I. Introduction.

On March 4, 2019, the Internal Revenue Service (the “IRS”) and the Department of the Treasury (the “Treasury”) released proposed regulations (the “Proposed Regulations”) regarding the deduction for “foreign-derived intangible income” (“FDII”) under section 250 of the Internal Revenue Code.[1] Section 250 was enacted in 2017 as part of the tax reform act.[2] Very generally, section 250 provides domestic corporations with a reduced effective 13.125% tax rate on FDII, which is a formulary proxy for a domestic corporation’s intangible income attributable to foreign sales and services.[3] The reduced tax rate for FDII is intended to encourage U.S. multinationals to retain intellectual property in the United States rather than transfer it to a foreign subsidiary where it could generate global intangible low-taxed income (“GILTI”), which is taxable at a 10.5% rate. The Proposed Regulations also would permit individuals who make a section 962 election with respect to their controlled foreign corporation (“CFCs”) to benefit from the reduced 13.125% rate on the GILTI earned by those CFCs.

The Proposed Regulations are generally effective for taxable years ending on or after March 4, 2019.

This post provides both background to and a summary of some of the most important aspects of the Proposed Regulations. For more information, please contact any of the Proskauer tax lawyers listed on this post or your regular Proskauer contact.

II. Summary of the Proposed Regulations.

-

The reduced FDII rate is available only with respect to foreign sales income and foreign services income. The Proposed Regulations provide specific rules to determine whether sales and services generate foreign income. Very generally, under the Proposed Regulations, a sale of “general” property (i.e. property other than intangible property, securities, or commodities)[4] to an unrelated foreign person must not be subject to a domestic use for three years from the date of delivery, or be subject to manufacture, assembly or other processing outside the United States before any domestic use, to generate foreign sales income. A component sold to an unrelated foreign person and incorporated into a second product must represent no more than 20% of the fair market value of the second product to be treated as foreign use. However, the second product could then be sold in the United States without jeopardizing the foreign source income of the component. This rule may encourage U.S. component manufacturers to sell to foreign assemblers to generate FDII, rather than sell to U.S. assemblers.

-

Under the Proposed Regulations, a sale of intangible property is for foreign use only to the extent it is exploited outside the United States, based on the location of the end user.

-

Under the Proposed Regulations, military sales to and services provided to the United States government under the Arms Export Control Act for the re-sale or on-service to a foreign government are treated as foreign sales or services.

-

Under the Proposed Regulations, sales to and services for related parties are subject to strict rules. Generally, if a foreign-related party uses purchased property to produce other property or provide a service, the seller must reasonably expect that more than 80% of the revenue earned by the foreign related party would be earned from unrelated transactions in order for the income from the related-party transaction to qualify as foreign sales income.

-

A service provided to a foreign related person that is then used to provide services to persons located in the United States may qualify as foreign services only if (i) less than 60% of the benefits are to persons located in the United States, and (ii) less than 60% of the price paid by persons located in the United States for the service provided by the related person are attributable to the related-party services.

-

The Proposed Regulations provide ordering rules to coordinate sections 250, 163(j), and 172(a) for purposes of calculating taxable income.

-

The Proposed Regulations provide that a corporate partner of a partnership must take into account its distributive share of partnership tax items in order to calculate the corporate partner’s FDII.

-

Extensive documentation is required to establish the prerequisites for FDII.

III. Background: The reduced tax rate on FDII.

Section 250(a) provides domestic corporations a reduced effective 13.125% tax rate on their FDII for taxable years beginning in 2018 and before 2026. The mechanism for the reduced rate on FDII is a deduction (the “section 250 deduction”) equal to 37.5% of the taxpayer’s FDII.[5]

For taxable years beginning after 2025, the reduced rate on FDII is 16.406%, reflecting a deduction of 21.875% of FDII.[6] (Click to enlarge figures)

