On June 8, 2020, the Federal Reserve Bank of Boston released updated Frequently Asked Questions (FAQs) and Term Sheets with respect to the Main Street Lending Program. Subsequently, on June 11, 2020, the Federal Reserve Bank of Boston released corresponding updates to many of the program’s documents. The Main Street Lending Program is not operational as yet.

The updates expand the scope of the Main Street Lending Program by (i) reducing the minimum loan amounts under the New Loan Facility and Priority Loan Facility from $500,000 to $250,000, (ii) removing the 35% sizing test from the Expanded Loan Facility, and (iii) increasing the maximum loan amounts available under each facility to $35 million for the New Loan Facility, $50 million for the Priority Loan Facility and $300 million for the Expanded Loan Facility.

Other notable changes are: (i) the SPV will now purchase a 95% participation in Priority Loans like the other facilities, (ii) maturity has been extended to 5 years instead of 4 years, (iii) principal payments are now deferred for 2 years instead of only 1 year, (iv) an updated payment amortization schedule has been provided for the New Loan Facility, and (v) clarification has been provided as to when an Eligible Borrower’s affiliates are taken into account for calculating loan sizing.

The updated materials are available at the Federal Reserve Bank of Boston’s website by clicking here.

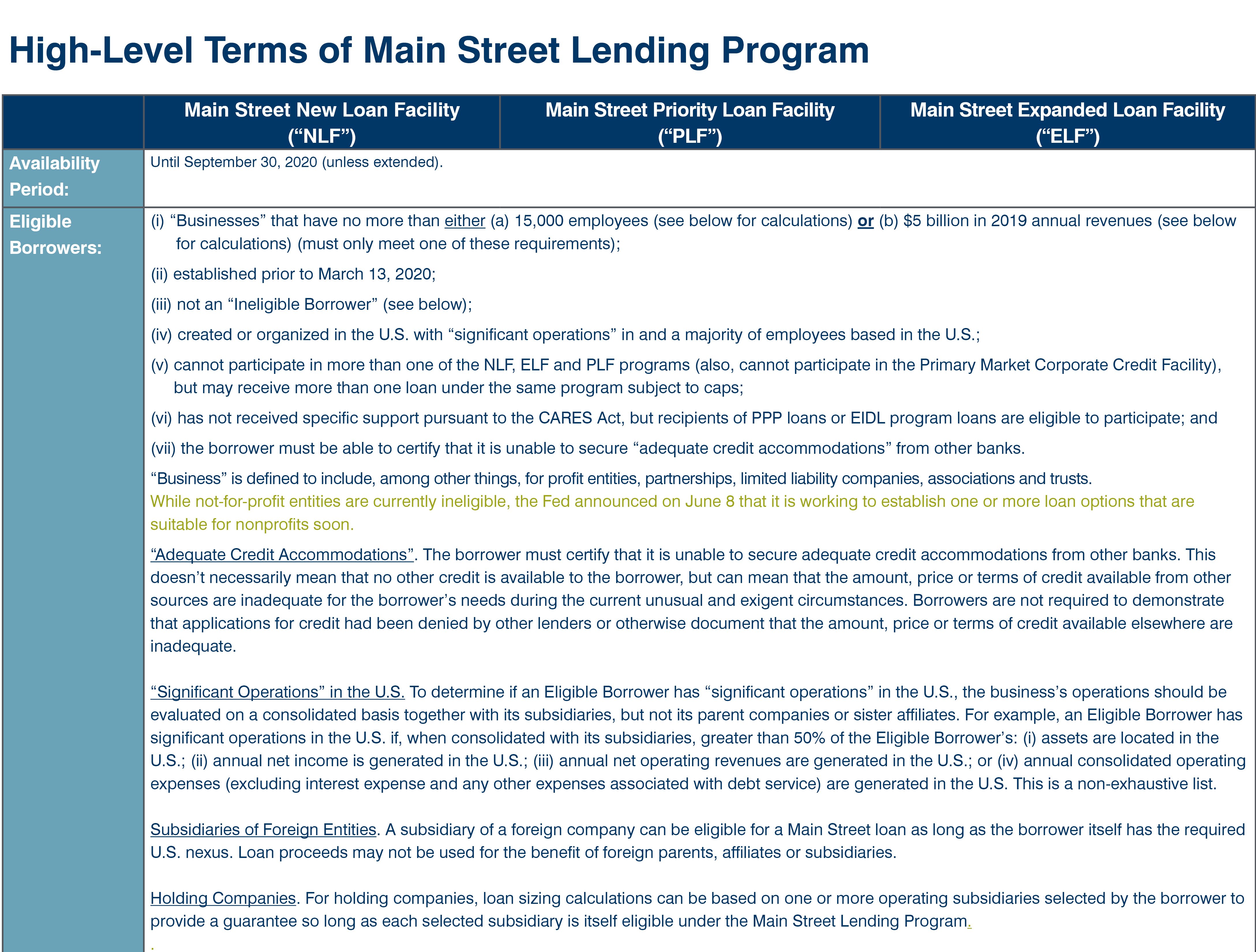

This bulletin briefly describes the key updates on the updated Main Street Lending Program materials. Alongside this bulletin, we have updated our easy-to-digest chart setting forth the high-level terms of the Main Street Lending Program. We note that this is current as of June 11, 2020 and adjustments to the program may be made in the future.

Click the image below to view the chart in full.

KEY UPDATES TO MAIN STREET LENDING PROGRAM

1. Loan Sizing:

-

Minimum: Minimum loan sizes for the NLF and PLF are reduced from $500,000 to $250,000.

-

Maximum: Maximum loan sizes (and upsized tranche) for each facility are increased: (i) from $25 million to $35 million under the NLF, (ii) from $25 million to $50 million under the PLF, and (iii) from $200 million to $300 million under the ELF.

-

35% Prong Under ELF: The 35% prong of the loan sizing test under the ELF has been removed.

2. Financial Statements: Guidelines have been provided as to the types of financial statements that an Eligible Borrower is expected to submit to an Eligible Lender. The relevant inputs to the Eligible Borrower’s EBITDA calculation should come from these financial statements.

3. Affiliates: If an Eligible Borrower is the only business in its affiliated group that has sought funding through Main Street, its affiliated group’s debt and EBITDA are not relevant to determining whether that business can qualify, except to the extent that the Borrower’s subsidiaries are consolidated into its financial statements. If the Eligible Borrower has an affiliate that has previously borrowed or has an application pending to borrow from a Main Street facility, then the entire affiliated group’s debt and EBITDA are relevant to determining the Eligible Borrower’s maximum loan size.

4. Payments: Maturity has been extended to 5 years, payments of principal are now deferred for 2 years (although interest payments are still only deferred for 1 year), and the amortization schedule under the NLF has been updated to be consistent with the PLF and ELF.

5. SPV Priority Loan Participation: The SPV will now purchase 95% participations in Priority Loans like the other facilities (an increase from 85%).

6. Consent Fees under ELF: Eligible Lenders may now charge customary consent fees if necessary when amending a credit facility to add an upsized tranche under the ELF.

7. Nonprofits: While the Main Street Lending Program is not currently available to nonprofits, the Fed announced that it is working to establish loan programs suitable for nonprofits.

/>i

/>i