On October 7, 2020, the European Commission accepted commitments offered by Broadcom Inc., ending its investigation into the chipmaker. Although a step in the right direction, the commitments address only a subset of Broadcom’s anticompetitive conduct in just a few discrete chip markets. Stated differently, the commitments do not alter the anticompetitive status quo in most product markets in which Broadcom operates. This is particularly true for companies operating in the U.S. because the commitments offer fewer protections outside of the European Economic Area.

The Commitments Are Limited in Scope

The EC investigation focused on exclusivity provisions in Broadcom’s contracts with six large purchasers of systems-on-a-chip for TV set-top-boxes and various types of internet modems. The commitments are therefore designed to address those specific problematic provisions and resulting issues. Specifically, at the worldwide level, the commitments prevent Broadcom from:

(i) requiring or inducing original equipment manufacturers to buy over 50% of their requirements of the relevant products from Broadcom via certain stratagems; and

(ii) conditioning the supply of or certain advantages for relevant products on an OEM obtaining 50% of its requirements for these or certain other products from Broadcom.

The commitments provide additional protections within the EEA, which most notably eliminate the 50% requirement thresholds identified above.

The Commitments Do Not Protect Most Markets or Participants

Unfortunately, given their limited scope, the commitments do not protect Broadcom customers or rivals from most forms of its anticompetitive conduct. For example, the commitments do not protect against the following misconduct in which Broadcom allegedly engaged:

(i) requiring customers to purchase up to 49% of their requirements for certain products outside of the EEA;

(ii) unlawful discount bundling;

(iii) refusing to deal with competitors and/or customers to reduce competition;

(iv) most forms of anticompetitive tying;

(v) predatory (i.e., below-cost) pricing; and,

(vi) certain forms of exclusive dealing.

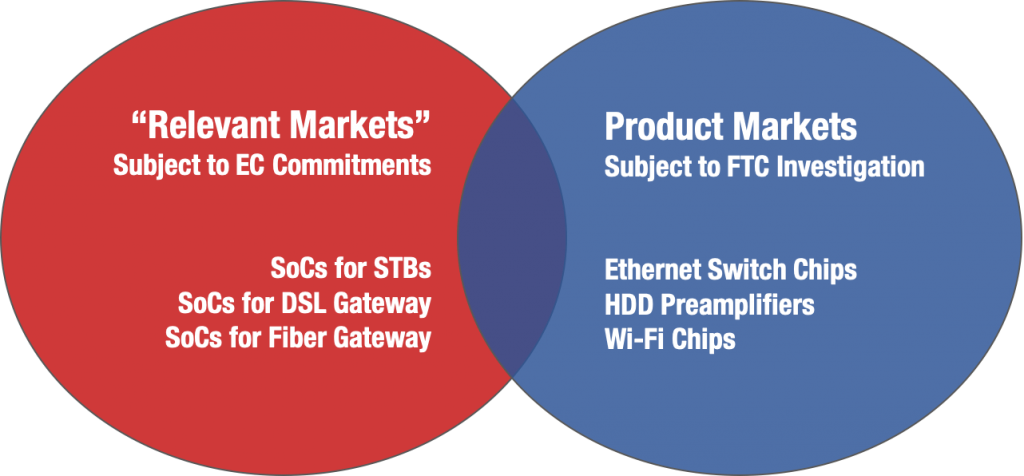

The commitments also provide virtually no protection for participants in most product markets in which Broadcom operates. This incorporates markets in which Broadcom has reportedly engaged in anticompetitive conduct, including those for front-end chips for STBs and internet modems, Wi-Fi chips, ethernet switch chips, and HDD preamplifiers. In fact, as the following diagram illustrates, there is no overlap between the “Relevant Markets” defined by the EC Commitments and the product markets reportedly subject to the U.S. Federal Trade Commission’s ongoing multi-year Broadcom investigation:

The limited scope of the commitments is significant because Broadcom is unlikely to alter its behavior where not explicitly required to do so. According to sources, Broadcom has continued to engage in anticompetitive conduct during the pendency of the EC investigation, including after the EC implemented rarely invoked interim measures against Broadcom in October 2019. It follows that if Broadcom is unwilling to alter behavior while under investigation by multiple competition agencies and subject to behavioral restrictions, then it is unlikely to alter its behavior now that the EC’s investigation has concluded.

The Commitments Can Be a Sword for Private Litigants

Although narrowly constructed, the commitments are likely a boon for any company filing a private antitrust action in the U.S. to either recover damages caused by Broadcom’s misconduct or alter Broadcom’s behavior going forward. The commitments effectively confirm that Broadcom executed anticompetitive contracts and engaged in related misconduct in the markets for SoCs for STBs and internet modems. This, at minimum, strongly supports reporting that Broadcom has engaged in comparable misconduct in other chip markets.

In sum, the commitments accepted by the EC were carefully designed to address specific exclusivity provisions in Broadcom’s contracts in discrete chip markets. Consequently, they do not address most of Broadcom’s alleged misconduct or offer protections for Broadcom customers and rivals in most pertinent product markets. This is particularly true for companies operating in the U.S., as the protections are even more limited outside of the EEA. And, given its behavior during the pendency of the EC investigation, Broadcom is unlikely to unilaterally alter its conduct in markets not affected by the commitments.

Nevertheless, the commitments provide customers and/or competitors with a powerful litigation tool to use against Broadcom, as they strengthen already strong antitrust claims. The remaining question therefore is how these customers and rivals will treat these claims. Will they treat them as litigation assets and use them to recover lost profits and overcharges (payments demanded by Broadcom at higher than freely negotiated, competitive market pricing) through automatic treble damages or settlement? Or will they disregard these wasting assets and hope that governmental enforcement will someday halt Broadcom’s costly anticompetitive conduct? Only time will tell.

Co-authored by Steven Benz, and Jayme Weber Partner and Associate, respectively, with Kellogg Hansen Todd Figel & Frederick PLLC in Washington, DC.

/>i

/>i