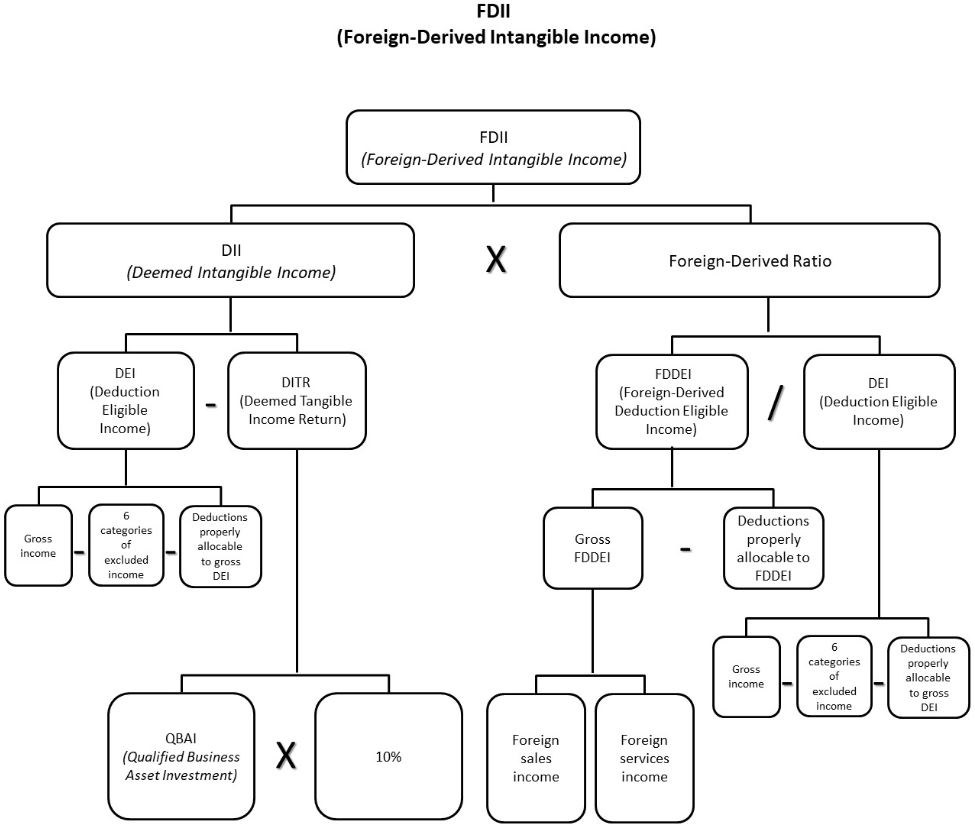

As mentioned above, FDII is a formulary proxy for a taxpayer’s intangible income attributable to foreign services and sales income. Mechanically, section 250 assumes that all income is earned either from tangible property or intangible property, and then assumes that the amount earned from tangible property is equal to 10% of the taxpayer’s investment in depreciable tangible property (i.e., “deemed tangible income return” or “DTIR” is 10% x “qualified business asset investment or “QBAI”). The balance of the taxpayer’s income is deemed to arise from intangibles (i.e., “deemed intangible income”, or “DII”). DII is multiplied by the ratio of the taxpayer’s foreign sales and services income, other than subpart F income, GILTI, dividends from CFCs, and foreign branch income (“income earned abroad”) and financial service income (generally “foreign-derived deduction eligible income” or “FDDEI”), to all of the taxpayer’s income, other than income earned abroad, financial service income, and domestic oil and gas extraction income (generally, “deduction eligible income” or “DEI”). The resulting product is FDII, or the portion of the taxpayer’s DII that is foreign-derived.

More precisely, FDII is the taxpayer’s DII multiplied by the ratio of the taxpayer’s FDDEI to its overall DEI (this ratio is the taxpayer’s “foreign-derived ratio”).[7] DII is the excess of the taxpayer’s DEI over its DTIR.[8]

A taxpayer’s DTIR is 10% of the taxpayer’s QBAI. QBAI, in turn, is the average of the taxpayer’s four end-of-quarter aggregate adjusted basis amounts in depreciable tangible property used in the production of its DEI.[9] Depreciable basis is determined using the alternative depreciation system, which is slower than modified accelerated cost recovery and bonus depreciation, and has the effect of inflating QBAI and minimizing FDII. Ten percent is a proxy for a “normal” return on tangible investment. Businesses with relatively high amounts of tangible investment as compared to taxable income receive less benefit; businesses that receive a greater than 10% return on their tangible assets receive more benefit, all other things being equal.

In broad terms, FDDEI is the portion of the taxpayer’s DEI that is derived from (i) sales of property by the taxpayer to a non-U.S. person for a foreign use (“foreign sales income”), and (ii) the provision of services by the taxpayer to any person, or with respect to property, that is not located within the United States (“foreign services income”).[10] DEI is the taxpayer’s gross income determined without regard to

-

Subpart F income,

-

GILTI,

-

Financial services income,

-

Dividends received from any of the taxpayer’s CFCs,

-

Domestic oil and gas extraction income, and

-

Foreign branch income.[11]

(Click to enlarge figure)

Property sold to a non-U.S. person for further manufacturing or other modification within the United States does not give rise to foreign sales income even if the property is subsequently used for a foreign use.[12] Likewise, income attributable to services provided to an unrelated person located within the United States is not treated as foreign services income even if the services are used by the recipient to provide foreign-derived services.[13]

Property sold to a related foreign party is treated as sold for a foreign use only if the property is eventually sold, or used in connected with property which is sold (or the provision of services) to an unrelated foreign party for a foreign use.[14] To qualify as foreign services income, income from services to a related party not located within the United States must not be substantially similar to services provided by the related party to other persons within the United States.[15]

