The UK Government recently published a draft Registration of Overseas Entities Bill that will require foreign entities who own or desire to own land in the UK to take steps to identify their beneficial owner(s) and to register them. Such a register would be a world-first and is part of the UK Government's drive to increase transparency to combat money laundering. The Bill imposes penalties for non-compliance and restrictions on the buying and selling of UK property for non-compliant entities.

Background

Plans for a public register of beneficial ownership of overseas companies owning property in the UK ( the "Register") were first announced at the Anti-Corruption Summit in May 2016 by then-Prime Minister David Cameron. Following this, in April 2017, the Government published its proposals on how it intended to implement the Register and called for evidence seeking views on these specific proposals. In May 2018, the UK Government published a response to the call for evidence—see our previous advisory, "UK Government Proposes Beneficial Owners Registry of Overseas Companies That Own UK Property," for more details.

How the Register Will Work

The key features of the Bill are as follows:

-

The Register will affect freehold and leasehold property (where the term is more than seven years) and will apply to all overseas entities, except governments and public authorities.

-

The definition of beneficial owner is modelled on the PSC regime for UK companies and LLPs.1

-

The Register is to be kept by Companies House and is to be available for public inspection (subject to limitations on the disclosure of certain sensitive information).

-

Beneficial ownership will need to be registered with (and verified by) Companies House, who will then issue a unique identification number (an overseas entity ID). Without the ID, the overseas entity will not be registered on the Register as the owner of the property.

-

Once registered, an overseas entity is required to update the information annually until such time as it successfully applies to be removed from the Register.

-

There are two key methods of enforcement: restrictions on property dispositions and criminal sanctions.

-

Restrictions will be put on all title registers of an overseas entity's properties that will prevent certain dispositions on the property, namely, transfer of title, grant of leases with terms of more than seven years or grant of charges, unless the overseas entity is registered (or is exempt from registration).

-

The criminal sanctions include fines and/or prison sentences. The severest penalty is an unlimited fine or five years' imprisonment for persons breaching any imposed restrictions on property dispositions (as described above). Individuals failing to register overseas entities when instructed, or individuals who knowingly try to deceive the Register by providing false information, face up to two years in jail and an unlimited fine.

-

Overseas entities who already hold UK property will be given 18 months from implementation of the new law to register and obtain an ID. After that, a restriction will be put on their property registers whether or not they have done so.

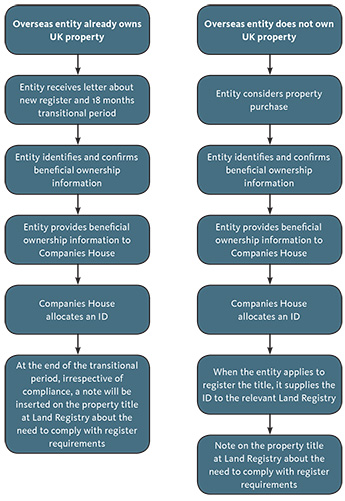

The diagram below (published by the UK Government alongside the Bill) sets out how the proposed system will work:

Next Steps and Comment

The UK Government is now consulting on this draft Bill (the Bill is available in full here) with the consultation closing at 5.00 p.m. on 17 September 2018. The UK Government has confirmed it is proposing a separate mechanism with regard to overseas entities that wish to engage in UK central government procurement.

This draft Bill fleshes out in detail the UK Government's plans for the Register. Non-UK investors in UK property will need to continue to be aware of such developments and give due consideration to the registration requirements as it is anticipated that the Register will come into force in 2021.

1 Under the PSC regime, beneficial owners of overseas entities are required to be registered with Companies House. A beneficial owner (X) of an overseas entity (Y) is defined as a person or other legal entity that satisfies one or more of the following conditions:

• Condition 1 – X holds, directly or indirectly, more than 25% of the shares in Y;

• Condition 2 – X holds, directly or indirectly, more than 25% of the voting rights in Y;

• Condition 3 – X holds the right, directly or indirectly, to appoint or remove a majority of the board of directors of Y;

• Condition 4 – X has the right to exercise, or actually exercises, significant influence or control over Y;

• Condition 5 – (a) the trustees of a trust, or the members of a partnership, unincorporated association or other entity, that is not a legal person under the law by which it is governed, meet any of the conditions above (in their specified capacity as such) in relation to Y; and (b) X has the right to exercise, or actually exercises, significant influence or control over the activities of that trust or entity.

/>i

/>i