Two Years Later, Regulation BI Remains a “Tremendous Priority” for FINRA

June 30th marked two years since the implementation of Regulation Best Interest (“Reg BI”) and the client relationship summary or Form CRS. Firm compliance with these new regulations remains a priority for FINRA, having conducted more than 570 firm exams relating to Reg BI through the end of 2021. In a recent episode of the FINRA podcast “FINRA Unscripted,” FINRA’s Meredith Cordisco, Scott Gilbert and Nicole McCafferty offered candid remarks about what FINRA has learned during this initial two-year review period, including common problem areas and some of the best practices firms use to achieve compliance.

Mr. Gilbert views Reg BI as “enhanc[ing]” the more traditional suitability rules, imposing four distinct obligations on broker dealers – the disclosure obligation, the care obligation, the conflict of interest obligation and the compliance obligation. Specifically, Mr. Gilbert emphasized that FINRA will be doing a “deeper dive” with respect to the standard of care obligation. For broker dealers and their registered reps, this means an increased focus and scrutinization of what securities recommendations look like and whether they truly are in the best interest of the customer given the specific client profile. Importantly, these reviews are all conducted in conjunction with the product specific rules at issue, including FINRA Rule 2330 (variable annuities) and FINRA Rule 2360 (options), and how complex products may or may not be consistent with a client’s investment profile.

Not surprisingly, FINRA’s exams have found that firms that historically have had suitability issues, now have issues relating to compliance with Reg BI’s Care Obligation. These same firms have found themselves not only the subject of FINRA examinations, but also FINRA arbitrations and, for the first time ever, an SEC Complaint.

SEC Brings First Ever Charges for Violation of Reg BI.

On June 15, 2022, in a matter that could yield important rulings on the scope of Reg BI, the U.S. Securities and Exchange Commission (“SEC”) filed the first complaint in the U.S. District Court for the Central District of California for violation of Reg BI. The Complaint filed against Western International Securities, Inc. (“Western”) and five of its registered representatives, alleges that they violated Reg BI in connection with the recommendations and sales of high risk, illiquid and unrated debt securities known as L Bonds issued by GWG Holdings, Inc. (“GWG”). Specifically, the SEC alleges that Western and the individual representatives recommended these bonds without understanding the risks associated with these securities and without a reasonable basis to believe that these investments were in the best interests of the investors—many of whom were retirees or were on fixed incomes with moderate risk tolerances.

The SEC claims that Western and the registered representatives violated Reg BI’s Care Obligation by failing to exercise reasonable diligence, care, and skill to understand the risks associated with L Bonds and recommending the L Bonds without a reasonable basis to believe the bonds were in the best interests of their customers. In addition, the SEC charged Western with violating Reg BI’s Compliance Obligation, alleging that Western’s policies and procedures were substantially copied from the SEC’s Small Entity Compliance Guide and contained no specific tailoring to Western’s particular business.

The SEC’s complaint provides a preview of what future Reg BI suits might entail and confirms the SEC’s willingness to pursue individual registered representatives for Reg BI violations.

Losses stemming from investments in L Bonds issued by GWG have already been the subject of multiple FINRA arbitrations, though any potential recoveries in those matters seems unlikely in light of GWG’s Chapter 11 bankruptcy filing in April 2022.