The section 250 deduction is limited by a taxpayer’s taxable income.[16] If, for any taxable year, a taxpayer’s FDII and GILTI exceeds its taxable income (without regard to section 250), the excess is allocated pro rata to reduce the taxpayer’s FDII and GILTI.[17] This prevents taxpayers with little or no taxable income in a taxable year from claiming the full benefit of the section 250 deduction.[18]

IV. Summary of the Proposed Regulations.

A. FDDEI transactions.

1. General rules for FDDEI transactions.

To calculate a taxpayer’s FDDEI, and consequently the foreign-derived ratio, the taxpayer must first calculate its gross FDDEI. The Proposed Regulations define gross FDDEI as the portion of DEI derived from FDDEI sales and services (collectively, FDDEI transactions), described in greater detail below.[19]

The Proposed Regulations require FDDEI transactions to be classified as either a sale or service. If a single transaction involves both sale and service elements, the transaction is classified according to its overall predominant character.[20] For example, a sale of manufacturing equipment that includes no-cost incidental support services from the seller’s employees would be classified as a sale.

A partnership is treated as a person for purposes of determining whether a sale of property to or by a partnership, or provision of services to or by a partnership, is a FDDEI transaction.[21] Accordingly, a sale of property or provision of services to a foreign partnership is a sale of property or provision of services to a foreign person even if one or more of the partners are U.S. persons. Conversely, a sale of property or provision of services to a domestic partnership is not a sale of property or provision of services to a foreign person even if one or more of the partners is a foreign person. However, the Proposed Regulations request comments on whether treating a partnership as an aggregate of partners would be more appropriate under certain circumstances.[22]

2. FDDEI sales.

A sale of property to a foreign person for foreign use is treated as a FDDEI sale.[23] The Proposed Regulations provide rules for determining whether a sale of property is made to a “foreign person” and for “foreign use”.

The Proposed Regulations treat an individual resident of a U.S. territory as a foreign person for purposes of the FDDEI sale rules in order to prevent the disparate treatment of a sale to entities in a U.S. territory and a sale to individuals in a U.S. territory.[24]

The determination of whether a sale of property is for foreign use depends on whether there is a sale of general property or intangible property. The Proposed Regulations define general property as property other than intangible property, securities, or commodities.[25]

General property is treated as sold for foreign use if (i) there is no domestic use of the property within three years of delivery,[26] or (ii) the property is subject to additional manufacture, assembly, or other processing outside the United States before any domestic use of the property.[27] The Proposed Regulations provide that general property is considered subject to manufacture, assembly or processing if, based on the facts and circumstances, there is a physical and material change to the property (excluding minor assembly, packaging or labeling) or the property is incorporated as a component of another product.[28] To be treated as incorporated as a component, the property’s fair market value must be no more than 20% of the fair market value of the second product of which it is a component.[29] Thus, if a U.S. corporation manufactures components that represent 20% or less of the fair market value of a product produced by an unrelated U.S. assembler, the FDII rules would encourage the U.S. manufacturer to sell its component to a foreign assembler. In this manner, the sales income could qualify for the reduced FDII rate.

The determination of whether intangible property is sold for foreign use depends on the location where revenue is earned, which is generally the location of the end-user customers who license the intangible property or purchase products for which the intangible property was used in development, manufacture, sale or distribution.[30] For example, if a U.S. corporation licenses intellectual property to its foreign affiliate, and the foreign affiliate incorporates the intellectual property into a product that is sold only to foreign consumers, the license fee would be treated as sold for foreign use and constitute FDDEI. However, if 50% of the products are sold to foreign consumers and 50% are imported into the United States, then only 50% of the license fee would be treated as sold for foreign use and constitute FDDEI.

3. FDDEI services.

FDEII services include any services provided by a domestic corporation to any person, or with respect to property, not located within the United States.[31] To determine whether a service qualifies as a foreign service, the Proposed Regulations provide different rules for four different types of services: (1) proximate services, (2) transportation services, (3) property services, and (4) general services.

i. Proximate services.

Proximate services are substantially performed in the physical presence of their recipients, such as on-site training or consulting.[32] A proximate service is a FDII service if it is performed outside of the United States, and may be proportionally allocated to gross FDDEI if the service is performed partly within the United States and partly outside of the United States.[33]

ii. Transportation services.

Transportation services are services to transport a person or property using any identifiable mode of transportation, including by aircraft, railroad, vessel, or other motor vehicle.[34] A transportation service is a FDDEI service if transportation is provided to a recipient or with respect to property located outside the United States, if both the origin and destination of the transport are outside of the United States.[35] Accordingly, 100% of the gross income will be included in gross FDDEI. However, if either the transport’s origin or destination (but not both) is within the United States, then 50% of the gross income resulting from the transportation service is included in gross FDDEI.[36]

iii. Property services.

