Research and Advice for Heads of Investment

A New Appetite

Investing has always been a balancing act.

Pursuing multiple investment goals means making trade-offs. Do you aim to minimise risk or maximise yield? How much importance should you place on past performance or brand? How do you weigh competing considerations alongside the desire to keep fees and costs down?

To help strike the right balance – and achieve their goals – investors frequently use third-party managed funds. Conventional wisdom suggests that this is how to access the best market opportunities; so investing directly has remained a less popular strategy.

Until now, that is.

Investors are currently re-evaluating their approach in response to a range of factors:

-

reducing fees paid to third-party managers

-

prevailing market conditions

-

a demand for greater flexibility and control

-

the need to recover portfolio values in light of the COVID-19 pandemic

In this challenging environment, a growing appetite for direct investment is emerging.

Our Research

Weighing their options in today’s uncertain climate, investors are increasingly eyeing what might be termed ‘dual investment’ strategies.

They’re embracing direct investment while continuing to invest in third-party funds to pursue multiple investment goals and improve portfolio performance.

Yet, there are legal, tax and regulatory challenges to making direct investments, which third-party managers would otherwise handle. How can investors get to grips with these challenges – especially if they haven’t built an internal capability to deal with them?

To find out, we carried out a two-part research programme exploring:

-

the factors driving investors to consider dual investment strategies

-

the impact of the pandemic on attitudes to direct investment

-

the advantages direct investment can bring

-

the barriers preventing investors from ‘going direct’

In late 2019, our market research partner conducted an independent survey of 150 heads of investment at international, UK based sovereign wealth funds, pension funds, financial institutions, corporate organisations and family offices with between $50m and $10bn of capital under investment. Then a year on, we updated our study with a series of select, in-depth interviews. This gave us a perspective on how the COVID-19 pandemic has affected investment strategies.

Direct Benefits

The Growing Appetite for Direct Investment

Changing Priorities

Even before the pandemic, our study found an overwhelming majority (85%) of heads of investment were struggling to balance performance and risk due to market uncertainty.

The study also highlighted that 83% of respondents were interested in a greater variety of investment strategies and opportunities than currently offered by third party funds.

Funds with defined investment criteria may not be able to pivot quickly enough to take advantage of new opportunities that lie outside of their initial investment guidelines. This could constrain the ability of funds’ (and investors’) to respond to market conditions and better balance risk and performance.

As such, nine in ten heads of investment (89%) were seeking new strategies to improve portfolio performance. Close to half (45%) were expecting to take on more direct investment before the pandemic.

These pressures to adapt are unlikely to have eased during 2020, when the financial impact of the pandemic hit all investment markets and asset classes. Some third-party managed funds adopted defensive postures during this time. Focused on recession-proofing their portfolios, they were reluctant to exit investments.

“It is difficult to completely rely on third-party funds to deliver on our investment strategy.”

Head of investment, family office

“We’re looking to maximise yield. You can’t follow existing market investment trends and expect to achieve superior rates of return.”

Head of investment, family office

Business as Usual?

For investors set up to handle deals themselves, an investment strategy that includes direct investments can enable them to:

-

deploy capital faster

-

take advantage of a buyers’ market

-

adjust their portfolios

-

balance risk and performance more effectively

As they fine-tune their strategies for 2021 and beyond, heads of investment ask: is relying solely on third parties still the optimal route to the most promising opportunities?

Increasingly, they’re exploring how to pursue direct investment opportunities alongside third-party managed funds to boost portfolio performance.

“There is no dearth of attractive investment opportunities, and with extra funds to deploy, we plan to increase our direct investments.”

CEO, multinational corporation

"To realise a return on our investments, we have no choice but to push our allocations…into higher-risk alternatives, including direct investments. COVID-19 will expedite these plans.”

Senior finance and investment management executive, sovereign wealth fund

Dual Control

How can dual investment strategies drive better performance?

Despite the risks and complexities, taking on direct investments can help maximise yields, and diversify and fine-tune portfolios.

Though they don’t benefit from the expertise of an experienced fund manager, investors gain greater control over portfolio strategy and risk management. And while there are additional costs, they don’t have to pay third-party managers’ fees.

As one family office’s head of investment told us:

“We run the show...we put in equity, and use the resources available to us to unlock greater value.”