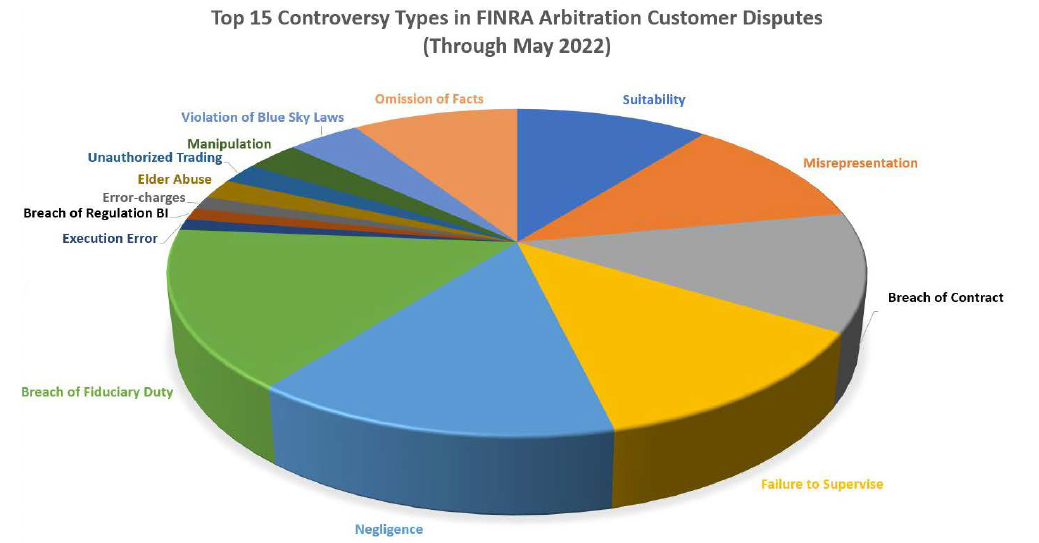

Reg BI Claims Break into Top 15 Causes of Action in FINRA Arbitrations.

According to FINRA’s recent Dispute Resolution statistics, claimants in FINRA arbitrations have filed 37 Reg BI claims against broker dealers and their registered representatives this year, marking the first time that claims tied to Reg BI have cracked the top 15 of FINRA arbitration claims. While traditional suitability claims will still be asserted if the alleged wrongdoing predated Reg BI, it is clear that Reg BI claims are trending upward and represent the future of customer arbitration cases.

Other FINRA News

FINRA Tells Us How It Used Its 2021 Fine Money.

On June 24, 2022, FINRA issued its report on its use of 2021 fine money. Since 2017, FINRA has issued this fine-spending report in an effort to make the SRO’s finances more transparent. For 2021, FINRA issued $90.1 million in fines, up from $57 million in 2020. However, the year-over-year increase is largely attributed to the $57 million fine levied against trading app Robinhood in June 2021 for allegedly misleading customers and allowing clients to engage in inappropriate options trading. FINRA earmarked $30 million of the money it collected from Robinhood to fund an education initiative that targets new investors who are trading on their own online and through mobile apps. “FINRA solicited input from firms, investors and other stakeholders on effective ways to reach these new investors,” the report states.

In addition to the $90.1 million in 2021 fines, the report also notes that FINRA collected another $37.6 million in what it refers to as “fines-eligible expenditures” that are funded by reserves and excess operating results. The total $127.7 million was allocated between capital initiatives ($80.4 million) and investor education programs ($47.3 million). Capital expenditures include modernizing enforcement technology, improving FINRA’s data analytics capabilities, strengthening market surveillance and modernizing securities industry infrastructure.

Independent Report on Arbitrator Selection Process.

On June 29th, FINRA published a report from independent counsel retained by FINRA’s Audit Committee of the Board of Governors in connection with a case focused on the arbitrator selection process.

The report found no evidence of an improper agreement to remove certain arbitrators from arbitration cases. As those that have been following this story will recall, this report was prompted following a highly publicized decision from the Georgia Superior Court that vacated an arbitration award after finding that one of the parties had manipulated the arbitrator selection process via an agreement with FINRA. The purported agreement allowed arbitrators from an earlier case involving the counsel to be automatically stricken from the list of potential arbitrators in any case in which the same counsel appeared. Following an investigation that included 29 interviews, the examination of more than 150,000 documents, emails, and telephone records, the independent counsel concluded that there was no such agreement between the financial institution and FINRA.