Property services, including assembly and maintenance, are provided with respect to tangible property if substantially all of the service is performed in close proximity to the property and the property is physically manipulated by means of the service.[37] For example, architectural services are property services only if such services are performed in physical proximity to the specific building, and the building structure is in some way physically altered by means of the service. A property service is a FDDEI service if the property is located outside of the United States for the duration of performance.[38]

iv. General services.

Services that are not proximate, transportation, or property services may fall into the residual category of “general services”. General services that qualify as FDDEI services serve either consumers or business recipients. General services provided to a consumer, or an individual that purchases the service for personal use, are FDDEI services if the consumer resides outside of the United States.[39] General services provided to a business recipient, or any recipient other than a consumer, are FDDEI services if the business recipient is located outside of the United States.[40] The location of a business recipient is based upon its operations (i.e., any place where it maintains an office or other fixed place of business) that receive a benefit from such service.[41]

4. Domestic intermediary rules.

If a taxpayer sells property to an unrelated buyer for further modification within the United States, the property will not be treated as a FDDEI sale even if the unrelated buyer goes on to use the property outside the United States.[42] Furthermore, if a taxpayer provides services to an unrelated person located in the United States, these services will not be treated as FDDEI services even if the receiving person uses the services to provide subsequent FDDEI services.[43]

5. Related party transactions.

As mentioned above, property sold to a foreign related party is treated as sold for foreign use only when it is resold by the foreign related party for foreign use, or used by the foreign related party in connection with the sale of other property or provision of services for foreign use. Similarly, the provision of services to a related party not located in the United States gives rise to FDDEI only if the provision of services to the related party is not substantially similar to the services the related person provides to persons located in the United States. The Proposed Regulations provide rules for determining whether a sale of property or provision of services to a related party is for foreign use.

For the resale of property by a related party, the resale must occur on or before the FDII filing date or the date (including extensions) that the seller files its tax return for the tax year in which the sale to the related party took place.[44] If the sale to the unrelated party occurs after the tax year in which the sale to the related party occurred, then the taxpayer must amend its return for the tax year of the related party sale.[45] If the related party uses the property in manufacturing or in the provision of services, the sale is treated as a FDDEI sale only if the seller reasonably expects that more than 80% of the revenue of the foreign related party will be from unrelated party transactions that are FDDEI transactions.[46]

The Proposed Regulations provide two tests for determining whether services provided to a foreign related party (“related party services”) are substantially similar to services provided by the foreign related party to persons in the United States. Under the benefit test, the related party services are substantially similar if 60% or more of the benefits conferred by the related party services are to persons located in the United States.[47] Alternatively, under the price test, the related party services are also substantially similar if 60% or more of the price paid by persons located in the United States for the services provided by the foreign related party are attributable to the related party services.[48]

B. Ordering rules for computing the section 250 deduction.

As mentioned above, the section 250 deduction is limited by a taxpayer’s taxable income (the “section 250(a)(2) taxable income limitation”).[49] The Proposed Regulations provide that, for this purpose, taxable income is determined by taking into account all applicable deductions other than the section 250 deduction.[50] In particular, the Proposed Regulations provide that taxable income is determined by taking into account the limitation for business interest expense under section 163(j)(1)[51] and the limitation on the deduction of net operating losses under section 172(a)(2)[52] (the “section 172(a)(2) deduction”), so that taxable income includes amounts carried forward under these sections to the taxable year.[53]

The Proposed Regulations, in connection with the rules under sections 163(j) and 172(a) and recently proposed regulations under section 163(j), provide ordering rules for applying the limitations on deductions under these three sections. First, the Proposed Regulations require the taxpayer to calculate the tentative amount of its FDII and the tentative amount of its section 250 deduction (the “tentative section 250 deduction”) taking into account all deductions except for the section 163(j) deduction for business interest expense (the “section 163(j) deduction”) and the section 172(a)(2) deduction and the section 250(a)(2) taxable income limitation.[54] Second, the taxpayer calculates its section 163(j) deduction taking into account the tentative section 250 deduction amount without regard to its section 172(a)(2) deduction.[55] Third, the taxpayer determines its section 172(a)(2) deduction taking into account its section 163(j) deduction and the section 250(a)(2) taxable income limitation.[56] Fourth, the taxpayer calculates its FDII amount taking into account the section 163(j) and section 172(a)(2) deductions calculated above. Finally, the taxpayer calculates its section 250 deduction after applying the section 250(a)(2) taxable income limitation, taking into account the section 163(j) and 172(a)(2) deductions calculated above.[57]

