Securities Class Action Filings—2021 Midyear Assessment

Executive Summary

Overall filing activity dropped considerably in the first half of 2021, falling to 112 filings from 150 filings in the second half of 2020. This decline was largely driven by a substantial reduction in the number of M&A class actions and federal and state 1933 Act filings, although core filings with Section 10(b) allegations were also down modestly.

Filings in the first half of 2021 were generally smaller, resulting in lower MDL and DDL indices. DDL fell 50% from $162 billion in 2020 H2 to $80 billion in 2021 H1. Similarly, MDL fell 64% from $991 billion in 2020 H2 to $361 billion in 2021 H1.

Special purpose acquisition company (SPAC) IPOs have continued to explode. Filings against SPAC-related entities increased sharply in the first half of 2021. There were also 10 filings related to COVID-19, largely concentrated in the first four months of the year.

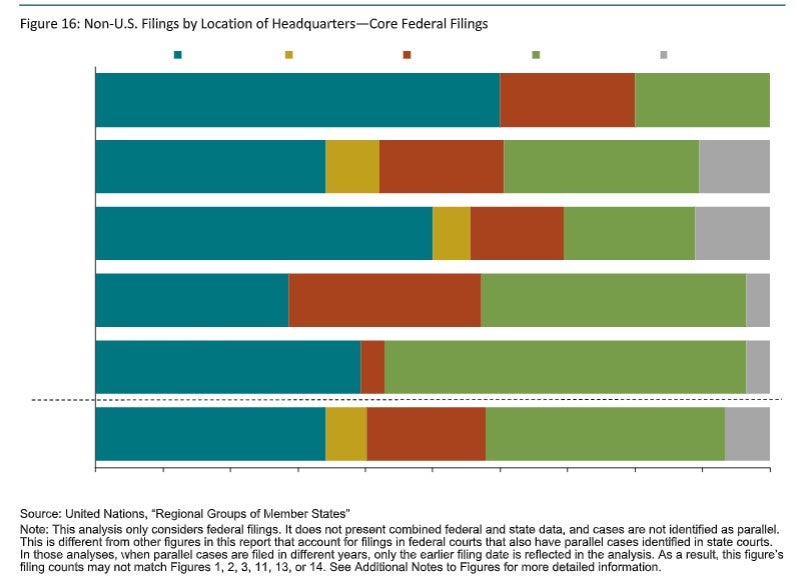

Federal Filings Against Non-U.S. Issuers

This index tracks the number of core federal filings against companies headquartered outside the United States relative to total core federal filings.

-

As a percentage of total core federal filings, core federal filings against non-U.S. issuers decreased to 16% from 33% in 2020, the lowest share of filings since 2009.

-

At the current pace, the number of core filings against non-U.S. issuers would be the lowest total since 2014.

The number of federal filings against non-U.S. issuers is on track to be less than half of 2020’s record high of 74.

-

All nine core filings against Asian firms were against Chinese firms. Three of the nine core filings against Chinese firms included allegations related to cryptocurrency, and one of the nine included allegations related to COVID-19.

-

Of the three core filings against Canadian companies, one had allegations related to cannabis, continuing the trend of at least one Canadian cannabis filing in each half year since its legalization in Canada in October 2018.

-

Core filings against European firms (three filings) declined to the lowest amount since the first half

of 2015.

While overall there were fewer core federal filings against foreign firms, 60% were against Asian firms.

Industry Comparison of Federal Filings

This analysis of core federal filings encompasses both the large-capitalization companies of the S&P 500 and smaller companies.

-

Financial sector filings declined from 16 and 13 filings in 2020 H1 and H2, respectively, to nine filings in 2021 H1, 60% of the 1997–2020 semiannual average of 15 filings.

-

The Consumer Cyclical sector (16 filings) returned to the high level of activity seen in 2020 H1 (17 filings), after decreasing to levels in 2020 H2 that were in line with the historical average.

Filings in the financial sector fell to less than two-thirds of the 1997–2020 semiannual average.

-

The Energy sector had nearly twice as many filings as it did in 2020 H2 and was also well above the 1997–2020 semiannual average.

-

Consumer Non-Cyclical continued to be the most common sector with 31 filings, 13 of which were in the Biotechnology subsector.

Federal Filings by Circuit

-

The Second and Ninth Circuits combined made up 72% of all core federal filings in the first half of 2021, in line with 2020 H1 and H2 (68% and 71%, respectively) and above the 1997–2020 semiannual average of 55%.

-

Core filings in the Ninth Circuit decreased 35% to 28 filings, still slightly above the 1997–2020 semiannual average of 25. Core filings in the Second Circuit (41) remained consistent with 2020 H1 and H2 (41 and 36, respectively) and were above the 1997–2020 semiannual average of 27.

-

Total MDL for Second Circuit filings fell from $385 billion to $92 billion in 2021 H1, a 77% decline. While the $385 billion MDL in 2020 H2 was abnormally high, the $92 billion 2021 H1 MDL was below the 1997–2020 semiannual average of $126 billion. (See Appendix 4)

-

SPAC-related actions (which include M&A filings) were typically filed in the Second and Ninth circuits (10 filings and seven filings, respectively). Collectively, these circuits accounted for 63% of SPAC filings from 2019 H1 to 2021 H1.

-

There were no core filings in the Seventh, Eighth, Tenth, or D.C. Circuits.

Core filings in the Ninth Circuit decreased 35% to 28 filings, slightly above the 1997–2020 semiannual average of 25.

/>i

/>i