The report also set forth a series of recommendations to better “reflect the neutrality of the dispute resolution services forum [“DRS”] and to further promote uniformity and consistency among the different DRS regions.” The recommendations included (i) ongoing and mandatory staff training; (ii) manual reviews for conflicts of interest; (iii) ensuring that FINRA rules and the dispute resolution manual are consistent with publicly available documents; (iv) requiring written explanations, upon request, whenever there is a causal challenge to the selection or removal of an arbitrator; (v) procedural review of the algorithms used “to determine if FINRA’s current technology is still the most effective means in creating random, computer-generated arbitrator lists”; and (vi) other updates to the dispute resolution manual to clarify the staff roles and procedures.

Notable Enforcement Matters and Disciplinary Actions

Underwriting

Brokerage firm National Securities Corporation (NSC) was sanctioned approximately $9 million for a wide range of alleged misconduct involving its underwriting activities. The AWC detailing FINRA’s findings on this matter is available here. Most notably, FINRA found that NSC attempted to artificially influence the market for the offered securities by entering into “tie-in agreements” with branch managers, whereby the manager’s allocation was expressly conditioned on an agreement to purchase a specific number of shares in the aftermarket. FINRA further found that NSC engaged in misconduct by agreeing to solicit customers receiving allocations to purchase additional shares in the aftermarket, and by threatening to reduce allocations to representatives who would not agree to solicit their customers in the aftermarket.

According to FINRA, NSC’s misconduct violated Rule 101 of the Exchange Act’s Regulation M, which establishes a “restricted period,” during which underwriters are prohibited from inducing bids or purchases of any offered security in the aftermarket.

In addition to NSC’s alleged Rule 101 violations, FINRA’s $9 million sanction resolves multiple other charges against NSC, including allegations that the underwriter:

-

negligently omitted to tell investors about delays in the issuer’s required public filings;

-

failed to obtain “locates” for more than 33,000 short sale transactions, in violation of Rule 203(b)(1) of Regulation SHO under the Exchange Act;

-

failed to reasonably supervise one of its representatives who falsified information about customers’ assets and suitability in order to avoid NSC’s internal rules; and

-

made inaccurate representations to FINRA regarding the sales of stock warrants.

-

Notably, FINRA had sanctioned NSC more than $663,000 in April, alleging that the firm deceived investors about the price of shares in connection with a pre-Initial Public Offering. The AWC detailing FINRA’s findings on this separate matter is available here.

WhatsApp and Private Messaging

Over the past two months, FINRA has fined one firm, Insight Securities, Inc., and one registered representative, Ramiro Luis Colon, for engaging in business-related communications on WhatsApp, in violation of the recordkeeping requirements in FINRA Rule 4511.

The fines levied by FINRA—in the amount of $50,000 and $5,000, respectively—come on the heels of recent reports that the SEC, too, is cracking down on the use of private communications applications by investment banking employees. Back in December 2021, the SEC levied fines against at least one financial institution for allegedly allowing its employees to use smartphone apps like WhatsApp to circumvent recordkeeping requirements. More recent news reports indicate that, beginning around May 2022, the SEC has been probing the personal mobile phones of certain employees at numerous financial firms to identify the potential use of unauthorized messaging platforms.

The recent FINRA disciplinary actions suggest that FINRA is taking cues from the SEC, and scrutinizing member firms for their employees’ usage of private messaging apps.

-

In the Insight Securities matter, FINRA found that, between 2016 and 2019, Insight Securities failed to capture, review and retain thousands of business-related communications sent and received through WhatsApp. As a result of the alleged violations, Insight Securities consented to the imposition of a censure and a $50,000 fine. The AWC detailing FINRA’s findings is available here.

-

As for Ramiro Luis Colon, FINRA found that he exchanged hundreds of communications with a single customer on WhatsApp between 2018 and 2020, without authorization and in violation of his firm’s written supervisory procedures. As a result, FINRA imposed a 30-day suspension from association with any FINRA member firm, and a $5,000 fine. The AWC is available here.

Notable FINRA Arbitration Awards

Options trading

We reported in our previous two issues on a series of customer arbitration proceedings related to investments in a securities broker-dealer’s managed account options trading strategy. Since we last reported, several more awards have been issued in similar cases, with mixed results that included one dismissal and three substantial monetary awards.