C. Clarifying the components of the FDII computation.

1. DEI and FDDEI.

To calculate a taxpayer’s foreign-derived ratio, the taxpayer must first determine its gross deduction eligible income (“gross DEI”) and gross foreign-derived deduction eligible income (“gross FDDEI”) and properly allocate and apportion deductions attributable to each of these gross amounts.[58]

With respect to property produced or acquired for resale, gross income is generally determined by subtracting cost of goods sold from gross sale receipts. For purposes of determining the amount of gross income included in gross DEI and gross FDDEI, the Proposed Regulations provide that taxpayers may use any reasonable method to attribute the cost of goods sold to gross receipts.[59] The cost of goods sold associated with activities undertaken in a previous taxable year cannot be segregated into component costs and attributed disproportionately to amounts excluded from either gross FDDEI or gross DEI.[60]

For purposes of allocating and apportioning deductions to gross DEI and gross FDDEI, the Proposed Regulations provide that a taxpayer must apply the rules under section 861 and its regulations.[61]

The Proposed Regulations also provide that the foreign-derived ratio (i.e., the ratio of FDDEI to DEI) may not exceed 1.[62]

2. QBAI anti-abuse rule.

As mentioned above, a taxpayer’s deemed intangible income (“DII”) is the excess (if any) of the corporation’s deemed eligible income (“DEI”) over its deemed tangible income return (“DTIR”). DTIR is 10% of the taxpayer’s qualified business asset investment (“QBAI”).

QBAI is the average of the taxpayer’s aggregate adjusted bases as of the close of each quarter of the taxpayer’s taxable year in “specified tangible property” that is used in a trade or business of the domestic corporation.[63] Very generally, specified tangible property is depreciable tangible property (for which a deduction is allowed under Section 167)[64] used in the production of DEI.[65]

All other things equal, the more QBAI a taxpayer has, the more DTIR it will have and, ultimately, the less FDII it will have.

To prevent taxpayers from purposefully minimizing their QBAI and consequently their DTIR, and thereby increasing their FDII, the Proposed Regulations incorporate anti-avoidance rules into the QBAI calculation. Generally, if a taxpayer transfers specified tangible property to a specified related party and, within six months leases it back, then the taxpayer is deemed to remain the owner of the transferred property for purposes of determining QBAI.[66] Otherwise, if a taxpayer transfers specified tangible property to a specified related party with the principal purpose of decreasing its DTIR, and, within the two-year period beginning one year before the transfer, the taxpayer leases that property back, then the taxpayer will be treated as owning the transferred property for the purposes of determining QBAI.[67] Under the Proposed Regulations, a “specified related party” is characterized by more than 50% ownership (vote and value) of a corporation.[68] The Proposed Regulations also extend this anti-avoidance rule to transfers to unrelated parties pursuant to a “structured arrangement,” where DTIR reduction is a material factor causing the transfer or the facts and circumstances indicate such a DTIR-related purpose.[69]

The Proposed Regulations also address dual use property, the amount of QBAI arising in a short taxable year, and calculating a domestic corporate partner’s share of partnership QBAI.

3. Special rules for partnerships and tax-exempt corporations.

The Proposed Regulations provide that a corporate partner of a partnership must take into account its distributive share of a partnership’s gross DEI, gross FDDEI, and deductions in order to calculate the corporate partner’s FDII.[70] Accordingly, a domestic corporation’s QBAI is increased by its share of the partnership’s adjusted basis in the partnership’s specified tangible property for purposes of determining the domestic corporation’s DTIR.[71]The section 250 deduction is computed and allowed only at the level of a domestic corporate partner, and therefore will not result in a basis adjustment to a domestic corporate partner’s interest in a domestic partnership.

A domestic tax-exempt corporation that is subject to the unrelated business income tax rules under section 511 may claim a section 250 deduction. For this purpose, the corporation’s FDII is determined only with respect to its items of income, gain, deduction, or loss, and adjusted basis in property, that are taken into account in computing its unrelated business taxable income.[72]

D. Consolidated groups.

The section 250 deduction is available to a member of a consolidated group in the same manner as the deduction is available to any domestic corporation. However, because a consolidated group could potentially segregate its income so as to distort its members’ FDII calculations, the Proposed Regulations provide that a member’s section 250 deduction is determined by reference to all members’ relevant items of income in the aggregate. The Proposed Regulations instruct a consolidated group to first calculate an overall section 250 deduction, and then allocate the deduction amount among the members according to each member’s respective contributions to the consolidated group’s aggregate amount of FDII and aggregate amount of GILTI.[73]

The Proposed Regulations also address the impact of intercompany transactions on group members’ QBAI computation[74] and the attribute redetermination rule (applied when calculating gross DEI and gross FDDEI).[75]

E. Reporting requirements.

1. FDDEI Transactions.

The Proposed Regulations also provide general documentation requirements for FDDEI transactions. The seller or service provider must (1) obtain any necessary FDDEI transaction documentation by the FDII filing date, (2) obtain the documentation no earlier than a year before the transaction, and (3) have no reason to know that the documentation is false or unreliable.[76]