“Our portfolio is almost exclusively third-party investments. We have very little control over where they invest or don’t invest. But our biggest frustration is speed – not deploying capital fast enough.”

Managing director, pension fund

“What is foremost for us is being able to identify differentiated investment opportunities where we can add the most value. Direct investment allows us to do this.”

Head of investment, family office

Hard Evidence

Of course, autonomy and control are only worthwhile if they enable investors to deliver results. Our analysis suggests that they do.

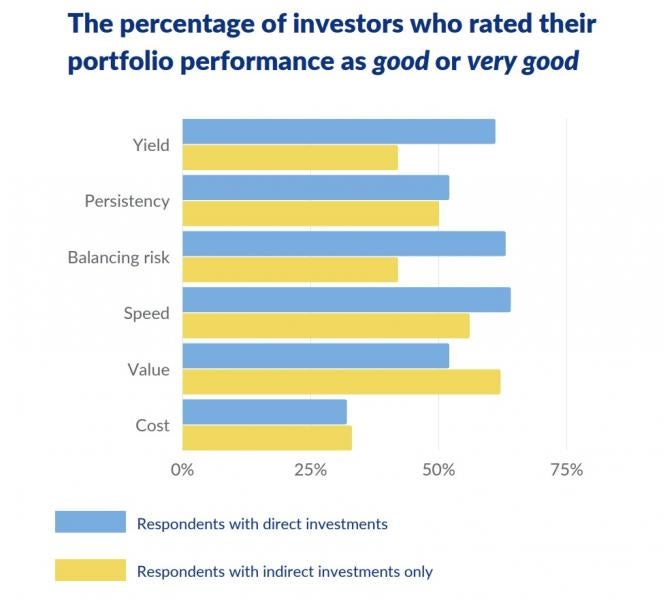

In our 2019 study and follow-up research, those who embraced dual investment reported better performance across a range of metrics than those sticking purely to third-party managed funds.

Little wonder, then, that investors are weighing the costs of third-party fees against the support required to identify opportunities and complete deals themselves.

The percentage of investors who rated their portfolio performance as good or very good

Risky Business

Barriers to Going Direct

A Different Ball Game

Despite their appetite for direct investment, many heads of investment are unfamiliar with the legal aspects of deal-making. So they’re cautious about the risks involved: 79% say they need more reassurance before investing directly.

Going direct takes investors into unknown territory, as it obliges them to:

-

source opportunities themselves

-

adopt the performance risk involved in executing and managing an investment that third parties usually bear

-

manage the legal, regulatory and tax burden that third parties would otherwise handle

“Legal and regulatory complexity should not be overlooked. A lack of legal knowledge opens up increased risk, and red tape can become a barrier to direct investment.”

CEO, multinational corporation

“Direct investment comes with higher risk. And if you don’t have the knowledge or expertise, you would rather third-party fund managers take on that risk.”

Senior finance and investment management executive, sovereign wealth fund

Steps for Success

Getting to Grips with the Legal Landscape

Three Priorities

With greater reassurance, investors would be keen to divert more capital to direct investments – giving them more flexibility and control as they look to thrive in a pandemicaffected market.

So how can they equip themselves to manage the performance risks and legal obligations involved?

In our experience, setting yourself up for success means focusing on three key areas:

-

Align investment terms

-

Get deals done

-

Protect deal economics

Aligning Investment Terms

If the financials don’t work, the legalities won’t matter. So put aside the legal and regulatory issues, to begin with, and start with the business case.

Ensure you know how the target investment works and whether it’s structurally set up to meet your investment goals.

That means understanding:

-

The type of business you’re investing in – how is it owned, structured and governed? What are its business, revenue and operational models and processes?

-

Where it’s located – and the governing law in that jurisdiction. How might the local legal landscape affect potential returns on your investment?

-

The sector(s) in which it operates – and what industry regulations apply. How might these impact returns?

-

Any assets it owns and contractual obligations – what due diligence will you need to conduct on these?

-

Your stake in the business – are you receiving debt or equity? What type? Will you be a major or non-major investor? Or is it a joint venture?

-

Your rights and protections – do these reflect the risks involved? If it’s a debt deal, what financial covenants should you impose?

-

The liquidity profile – what are your liquidity rights? Are they compatible with your needs?