-

FINRA Case No. 20-03990 – Following a twelve-day hearing related to a claim involving the options trading strategy, an arbitration panel found the broker-dealer liable for $900,000 in damages, in addition to nearly $300,000 in costs and attorneys’ fees.

-

FINRA Case No. 20-03978 – In an arbitration proceeding relating to claims that the same options trading strategy was unsuitable for the Claimants, a three-arbitrator panel issued an award against the broker-dealer for nearly $500,000 in compensatory damages, plus an additional $500,000 in punitive damages and $325,000 in attorneys’ fees pursuant to Texas statutory law.

-

FINRA Case No. 20-00464 – An Illinois-based arbitration panel, after conducting a five-day hearing, found the same broker-dealer liable for $250,000 in damages on similar claims relating to its managed account options strategy.

-

FINRA Case No. 20-01660 – After a five-day arbitration hearing held on Boston, the arbitration panel dismissed the claims of two Claimants who participated in the managed options trading strategy. The panel furthermore granted expungement to the registered representative who handled the accounts, on the grounds that the Claimants were advised exclusively by their own outside investment advisor.

Defamation

-

FINRA Case No. 18-03174 – Following a 25-day hearing, a FINRA arbitration panel found that hedge fund D.E. Shaw & Co. had defamed its former managing director, Daniel Michalow, awarding more than $52.1 million in compensatory damages. Although the award itself did not include details of Michalow’s arbitration claims, press reports from 2018 indicate that the hedge fund had terminated Michalow due to his “abusive and offensive conduct.” In addition to defamation, Michalow had alleged gender discrimination, violation of New York labor laws, breach of contract and unjust enrichment, and he sought more than $1.8 billion in compensatory and punitive damages. In rendering its award, the panel made it a point to specifically find that Michalow “did not commit sexual misconduct.”

Automated investing.

-

FINRA Case No. 20-02414 - An individual Claimant, appearing pro se, prevailed in an arbitration proceeding brought against a broker-dealer on allegations that a representative of the broker-dealer failed to follow the Claimant’s instructions to “dollar cost average” his investment in a portfolio managed by a robo-advisor. Dollar cost averaging is an investment strategy in which an investor makes an investment in several installments at regular intervals, intended to mitigate risks associated with poor market timing. The award, rendered by a sole arbitrator, found the Respondent firm liable for nearly $80,000 in damages, plus pre-judgment interest at 18%.

FINRA Notices and Rule Filings

-

Regulatory Notice 22-13 – FINRA announced the adoption of amendments to FINRA Rule 6732, which governs the exemption from the Trade Reporting Obligation for certain transactions on an Alternative Trading System (“ATS”). The amendments expand the scope of the exemption to allow a member ATS to apply for an exemption for certain transactions between a member subscriber and a non-member entity, such as a bank. Whether such a transaction is eligible for the exception will depend on five criteria, which are detailed in the full Regulatory Notice.

-

Regulatory Notice 22-14 – FINRA proposed a new trade reporting requirement for transactions in certain over-the-counter (“OTC”) options, and is currently requesting comments on the proposal. The proposal seeks to close a loophole that allowed OTC options transactions to go unreported to FINRA or the SEC, while a virtually identical “listed option” traded through a registered options exchange would be required to be reported to the relevant regulatory agency. FINRA is accepting comments on the proposal through September 20, 2022.

-

SR-FINRA-2022-015 – Last month, we reported on FINRA’s adoption of Rule 4111, which establishes a “Restricted Firm” label for broker-dealers that historically have had higher levels of risk-related disclosures, and also requires those firms to put aside reserve funds that can be used only to pay future or unpaid investor claims. This month, FINRA proposed an amendment to FINRA Rule 8312 that would authorize FINRA to report a current or former member firm’s “Restricted” status through its BrokerCheck disclosure system.

/>i

/>i