2. Foreign sales and services documentation.

The Proposed Regulations also include documentation and knowledge requirements.[77] A recipient of property is considered a foreign person only if the taxpayer obtains documentation of the recipient’s foreign status and does not know or have reason to know that the recipient is not a foreign person.[78] Documentation of foreign status of the recipient generally includes a written statement that the recipient is a foreign person or some form of the recipient’s identification or filing with a foreign governmental entity that demonstrates foreign status.[79] Sellers with less than $10 million in gross receipts during a prior taxable year may establish foreign status of the recipient through proof of a shipment address.[80] Property is considered sold for foreign use only if the seller obtains documentation that the property is for foreign use and does not know or have reason to know that the property is not for a foreign use.[81] Documentation of foreign use generally includes a written statement that the property is for foreign use, a binding contract stipulating that the property is for foreign use, an export bill of lading (in the case of general property) or financial statements or reports showing revenue generated within and outside the United States (in the case of intangible property).[82] For sales of general property, proof of a shipment address can be used as documentation of foreign use by sellers with gross receipts of less than $10 million or for sellers that receive less than $5,000 in gross receipts from one recipient.[83]

Because many of the components of the FDII calculation are used only in the context of section 250, the IRS is not able to wholly utilize pre-existing forms to collect taxpayer data. As such, the Proposed Regulations require taxpayers claiming a section 250 deduction to file the new Form 8993, “Section 250 Deduction for Foreign-Derived Intangible Income (FDII) and Global Intangible Low-Taxed Income (GILTI)”, with the taxpayer’s annual income tax return. On April 14, the Treasury announced that it plans to add more documentation options and clarifications for taxpayers claiming a section 250 deduction, although these additional documentation rules have not yet been released.[84]

F. Reduced GILTI Rates for Individuals That Make a Section 962 Election With Respect to their CFCs.

Very generally, section 962 allows an individual “United States shareholder”[85] of a CFC[86] to elect to be taxable with respect to the subpart F income (generally passive income like interest and capital gains) of his or her CFC as if the United States shareholder held the CFC through a U.S. corporation.[87] Accordingly, a United States shareholder who makes the election is taxable at a 21% rate with respect to the undistributed subpart F income of the CFC (the same as if the CFC were owned by a U.S. corporation). However, if the CFC makes an actual distribution, the shareholder is subject to an additional tax (i.e., analogous to dividend income from a C corporation) on 79% of the income (i.e., 100% – 21%).[88] The Proposed Regulations provide that an individual United States shareholder of a CFC also benefits from the reduced GILTI rate (i.e., 10.5%) with respect to the undistributed GILTI income of the individual’s CFC. If the CFC makes an actual distribution of GILTI income, the shareholder will be subject to an additional tax on 89.5% of the income (100% – 10.5%).

[1] Deduction for Foreign-Derived Intangible Income and Global Intangible Low-Taxed Income [REG-104464-18], 84 Fed. Reg. 8188 (Mar. 6, 2019). All references to section numbers are to the Internal Revenue Code or the Proposed Regulations.

[2] Pub. L. No. 115-97, 115 Stat. 2054 (2017).

[3] See Joint Comm. On Tax’n, General Explanation of Public Law 115-97 at 377 (2018).

[4] The Proposed Regulations refer to section 367(d)(4) for the definition of intangible property. Section 367(d)(4) defines intangible property as any (i) patent, invention, formula, process, design, pattern, or know-how, (ii) copyright, literary, musical, or artistic composition, (iii) trademark, trade name, or brand name, (iv) franchise, license, or contract, (v) method, program, system, procedure, campaign, survey, study, forecast, estimate, customer list, or technical data, (vi) goodwill, going concern value, or workforce in place, or (vii) other item the value or potential value of which is not attributable to tangible property or the services of any individual.

[5] Section 250(a)(1).

[6] Section 250(a)(3).

[7] Section 250(b)(1).

[8] Section 250(b)(2)(A).

[9] Section 250(b)(2)(B).

[10] Section 250(b)(4). Sales include any lease, license, exchange, or other disposition and foreign use means any use, consumption, or disposition which is not within the United States. Section 250(b)(5)(A), (E).

[11] Section 250(b)(3).

[12] Section 250(b)(5)(B)(i).

[13] Section 250(b)(5)(B)(ii).

[14] Section 250(b)(5)(C)(i).

[15] Section 250(b)(5)(C)(ii).

[16] Section 250(a)(2).

[17] Section 250(a)(2).

