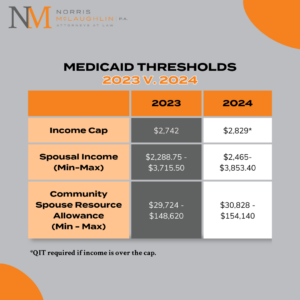

Every year, new Medicaid thresholds are announced outlining the amount a Medicaid beneficiary can keep in income and pass to their spouse, and the amount the spouse can have in assets. This is a complicated area of the law. The annual thresholds reveal only a small part of the story in terms of protections for spouses and other family members. Here are a few facts to keep in mind:

1. The income cap for Medicaid applicants needing long-term care has been raised from $2,742 to $2,829 in 2024. But it isn’t really a cap; individuals can still receive benefits if they have higher income. A qualified income trust (QIT) account must be opened for individuals exceeding the income cap.

2. Generally, a Medicaid recipient must pay most of their income to the facility where they reside. However, if they have a spouse with limited income, the spouse may be entitled to receive income from the Medicaid recipient to bring their own income up to $2,465 (2024 minimum monthly maintenance needs allowance - MMMNA), or as much as $3,853.40 if they have substantial household expenses. The community spouse may keep all their own income, without limitation.

3. Even without sophisticated asset protection strategies, a spouse is entitled to retain up to $154,140 (the 2024 community spouse resource allowance - CSRA). However, it will require careful planning to ensure that all assets are considered in calculating the spousal allowance, and that the assets are transferred into the community spouse’s name.

4. Medicaid will look back at gifts made within five years of application. If a non-exempt transfer has taken place during the lookback period, a penalty may be imposed. An experienced elder law attorney can provide guidance in designing a strategy to protect assets even within the five-year period.

5. Unlike transfers to persons other than spouses made within five years of application, which usually subject the donor to penalties that result in periods of ineligibility for Medicaid, transfers to spouses are exempt. There can be important advantages to transferring certain exempt assets such as the marital home to the healthy spouse.

6. Individuals and married couples are permitted to own certain types of assets and still qualify for Medicaid. Examples of exempt resources include:

- one vehicle,

- household furnishings,

- pre-paid funerals,

- and the marital residence, if the applicant or spouse is still living there.

Besides these, and the community spouse resource allowance of up to $154,140, additional assets can often be protected with proper planning.

Individuals navigating Medicaid should seek advice from experienced elder law attorneys to spend any excess resources in ways that are beneficial to them and their families and can provide a spouse remaining at home with a good quality of life.

The Medicaid laws and regulations are complicated and subject to change. Filing a Medicaid application is comparable to filing an income tax return that you know will be audited. Medicaid agencies have an incentive to deny applications quickly, so the application must be correct and complete. Collaborating with an experienced attorney is the best way to avoid costly mistakes.

/>i

/>i