail customers. Under the CEA, only certain regulated entities may be counterparties to these off-exchange trades with retail customers. These regulated entities are certain registered futures commission merchants (FCMs) and registered Retail Foreign Exchange Dealers (RFEDs). All other off-exchange futures and options transactions with U.S. retail customers are unlawful unless done on or subject to the rules of a regulated exchange.

Prior to October 2010, non-ECP investors were required to conduct retail foreign exchange transactions with entities that were licensed as banks, broker-dealers, FCMs, insurance companies, or material affiliates of broker-dealers or FCMs; however, the activity was not subject to statutorily mandated rules. Institutional foreign exchange was not directly regulated. Congress created a regulatory regime for retail foreign exchange with the enactment of the Dodd-Frank Act. The Dodd-Frank Act amended the CEA to provide that a U.S. financial institution for which there is a federal regulatory agency may not enter into, or offer to enter into, retail foreign exchange transactions except pursuant to a rule or regulation of a federal regulatory agency prescribing the terms and conditions of those transactions.

Although there is no legislative history explaining the intent of Congress in requiring adoption of the retail forex rule, it is generally understood that Congress was seeking to ensure that entities conducting retail foreign exchange activities were subject to a comprehensive regulatory scheme protecting small, unsophisticated retail clients from potentially problematic business practices employed by a class of thinly capitalized retail foreign exchange dealers. As a result of this amendment, other federal regulatory agencies have adopted rules addressing retail foreign exchange, including the Securities and Exchange Commission, the Federal Deposit Insurance Corporation (FDIC) and the Office of the Comptroller of the Currency (OCC). The CFTC previously adopted rules addressing retail foreign exchange for persons subject to CFTC jurisdiction.

Conclusion

When interest rates are low, banks must find new opportunities to generate revenue. Interested Banks should determine how sensitive their balance sheets are to interest rate and foreign currency risk and consider using derivatives to mitigate this risk as the market for long-term fixed-rate loans and foreign exchange products continues to grow. Prudent risk management practices and hedging strategies can position community banks effectively with larger financial institutions and will help them prosper in a low-interest-rate environment.

1 The term "financial entity" is defined in Section 2(h)(7)(C)(i) of the CEA for purposes of mandatory clearing as (i) a swap dealer, (ii) a security-based swap dealer, (iii) a major swap participant, (iv) a major security-based swap participant, (v) a commodity pool, (vi) a private fund as defined in Section 202(a) of the Investment Advisors Act of 1940, (vii) an employee benefit plan as defined in paragraphs (3) and (32) of section 3 of the Employee Retirement Income and Security Act of 1974, and (viii) a person predominantly engaged in activities that are in the business of banking, or in activities that are financial in nature as defined in Section 4(k) of the Bank Holding Company Act of 1956.

2 A municipal advisor is a person who (1) provides advice to or on behalf of a municipal entity or obligated person with respect to municipal financial products or the issuance of municipal securities, including advice with respect to the structure, timing, terms and other similar matters concerning such financial products or issues, or (2) undertakes a solicitation of a municipal entity.

3 Municipal entities include municipal securities issuers, and other state and local subdivisions and agencies.

4 Obligated persons include conduit borrowers who are committed to support the payment obligations on municipal securities.

i

i