From television commercials to naming rights for arenas, the topic of cryptocurrency has been hard to avoid. While cryptocurrency may be virtual, its creation or ’mining’ occurs in the real world. This mining poses a credit risk for utility companies, given the incredible amount of electricity required to operate a “mining” facility. For example, crypto mining company Core Scientific, Inc. and its related companies, recently filed Chapter 11 bankruptcy cases where they reported their average monthly utility bills were more than $24.5 million dollars.

While there are many types of cryptocurrency, the most popular and valuable digital currency is Bitcoin. To create or “mine” Bitcoin, a company needs two things: (i) many powerful computers constantly connected to and working for the Bitcoin network or “blockchain” and (ii) access to substantial amounts of electricity to operate (and cool) those computers. Because of this steady demand, utility companies with more capacity than demand have sought out crypto-mining companies as customers. In exchange for this usage, utility companies offer miners favorable rates for electricity and may build out the infrastructure necessary to deliver the requested power.

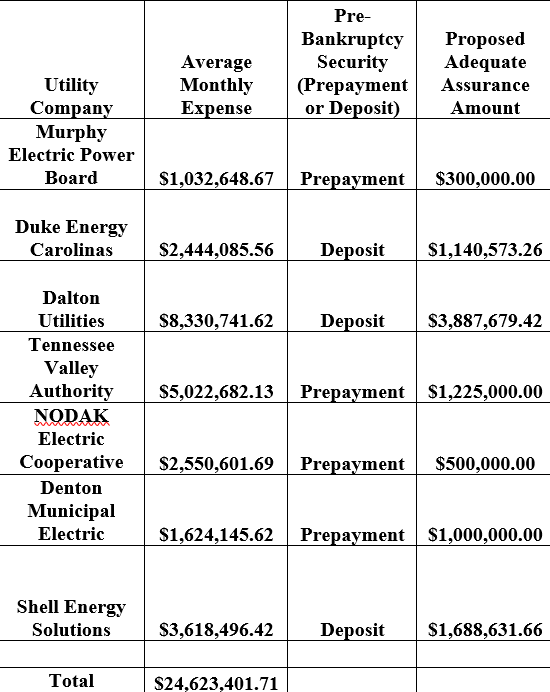

However, recent volatility in the cryptocurrency markets[1] has forced some cryptocurrency brokers/miners into bankruptcy, and these filings highlight the credit risk that utilities face when a significant customer ceases operations or files bankruptcy. For example, Core Scientific, Inc. and related companies (“Core”) – recently filed a Chapter 11 bankruptcy. As part of its bankruptcy filings, Core stated that its total average monthly bill for electricity was more than $24 million dollars split between seven providers. Prior to the bankruptcy, Core had either posted deposits with its providers or was pre-paying for the following week’s estimated usage. The table below was copied from a pleading in the case.

While few Chapter 11 debtors spend $24 million dollars a month on electricity, almost all Chapter 11 debtors seek court approval of their proposed plan to give “adequate assurance” of the debtors’ ability to pay their utility providers in bankruptcy. Debtors immediately seek court approval of their proposed “adequate assurance” because the Bankruptcy Code permits utilities to terminate service if the debtor fails to propose “adequate assurance” within the first twenty days of the case. Debtors can provide adequate assurance of payment with deposits or certificates of deposit, letters of credit, surety bonds, prepayment, or any other form of security that is agreeable.

The standard motion to provide adequate assurance to utilities states that the Chapter 11 debtor will escrow funds equal to the cost of two weeks of its average monthly utility expenditures. This will serve as adequate assurance of future payment for all utility providers. In exchange for this deposit, the Court typically approves the debtor’s requested procedures that utilities must follow to (i) terminate service in the case of non-payment and (ii) make demand upon the deposit for payment of unpaid bills. In the Core case, the debtors proposed to continue pre-paying certain utility companies for future use at an average of $3 million dollars a week while depositing $6.75 million in an escrow account split between the other providers. In exchange, the Court required the identified utilities to (i) file a request for additional or modified adequate assurance within thirty days of the filing of the bankruptcy or be bound by the debtor’s proposed terms, (ii) make demand on the deposit before seeking termination of services if the debtor failed to pay post-petition invoices, and (iii) halt any attempt to terminate service due to unpaid pre-petition bills or the inadequacy of the proposed “adequate assurance.”

A utility company can only object to a debtor’s “adequate assurance” procedures within thirty days of the order being entered, and without objection, the procedures may be approved before the utility has retained counsel. Given the standard “adequate assurance” deposit and the typical billing cycle of a utility, it is easy to see how the bankruptcy of a crypto miner or other major customer represents serious credit risk for a utility providers. This credit risk can arise in three areas:

- Pre-petition Risk. If the utility did not require a large enough deposit when the crypto miner opened its account or failed to keep a letter of credit in good standing, the utility may suffer substantial losses on bills created before the bankruptcy was filed. Because most bankruptcies pay so little to unsecured creditors, deposits or letters of credit given before the bankruptcy will likely be the only way pre-petition bills can be paid in full.

- Post-Petition. If a crypto miner in bankruptcy defaults on its post-bankruptcy utility invoices, the utility will not know of the default until the subsequent month if normal billing procedures are in place. In this scenario, the utility company’s only recourse would be to file a motion with the Bankruptcy Court to terminate service to the debtor and to make demand for payment of its portion of the deposit in escrow. However, even if an amount equal to only two weeks of service was escrowed for the utility, the utility might be six or eight weeks behind on payment at that point. Similarly, a utility which is being pre-paid for the subsequent week’s electricity would be required to keep supplying power to a debtor even if the pre-payments stopped. The utility would need bankruptcy court approval to disconnect service, which may take days or weeks.

- Rejection of Contracts. The ability to reject and terminate unprofitable or unneeded contracts is a major benefit of bankruptcy. In the case of a bankrupt crypto miner, it could close location(s) and reject all contracts associated with that site. For utility companies, the rejected contracts could include not only the power supply contracts, but also the debtor’s obligation to contribute to improvements to the electrical grid that were to benefit mining operations. The rejection and termination of contracts like these could pose serious losses for a utility that had planned on a long-term relationship with the crypto miner to absorb excess demand and/or to recoup the costs of improvements.

Given the amount of electricity required for crypto mining and the pace of activity in a Chapter 11 bankruptcy case, it is essential that utilities with crypto miners as customers retain experienced bankruptcy counsel if their crypto-miner customers file bankruptcy. Similarly, utility companies should be monitoring any other litigation that could harm the ability of that customer to continue operations.[2] Utilities should also be pro-active in reviewing the continued validity of any deposits or other security given at the time the crypto miner opened account(s) with the utility.[3] The same advice is true for any other substantial customer of the utility.

[1] For example, the value of one Bitcoin fell from a high of $48,408.46 in the spring of 2022 to a low of $15,559.05 in November 2022, for the price to increase to approximately $24,000 in the middle of February 2023.

[2] For instance, the secured lender to a crypto miner could file suit to enforce loan documents in default and repossess the “mining” computers. This would end operations at the site and leave nothing to pay for the prior weeks of service.

[3] For example, utilities should confirm that letters of credit have been renewed and remain in place, review any guarantees given to be certain they are valid and enforceable, etc.

/>i

/>i