[18] For example, assume a U.S. shareholder has FDII of $100, GILTI of $300, deductible expenses of $100 and no other income or expense. The shareholder’s taxable income is, therefore, $300. Because the shareholder’s FDII and GILTI exceed its taxable income by $100, the shareholder’s FDII and GILTI must be reduced, in the aggregate, by this excess amount. The shareholder’s FDII is reduced by $25 (the amount that bears the same ratio to the excess amount ($100) as the shareholder’s FDII ($100) bears to the sum of FDII and GILTI ($400)) and the shareholder’s GILTI is reduced by $75 (the amount that bears the same ratio to the excess amount ($100) as the shareholder’s GILTI ($300) bears to the sum of FDII and GILTI ($400)). Accordingly, the shareholder’s FDII is $75 and GILTI is $225. Therefore, the shareholder is entitled to a section 250 deduction of $140.63 ($75 * 37.5% + $225 * 50%).

[19] Prop. Reg. § 1.250(b)-1(10), (15).

[20] Prop. Reg. § 1.250(b)-3(e).

[21] Prop. Reg. § 1.250(b)-3(g).

[22] 84 Fed. Reg. 8192.

[23] Section 250(b)(4)(A); Prop. Reg. § 1.250(b)-4(b).

[24] Prop. Reg. § 1.250(b)-3(b)(10).

[25] The Proposed Regulations refer to section 367(d)(4) for the definition of intangible property. Section 367(d)(4) defines intangible property as any (i) patent, invention, formula, process, design, pattern, or know-how, (ii) copyright, literary, musical, or artistic composition, (iii) trademark, trade name, or brand name, (iv) franchise, license, or contract, (v) method, program, system, procedure, campaign, survey, study, forecast, estimate, customer list, or technical data, (vi) goodwill, going concern value, or workforce in place, or (vii) other item the value or potential value of which is not attributable to tangible property or the services of any individual.

[26] Transportation property (which includes aircrafts, railroad rolling stock, vessels, motor vehicles, or other similar transportation property that can travel internationally) will be considered sold for foreign use only if, during the three year period after delivery, the property is located outside the United States for more than 50 percent of the time and more than 50 percent of the miles traversed in the use of the property is traversed outside the United States. Prop. Reg. § 1.250(b)-4(d)(2)(iv).

[27] Prop. Reg. § 1.250(b)-4(d)(2)(i).

[28] Prop. Reg. § 1.250(b)-4(d)(2)(iii).

[29] Prop. Reg. § 1.250(b)-4(d)(2)(iii)(C).

[30] Prop. Reg. § 1.250(b)-4(d)(2)(i).

[31] Section 250(b)(4)(B).

[32] Prop. Reg. § 1.250(b)-5(c)(6).

[33] Prop. Reg. § 1.250(b)-5(f).

[34] Prop. Reg. § 1.250(b)-5(c)(7).

[35] Prop. Reg. § 1.250(b)-5(h).

[36] Prop. Reg. § 1.250(b)-5(h).

[37] Prop. Reg. § 1.250(b)-5(c)(5).

[38] Prop. Reg. § 1.250(b)-5(g). The Treasury Department and the IRS request comment on whether to carve out an exception for services with respect to property located in the United States temporarily, solely for purposes of the performance of maintenance or repairs. 84 Fed. Reg. 8197.

[39] Prop. Reg. § 1.250(b)-5(d).

[40] Prop. Reg. § 1.250(b)-5(e)(1).

[41] Prop. Reg. § 1.250(b)-5(e)(2)(i). The Proposed Regulations use the term “benefit” as defined in Treas. Reg. § 1.482-9(l)(3) (“An activity is considered to provide a benefit to the recipient if the activity directly results in a reasonably identifiable increment of economic or commercial value that enhances the recipient’s commercial position, or that may reasonably be anticipated to do so.”).

[42] Section 250(b)(5)(B)(i).

[43] Section 250(b)(5)(B)(ii).

[44] Prop. Reg. § 1.250(b)-6(c)(1)(i).

[45] Prop. Reg. § 1.250(b)-6(c)(1)(i).

[46] Prop. Reg. § 1.250(b)-6(c)(1)(ii).

[47] Prop. Reg. § 1.250(b)-6(d)(2)(i).

[48] Prop. Reg. § 1.250(b)-6(d)(2)(ii).

[49] Section 250(a)(2) provides that if, for any taxable year, a taxpayer’s FDII and GILTI amount exceeds its taxable income (without regard to section 250), the excess is allocated pro rata to reduce the taxpayer’s FDII and GILTI.

[50] Prop. Reg. § 1.250(a)-1(c)(4).

[51] Section 163(j)(1) generally limits a deduction for business interest expense to the sum of (i) business interest income, (ii) 30% of adjusted taxable income (“ATI”), and (iii) floor plan financing interest expense in the current taxable year.

[52] Section 172(a)(2) generally limits a deduction for NOLs to 80 percent of taxable income determined without regard to the deduction allowed under section 172 for NOLs.

