The eight new freeports in England include tax breaks for employers and businesses, but what are they and where will they be?

What Are Free Zones?

Free zones (also known as freeport customs sites) are designated areas, located at ports (sea, air, or rail), which benefit from a more favourable customs regime than otherwise applies elsewhere. For example, businesses authorised to store or process goods in a free zone may do so under duty suspension. No import duty (including import VAT) will usually be chargeable until those goods enter into free circulation. If they are re-exported without entering into free circulation, they will escape duty altogether.

In the Spring 2021 Budget, the Chancellor confirmed that there will be eight freeports in England at the following locations:

-

East Midlands Airport;

-

Felixstowe & Harwich;

-

Humber;

-

Liverpool City Region;

-

Plymouth and South Devon;

-

Solent;

-

Teesside; and

-

Thames.

Benefits Obtainable from Freeport Tax Sites

It is understood that businesses located within any of the above designated freeport tax sites may benefit from:

-

enhanced structures and buildings allowances (SBAs);

-

enhanced plant and machinery allowances (PMAs);

-

stamp duty land tax (SDLT) relief;

-

business rates relief; and

-

employer's national insurance contributions (NICs) relief.

The SBAs, PMAs and SDLT relief will become available through the secondary legislation designating the relevant freeport tax sites. Business rates relief and employer's NICs relief are dependent on further announcements and legislation (note: NICs relief is intended to be available from April 2022 or, if later, when a freeport tax site is designated).

The Regulations

Presently, the UK Government has announced regulations for a number of freeports:

1. Teeside, Thames and Humber

On 28 October 2021, regulations were made designating freeport tax sites for the Teesside, Thames and Humber freeports.

The designations made by the regulations all took effect from 19 November 2021 (the date that the regulations come into force). This date is important because it features in the conditions that need to be met to obtain the benefit of enhanced capital allowances and the specific SDLT relief for acquisitions of land in freeport tax sites. For example, one of the conditions for obtaining PMAs is that the plant and machinery must be primarily for use in an area which, at the time the expenditure is incurred, is a freeport tax site. Similarly, to obtain SBAs, the freeport tax site designation must be in place at the time the construction of the building or structure begins. For SDLT relief, the designation must be in place at the effective date of the land transaction.

2. Felixstowe and Harwich

On 8 December 2021, the regulations designating three areas as freeport tax sites within Harwich, Gateway 14 (Mid-Suffolk) and Felixstowe (East Suffolk) (together known as, Freeport East) were made.

The designations made by the regulations took effect from 30 December 2021 (the date the regulations come into force). As above, this date is important because it features in the conditions that need to be met to obtain the benefit of enhanced capital allowances and the specific SDLT relief for acquisitions of land in freeport tax sites.

The Orders

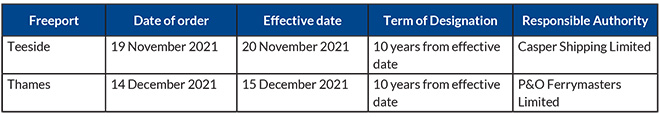

The Government has also made orders designating customs free zones within these freeports as shown in the table below. At present, the Government has only announced the orders for Teesside and Thames freeports, with others to follow in the coming months.

HMRC has published some useful guidance to assist businesses that are operating in or want to operate in a freeport site. Some of these include:

Will More Freeports Follow?

Although the Government has confirmed eight freeports in England, it is possible this number could increase. There were 24 Enterprise Zones launched in 2012 but by 2011 the number had doubled to 48 zones; this included the extension of certain zones such as the Sheffield City Region Enterprise Zone. So can we expect a similar expansion in the number of freeports? At the moment, it seems the Government may want to wait and see the economic effects of these freeports before they decide whether or not to increase them or extend them in certain areas.

Ugo Onwumelu, a trainee in the Tax practice, contributed to this advisory.

/>i

/>i