-

The tax implications of the investment

Technical Support

Of course, you’ll need technical experts to help you understand these elements and value the target business.

But for investors unaccustomed to direct investment, the first step is to know which experts to hire.

Will you need regulatory specialists, tax experts and/or multijurisdictional lawyers? Will your operational due diligence require forensic accountants?

You’re likely to need advice on this upfront to ensure that you put the right support in place.

Getting Deals Done

Once you know what you’re getting from the deal and how it will deliver your investment aims, you can turn your attention to legal due diligence.

There’s no such thing as an investment devoid of risk, so expect this stage to throw up potential deal-blockers. If you don’t discover legal, tax or regulatory issues, you’re probably not looking hard enough.

For heads of investment not used to going direct, these bumps in the road can seem daunting. But don’t assume that dealblockers are deal-killers.

More often than not, blockers can be mitigated by putting two crucial elements in place:

-

a commercially savvy, judgement-led framework to help you make the right decisions

-

a creative and efficient approach to implementing the necessary economic protections.

“You will always get some ‘noise’ back in legal due diligence; applying judgement is important. What isn’t a big deal? What can be mitigated? And what’s a deal killer? Having a framework to make those decisions is vital.”

Lance Zinman, partner and global chair, financial markets and funds, Katten Muchin Rosenman

A Judgement-led Perspective

A judgment-based framework is essential to making the right decisions when faced with legal considerations.

Investors should undertake focused due diligence aimed at unearthing any issues that could affect value.

Typically, anything that may harm the deal’s economics or negatively impact your other investments should be a red flag. From a legal standpoint, this might be regulatory enforcement, a patent issue, or a current or impending lawsuit, for example.

A skilled legal advisor with the right experience is critical to this judgment process. Rather than receiving summaries of contracts, investors need help to better understand the nature and scope of any issues that emerge and their possible effect on the bottom line.

“Deal-killers are rare. But when they do occur, it will be something that kills the economics of a deal, rather than an issue of legal complexity.”

Christopher Shannon, partner and chair, financial transactions and trading, Katten Muchin Rosenman

Protecting the Economics

As well as overcoming the legal hurdles, investors must act to protect the economics of the deal.

This means guarding against:

-

loss of value

-

the obligation to re-invest in the target further down the line

-

restrictions on your ability to invest elsewhere (e.g. in competing businesses)

Achieving that requires a series of essential economic protections to be put in place.

“Direct investment can come with very stringent covenants, placing restrictions on what I can do, and how and when I can exit.”

Senior finance and investment management executive, sovereign wealth fund

“Investors should make sure that the deal structure allows for flexibility on an exit in order to maximize value.”

Edward Tran, partner, financial transactions and trading, Katten Muchin Rosenman

Critical Economic Protections

Pre-emptive rights

The right to maintain your stake at its current level if the target business seeks further funding in the future.

Anti-dilution rights

The right to adjust the value of the shares you hold in the target business. This is important if the company subsequently sells shares at a lower price than you bought them for.

Control rights

The right to a veto in certain critical matters relating to the target business; and to appoint a member of the board of directors. For example, a veto right over a sale of the business if a certain level of return is not achieved for the investor in such a sale.

Deadlock resolution

A mechanism to resolve differences with other investors in the target business if a course of action can’t be agreed upon.

Information rights

The right to receive periodic information about the target business and its performance.

Distributions

Policies governing the payment of distributions and dividends.

Co-sale rights

The right to participate in another shareholder’s negotiated sale of its equity. This enables the investor to force a selling shareholder to include the investor’s equity in the sale on a pro rata basis. Co-Sale rights and veto rights over certain sales of the business are important if the majority of owners decide to exit.

Put rights

If the investor holds a minority stake, the investor may want to have put rights giving the investor the ability to require the majority investors to purchase the minority investor’s stake.

Steps For Success

In a Nutshell

-

Align investment goals

-

Understand the business case before worrying about the legalities. Make sure your target investment will meet your objectives.

-

Getting deals done

-

Don’t be put off by bumps in the road during the legal due diligence phase. Make sure you have a robust decision-making framework for evaluating the legal issues you encounter.

-

Protecting the economics

-

Make sure the deal provides you with the appropriate economic protections. Guard against loss of deal value, the obligation to put in more money, and restrictions on your investment activity.

/>i

/>i