[53] Preamble to the Proposed Regulations.

[54] Prop. Reg. § 1.250(a)-1(c)(4).

[55] Section 163(j)(8)(A)(iii); Prop. Reg. § 1.163(j)-1(b)(1)(i)(B), (b)(37)(ii).

[56] Section 172(d)(9).

[57] For an example of how the ordering rules operate, see Prop. Reg. § 1.250(a)-1(f)(2), Example 2.

[58] Prop. Reg. § 1.250(b)-1(c)(2), (3).

[59] Prop. Reg. § 1.250(b)-1(d)(1).

[60] Prop. Reg. § 1.250(b)-1(d)(1).

[61] Prop. Reg. § 1.250(b)-1(d)(2). Section 861 provides general rules for allocating and apportioning expenses to different types of a taxpayer’s income. Under these rules, expenses are first allocated to classes of gross income (generally consisting of items (or subdivisions of these items) of income listed in section 61), and then apportioned among statutory and residual groupings of gross income as determined by the operation section (gross income from a specific source or activity).

[62] Prop. Reg. §1.250(b)-1(c)(13).

[63] Prop. Reg. § 1.250(b)-2(b).

[64] Section 167 generally allows a depreciation deduction for “the exhaustion, wear and tear” of property used in a trade or business or property that is held for the production of income. Section 167(a).

[65] Prop. Reg. § 1.250(b)-2(c)(1).

[66] Prop. Reg. § 1.250(b)-2(h)(3).

[67] Prop. Reg. § 1.250(b)-2(h)(1).

[68] Prop. Reg. § 1.250(b)-1(c)(17)(i), (19).

[69] Prop. Reg. § 1.250(b)-2(h)(2).

[70] Prop. Reg. § 1.250(b)-1(e).

[71] Prop. Reg. § 1.250(b)-2(g).

[72] Prop. Reg. § 1.250(b)-1(g). For example, if a tax-exempt corporation has tangible property used in the production of both unrelated business income and gross income that is not unrelated business income, only the portion of the basis of such property taken into account in computing the corporation’s unrelated business income is taken into account in determining the corporation’s QBAI. Similarly, if a tax-exempt corporation has tangible property that is used in both the production of gross DEI and the production of gross income that is not gross DEI, only the corporation’s unrelated business income is taken into account in determining the corporation’s dual-use ratio with respect to such property under Prop. Reg. § 1.250(b)-2(d)(2).

[73] Prop. Reg. § 1.1502-50(b).

[74] Prop. Reg. § 1.1502-50(c)(1).

[75] Prop. Reg. § 1.1502-50(c)(2). The attribute redetermination rule is found in Treas. Reg. § 1.1502-13(c)(1)(i).

[76] Prop. Reg. § 1.250(b)-3(d).

[77] Prop. Reg. § 1.250(b)-4(c)-(e).

[78] Prop. Reg. § 1.250(b)-4(c)(1).

[79] Prop. Reg. § 1.250(b)-4(c)(2).

[80] Prop. Reg. § 1.250(b)-4(c)(2)(E).

[81] Prop. Reg. § 1.250(b)-4(d)(1), (e)(1).

[82] Prop. Reg. § 1.250(b)-4(d)(3), (e)(3).

[83] Prop. Reg. § 1.250(b)-4(d)(3)(ii).

[84] Andrew Velarde, “U.S. Treasury Promises Expansion of FDII Documentation Rules”, Tax Notes (Apr. 5, 2019), https://www.taxnotes.com/worldwide-tax-daily/foreign-source-income/us-treasury-promises-expansion-fdii-documentation-rules/2019/04/05/29bfj.

[85] A United States shareholder is a United States person (such as a U.S. resident individual) who owns, or is treated as owning, 10 percent of the voting power or value of a foreign corporation. Section 951(b).

[86] A controlled foreign corporation is a foreign corporation 50% of the vote or value of which is owned (or treated as owned) by United States shareholders. Section 957(a).

[87] See section 962; Treas. Reg. § 1.962-1(a) (stating that if a section 962 election is made, the individual is subject to tax in an amount equal to the tax which would be imposed under section 11 if the amounts of taxable income were received by a domestic corporation).

[88] The second tax upon an actual dividend is subject to tax at ordinary income rates (i.e., 40.8% maximum rate [37% + 3.8%]) unless the dividend is qualifying dividend income, in which case it would be taxable at a 23.8% rate (the qualified dividend rate of 20% plus the 3.8% net investment tax).

Additional authors: Michael Fernhoff, Martin T. Hamilton, Malcolm Hochenberg, Scott S. Jones, Mary B. Kuusisto, Arnold P. May, Jeremy Naylor, Alan Parnes and Jamiel E. Poindexter

/>i

/>i